Are some auto players set to recover? – (CGC, EHL, ARB, GUD, BAP, APE, SUL, AHG)

The ASX200 rebounded strongly on Wednesday as the influential banking sector led from the front with the “Big Four” rallying over +2% on average. This heavy index buying was accompanied by some broad based gains in most sectors while the IT stocks again the standout with the sector rallying an impressive +2.4% - the momentum funds now piling into the sector from what I can see.

It feels like we are watching 2 very different groups within our market but in both cases the influence is currently very much on the upside:

1 – As mentioned above the “momentum funds” are driving up stocks that have outperformed over the last 3-months e.g. Bravura Solutions (BVS), Afterpay Touch (APT), Altium (ALU) and Appen (APX) are up over 50% on average over the last 3-months alone – simply huge performances and a theme we sold out of too early.

2 – Stocks which have been slammed over recent times are recovering strongly if / when they release news to the market that’s “not too bad” e.g. Bingo (BIN) +5.3% and Costa Group (CGC) +3.7% yesterday following presentations at the Macquarie Conference which were ok – Bingo reconfirming guidance.

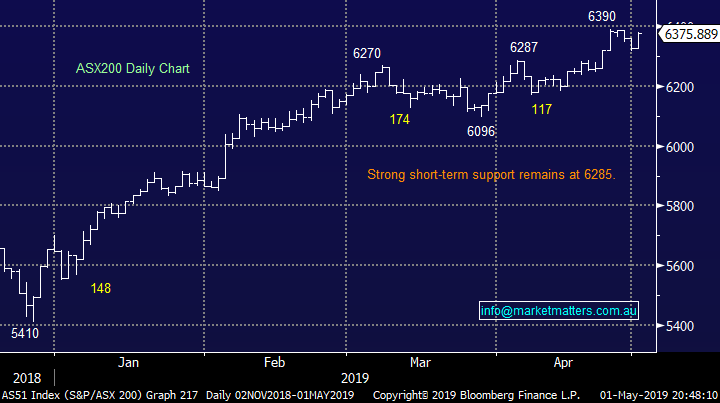

The ASX200 breached our previous upside target area leaving us now mildly bullish assuming the 6280 area holds.

Overnight the US indices fell with the Dow closing down 162-points after the Fed left interest rates unchanged while reiterating patience, it feels like the market had become too dovish (looking for interest rate cuts). The SPI futures are calling the ASX200 to open down around -0.5% with BHP’s -1.3% fall on Wall Street implying weakness in our resources this morning, thanks mostly to a large drop in Copper.

This morning we are going to look closely at some of the automotive stocks, a group which have been “under the pump” over the last 1-2 years, to consider if some of the players look set to follow the likes of Bingo (BIN) and Costa Group (CGC).

ASX200 Chart

As touched on above 2 stocks we put in our MM Growth Portfolio as “dogs” who we felt looked set to recover have enjoyed strong moves this week with Costa Group (CGC) now testing its 2019 highs. Australia’s largest grower of fruits and vegetables CGC clearly has had a tough 12-months, but we believe their issues are more cyclical than structural. And at the end of the day we all need to eat.

Currently MM has a small 2% position in CGC which is showing a ~8% paper profit but our $7 target area still leaves plenty of reason to consider buying CGC.

MM is considering adding to our CGC position below $5.90.

Costco Group (CGC) Chart

The leaser of earthmoving equipment Emeco Holdings (EHL) is another stock we bought for the MM Growth Portfolio looking for a recovery although the stock has not been as obliging – yet.

We think the stock is poised to recover at least a healthy portion of its losses of the last 7-8 months. While we are currently behind 7% on our position it now feels like a reasonable time to increase our position.

MM is considering adding to our EHL position below $2.10.

Emeco Holdings (EHL) Chart

**NAB 1H19 Result out this morning**

Cash earnings per share (EPS) of $1.07 which was inline and included additional remediation costs, the dividend was 83cps, below expectations however unlike ANZ yesterday, NAB actually showed top line revenue growth of 1.5% which is the positive.

Capital levels were low at 10.4%, below the 10.5% unquestionably strong level although they have a path to get there.

