Boral (BLD) the standout on the reporting front today (BLD, IGO)

WHAT MATTERED TODAY

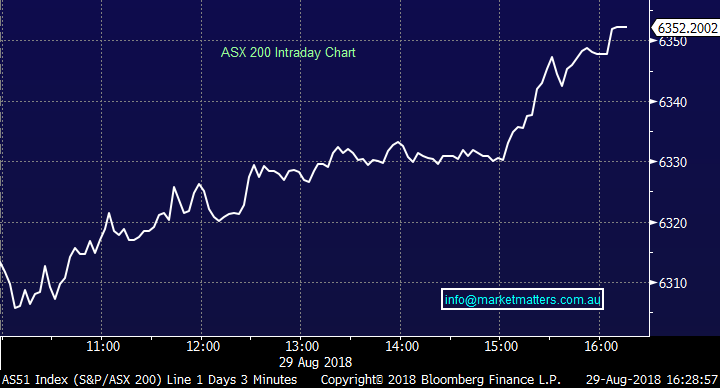

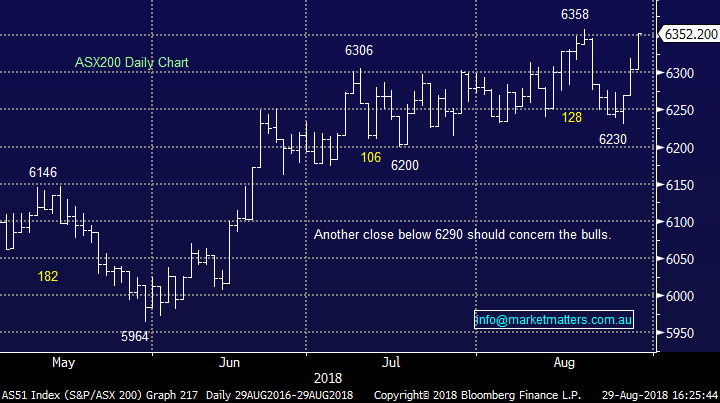

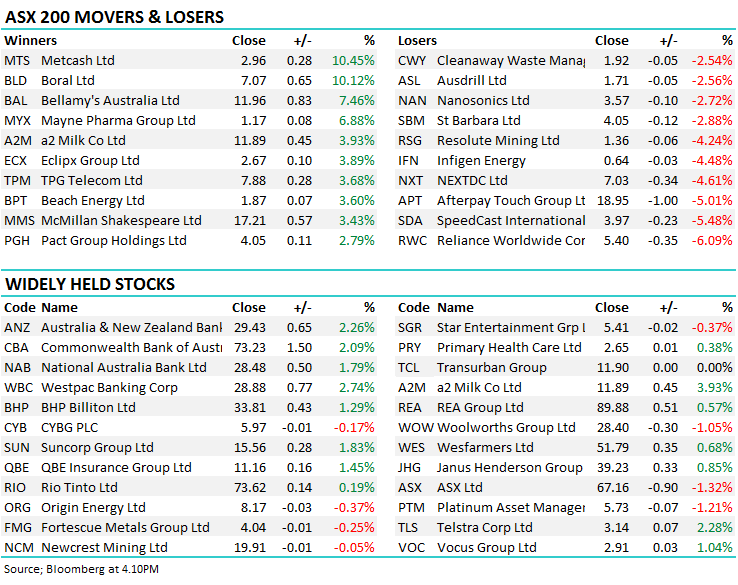

Another strong day for the local market thanks to coordinated buying in the banks and the miners a theme that has played out since Monday and that’s prompted a quick +120pt rally from the recent lows, recouping the losses we saw in the market last week. Telstra (TLS) traded ex-divi today for 11cps plus franking (15.7c value) and ended down 4c, a pretty strong result really, while Westpac’s (WBC) move to increase mortgage rates to offset margin pressure (which we saw in their recent quarterly update) was applauded by the market, although I suspect borrowers won’t share the same enthusiasm.

Elsewhere, Boral (BLD) was strong on the back of good numbers, Bellamy’s (BAL) had a very volatile day after their results met market expectations, however the guidance missed the mark. The conference call obviously did the good job of talking the market around – the stock rallying ~18% from the lows to close at $11.96 while Bega (BGA) showed similar form, missing market expectations for FY18 earnings while providing no real formal guidance for FY19, however they also got the markets blood flowing on the call – ending higher on the session. The opposite played out for Independence Group (IGO) today after the market liked their result early, but sold them off sharply when more detail came to light. More on that one below.

