Santos up scales production – franking credit debate continues to rage! (STO, NBI, TLS)

WHAT MATTERED TODAY

Before we get into our usual missive on today’s market, this morning our friends at Livewire published a piece on franking credits we penned a little while ago that mused about the potential market impact if the change in policy got up under a Labor government. We applied our usual approach of unemotional analysis while we intentionally glanced over the shortcomings of the proposed change. Just to be clear, we wholeheartedly disagree with the proposed policy to abolish the cash refund associated with franking credits – it’s very obvious this was an ill thought out policy that ultimately targets an unintended demographic. The rhetoric around ‘targeting the wealthy’ is complete non-sense – it can be disproven emphatically and for that reason we give the policy a less than 20% chance of actually getting up in its current form. From a business perspective, we clearly have a vested interest against the policy as do many of the fund managers that have been vocal against it – not to mention the individuals who are directly impacted, however we always try to put our interests to one side and put forward constructive views. Our musings on the change could well prove pointless, however for those interested, we’ve written a number of articles on it; here, here & todays piece here

The Aussie market was strong early today, although it was only small pockets that did the heavy lifting. Resources + Energy were well bid while the banks traded down ahead of the draft release from the Royal Commission due out on Friday. I was on Sky Biz today at midday talking about the banks and others, and while the outcomes / recommendations will once again shine a negative light on the sector, the drag on bank earnings from the recommendations around wealth management / insurance and the like will have a smaller impact on the banks than the wealth managers / insurance stocks like AMP, IOOF, Clearview etc. The main area of concern for the banks is around lending standards, and the impact of tighter regulation on the availability of credit. We’ll be interested to see the draft report when released.

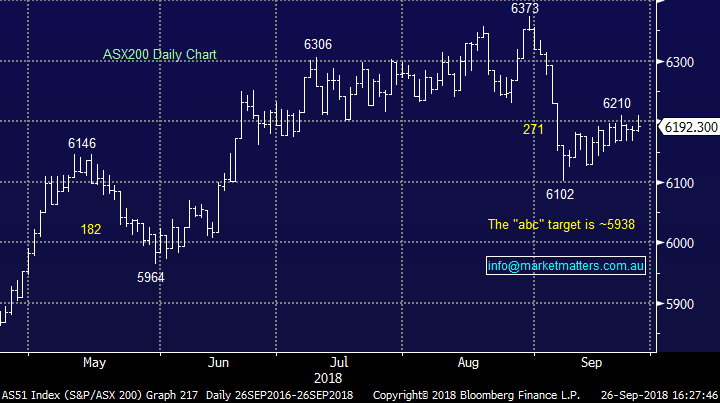

From an index perspective today, it was a weak session with sellers coming over the top during the day. As we mentioned yesterday, from the end of August high on the ASX 200 of 6373 the market then got hit by -271pts / -4.25% in a short sharp decline that lasted just 6 trading days. Since then we’ve taken 13 trading days to recover back to a high of 6210 as we continue to see the market dominated more by sector rotation than outright bullish sentiment. The simple conclusion here is that buyers aren’t in control – the market is edging up on low volume but is far from convincing.

· We still favour a move below 6000 for the ASX 200

Overall, the index closed up +6 points or +0.10% today to 6192. Dow Futures are currently trading up +38pts.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

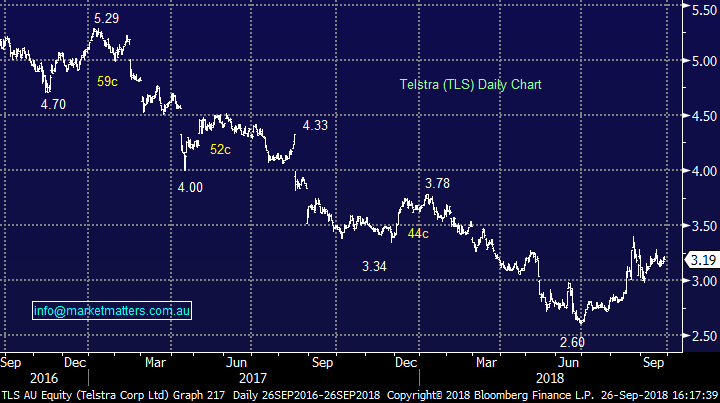

Broker Moves; CITI put a bearish note out on Telstra (TLS) that got some airtime around the place, with analysts saying that Telstra’s free cash flow will likely settle at A$1.9b after infrastructure assets are separated, NBN payments have stopped and earnings decline, below what’s needed to fund the payout. They then go on to say that TLS will need to cut its mobile plan prices again to maintain market share; the 40% premium for SIM-only plans, 30% across broader range is “too large” to peers given most of growth is at lower price points. That’s a bearish view on TLS if read in isolation however worth noting that CITI turned super bearish on TLS on the 20th June this year cutting their price target to $2.30 versus the close that day at $2.77. Despite the negative skew to the note today, they’ve upgraded from that $2.30 PT to $2.65 target today – but retained the SELL recommendation. While Citi doesn’t put their recs on Bloomberg, the rest of the market is more upbeat.

Broker calls on Telstra (TLS)

Telstra added +0.63% today to close at $3.19 – we remain keen on TLS at current levels and hold it in both portfolios, the next catalyst being an uptick in volatility across the market!

Telstra (TLS) Chart

RATINGS CHANGES:

· Woolworths Group Upgraded to Buy at Citi; PT Set to A$32

· Regis Resources Upgraded to Hold at Morningstar

· API AU Cut to Underperform at Credit Suisse

· Stockland Upgraded to Buy at Goldman; PT A$4.82

· Mirvac Group Downgraded to Neutral at Goldman; PT A$2.55

· Whitehaven Upgraded to Outperform at Credit Suisse; PT A$6

NB Global Income Trust (NBI) $2.04 / +2.00%; A new listing on the boards this morning at 11am that was added to the income portfolio at $2.00, NBI is a US based asset manager that raised $413mil and follows a currency hedged corporate bond strategy that aims to pay 5.25% p.a. paying distributions monthly. While we normally like to hold assets directly, however simply put, we can’t get the level of diversification or access to these sort of investments outside a fund structure such as this one. We like NBI for an income play, and so too does the market with the trust currently trading 2% higher to $2.04, above their NAV at listing of $2

Santos (STO) $7.25 / -1.09%; Investor presentation today and the stock was strong early before being sold late in the day – which fitted our view this morning. Their presentation showed plans to nearly double oil production over the next 7 years to produce around 100 million barrels a year while still keeping a lid on costs within the business. The acquisition of WA gas company Quadrant Energy, currently seeking regulatory approval, will go some way to bridging the gap by adding around 19 barrels of oil equivalent (boe) + Santos also plans to leverage the core assets in Australia and PNG to ramp up output.

History shows that Santos has a poor track record in terms of production expansion and acquisition. Although we see some legs in this run in energy prices from here, it feels like STO is once again upscaling at the wrong point in the cycle. We’d like them to be selling strength rather than buying strength as they have announced today.

Santos (STO) Chart

OUR CALLS

No trades in the MM Portfolios today other that NBI – a new listing that commenced trading and closed 2% above the issue price of $2.00

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.