The dividend will be the main focus with the market expecting 90cps and $1.80 for the full year. NAB printing 83c or annualised at $1.66, which is 6.4% fully franked. While the dividend will no doubt get the headlines, the underlying result is more important and we actually think an aggressive re-rate of the dividend could be a positive for the business moving forward. At 83c on $1.07 of earnings, that’s a 77% payout ratio, however the $1.07 also includes remediation costs which are not ongoing, so payout drops further in time. We recently write about NABs likely dividend cut here

The final day of the Macquarie Conference today with the agenda as follows

8.45am – Wesfarmers (WES), Jumbo Interactive (JIN), Western Areas (WSA), Australian Finance Group (AFG)

9.30am – Seek (SEK), Independence Group (IGO), 3P Learning (3PL)

10.30am – Pinnacle Investment Management Group (PNI), Clean Teq (CLQ), Australian Pharmaceutical Industries (API)

11.15am – Challenger (CGF), Pro Medicus (PME), Sandfire Resources (SFR), G.U.D. Holdings (GUD),

12.00pm – Cleanaway Waste Management (CWY), InvoCare (IVC), OZ Minerals (OZL), Contact Energy (CEN)

1.30pm – Downer Group (DOW), IOOF (IFL), Orocobre (ORE), Abacus Property Group (ABP),

2.15pm – Orora (ORA), GTN, Pilbara Minerals (PLS), Heartland Group (HGH)

3.00pm – Atlas Arteria (ALX), GWA, Carnarvon Petroleum (CVN), Marley Spoon (MMM)

4.00pm – WorleyParsons (WOR), Aurelia Metals (AMI), IPH

Looking at the Auto stocks for some value.

As we mentioned above a number of previously unloved stocks have been recovering strongly in 2019 and the auto sector is certainly one group that’s been sold off solidly as the indebted Australian consumer continues to tighten their belt.

Today we have looked at 6 stocks that could recover strongly when the sector gets a decent modicum of investor love – we should remember the ASX200 Accumulation Index is at all-time highs and investors are scouring the landscape for any perceived bargains in what appears to be a fully valued market.

ASX200 Accumulation Index Chart

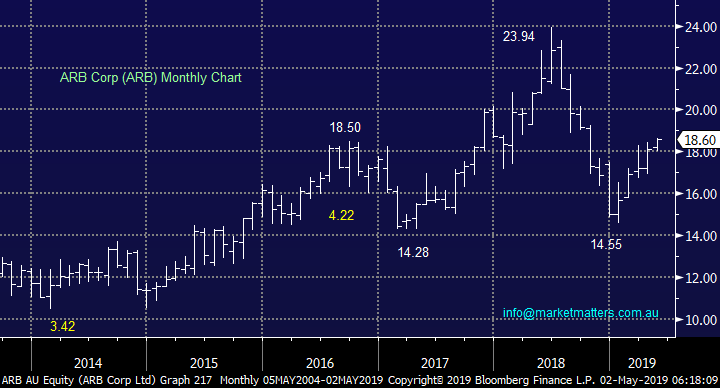

1 ARB Corp (ARB) $18.60

Four-wheel drive vehicle accessories business ARB produced a 5.6% increase in sales revenue in the first half of FY19 to almost $218m, some good numbers in relatively tough times. However understandably the company warned that economic conditions remain unpredictable in many of its primary market areas.

The stock is not cheap trading on an Est P/E for 2019 of almost 26x while yielding 2% unfranked. Technically the stock looks ok at current levels but far more attractive around $17.

MM is neutral ARB here but interested around $17.

ARB Corp (ARB) Chart

2 GUD Holdings (GUD) $12.07

Manufacturer of consumer / industrial products, including automotive parts, GUD Holdings (GUD) had an awful start to 2019 following the release of its half year results which produced a net profit after tax of just over $29m.

Their Automotive products actually achieved sales growth of 18% due to a combination of organic growth and the purchase of both Disc Brakes Australia and AA gaskets – we like the acquisition strategy in a tough market. However the balance of the business outside of auto did not perform as well over the last year.

GUD is reasonably priced trading on an Est P/E for 2019 of 17.1x and its current yield of 4.4% fully franked is not to be sneezed at. Technically the stock looks good medium-term.