Overall, the index closed up +47 points or +0.75% today to close at 6352.

Reporting winding down however still providing stock volatility – particularly intra-day.

For a full list of company reporting dates – click here

Ramsay Healthcare (RHC) is one we’ll be focussed on tomorrow with the market expecting…profit of A$418.3 million on core EBITDA of A$1.38 billion. And importantly, more colour around the Capio bid where reports have them likely to raise their bid price – hopefully not too far!

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Blackmores copping downgrades across the board this morning after rallying strongly yesterday.

Elsewhere;

· Regis Resources Upgraded to Neutral at UBS; PT A$4.20

· Regis Resources Raised to Neutral at JPMorgan; Price Target A$4

· Regis Resources Upgraded to Buy at Bell Potter; PT A$4.65

· Sigma Healthcare Downgraded to Neutral at Citi; PT Set to A$0.55

· Reliance Worldwide Cut to Sell at Deutsche Bank; PT A$4.80

· Select Harvests Upgraded to Hold at Wilsons; PT A$5.74

· Caltex Australia Cut to Neutral at Credit Suisse; PT A$32.55

· Blackmores Downgraded to Underperform at Credit Suisse; PT A$130

· Blackmores Downgraded to Neutral at JPMorgan; PT A$160

· Blackmores Downgraded to Reduce at Morgans Financial; PT A$130

· RCR Tomlinson Downgraded to Neutral at JPMorgan; PT A$1.38

· SpeedCast Downgraded to Hold at Morgans Financial; PT A$4.09

· Orocobre Downgraded to Hold at Baillieu Holst Ltd; PT A$4.60

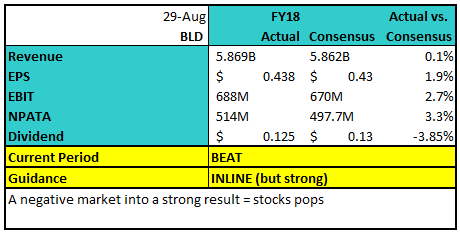

Boral (BLD) $6.95 / +10.12%; This morning Boral (BLD) reported their full year results and they were above market expectations by around 3%. Adjusted net profit after tax came in at $514m versus the markets expectation of $497m whilst most other metrics were strong. Revenue was up 34% with both the Australian and US operations ticking along nicely. The market was bearish BLD leading into this result after what seemed to be a tough year as they bedded down the $3.5bn Headwaters acquisition.

A good result from BLD today with guidance that was strong, but broadly inline with existing market expectations. Expect analysts to roll forward valuations and on the back of the beat in FY18, upgrades to flow through.

Boral (BLD) Chart

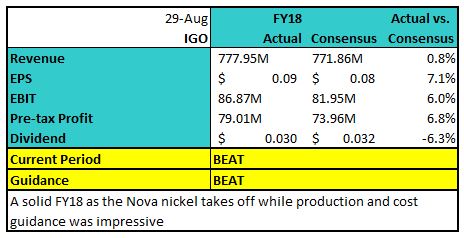

Independence Group (IGO) $4.34 / 0.7%; Nickel / gold miner Independence Group posted a bumper FY18 profit thanks to contributions from their new Nova nickel project. The stock had fallen steadily over the past few months thanks in part to a weak resources sector, but also due to the high expectations the market had held for the nickel mine. The market was forced to rebase earnings for the year at the 3rd quarter fearing numbers were too high, but a solid 4th quarter has helped the full year numbers beat the streets expectations, likely helped by higher grade nickel production in the quarter despite production numbers falling short of previous guidance.

Currently about a third of IGO’s sales are generated by gold through the Tropicana mine, however this number is falling as the company moves more towards nickel and copper. Production guidance was solid, driven by the Nova projects higher than expected run rate. We like the diversified exposure received from IGO, especially when looking for copper and nickel exposure. Both commodities have seen their fair share of weakness recently and we are looking for signs that the tide is turning. IGO has turned disappointing announcements throughout the year into a good result and we believe that their projects have turned a corner

Independence Group (IGO) Chart

OUR CALLS

No trades across the MM Portfolio’s today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here