MM likes GUD around $12 but would leave $$ to average another leg down.

GUD Holdings (GUD) Chart

3 Bapcor (BAP) $5.71

Automotive retailer BAP has clearly been operating in a tough 12-months for the sector and its guidance delivered in February for ~9% profit growth sent the shares down to a fresh 1-year low (given markets lofty expectations) but this is a company with in our opinion a solid management team.

The stock is showing some value at current levels trading on an Est P/E for 2019 of ~15.5x, which is cheap relative to recent history while yielding 2.8% fully franked. Technically we feel a 15% bounce is likely.

MM likes the idea of accumulating BAP into current weakness but not all in one hit!

Bapcar (BAP) Chart

4 AP Eagers Ltd (APE) $8.80.

This seller of used and new vehicles has proposed an all share bid for Automotive Holdings (AHG) to create a $2.4bn dominant player assuming the deal gets ACC approval. APE had held ~28% of AHG for a while so this deal has been on the cards. Nick Politis, the Chairman of the Sydney Roosters and major shareholder in APE is a great operator and the deal make total sense with $23.5m of muted costs savings, however the issue for the stock is the deal has a few different paths from here, and of course, when the ACCC is involved the outcome is less certain.

MM is neutral AP Eagers (and Automotive Holdings).

AP Eagers (APE) Chart

5 Super Retail Group (SUL) $7.90

SUL is a retailer of auto parts, tools, camping, gardening and boating equipment – the healthy outdoor life.

The stock roared higher after presenting at the Macquarie Conference with sales growth that was better than the markets downbeat expectations – or in other words, they’re doing okay in a tough environment. Yesterday’s pullback below $8 feels like an opportunity, albeit in a volatile easily rattled part of the market.

The stocks now at the cheap end of town trading on an Est P/E of 10.3x for 2019 while yielding over 6% fully franked.

MM likes SUL into weakness below $8.

Super Retail group (SUL) Chart

6 Automotive Holdings (AHG) $2.39

AHG is a holding company for a large group of car dealerships, a tough place to be over recent years. However the potential merger / takeover from AP Eagers (APE) to create a $2.4bn dominant player has helped shareholders with the 7.6% premium being offered on AHG shares.

MM is neutral AHG.

Automotive Holdings (AHG) Chart

Conclusion (s)

Of the 6 stocks we looked at today our favoured 2 into current weakness are Bapcor (BAP) and Super Cheap Auto (SUL),

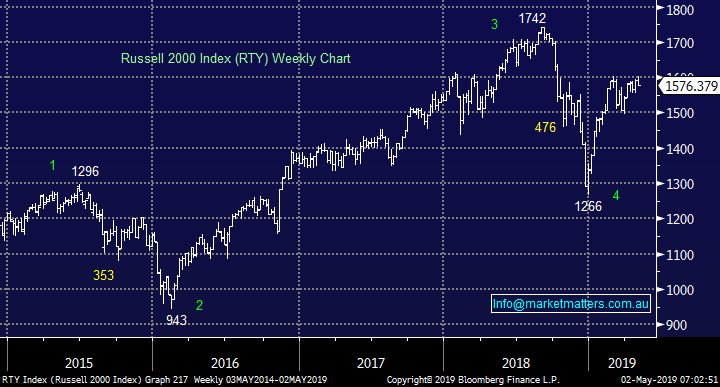

Global Indices

US stocks were weak overnight as the Fed failed to deliver any further dovish commentary to stoke the recent “free money” rally.

We are now bearish US stocks looking for a ~5% correction.

US Russell 2000 Chart

No change with European indices, we remain cautious as we enter the “sell in May and go away” period for European stocks.

German DAX Chart

Overnight Market Matters Wrap

• The US lost ground overnight, as the US Fed Reserve kept it rates on hold and left a neutral stance, erasing hopes of a cut in rates in the future.

• The USD rallied following its comments, while Dr,. Copper, a leading indicator of global growth slumped.

• The resource sector is expected to underperform the broader market, with BHP expected to underperform the broader market after ending its session down an equivalent of 1.32% from Australia’s previous close.

• The June SPI Futures is indicating the ASX 200 to open 30 points lower towards the 6345 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 02/05/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.