Corporate activity fails to ignite the market (GTY, APA, KGN)

WHAT MATTERED TODAY

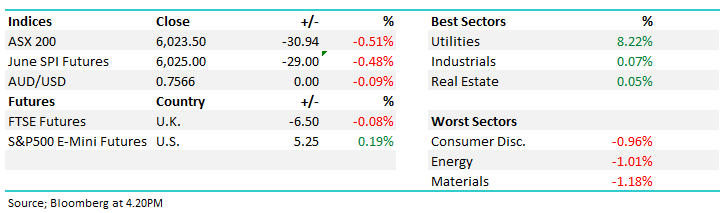

Some coordinated selling hit the market with both the Materials and the Financials suffering at the hands of sellers. Of the 31 point drop on the index, resources accounted for ~13pts while the Financials took off ~12 making up the bulk of the rout. Some corporate activity, mainly in the beaten up yield names helped to offset the negativity with bids for both APA Group (APA) and Gateway Lifestyle (GTY) out this morning – both stocks up strongly although it seems the market is sceptical on the APA bid given likely FIRB / Govt issues, while Gateway seems to be an initial low ball offer, and something more could come of it. Elsewhere, Kogan (KGN)shares tanked after the founders finally attracted a bid for some of their stock, although a 10.8% discount to yesterdays close for less than 50% of the amount they were trying to sell simply creates an ongoing overhang here…

Overall the ASX 200 index lost -0.51%, or -31 points to 6023 while the DOW Futures are trading up +16pts at time of writing.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Should a formal deal be announced for APA Group, there is a low likelihood of a competing bid, although CK Infrastructure may find winning approval from FIRB “challenging,” Ord Minnett analysts said today…

Elsewhere…

· Metcash Upgraded to Buy at UBS; PT A$3

· Ausdrill Upgraded to Buy at Moelis & Company; PT A$2.44

· Ausdrill Upgraded to Buy at Argonaut Securities; PT A$2.40

· Caltex Australia Upgraded to Outperform at Macquarie; PT A$37

· Caltex Australia Upgraded to Overweight at JPMorgan; PT A$35

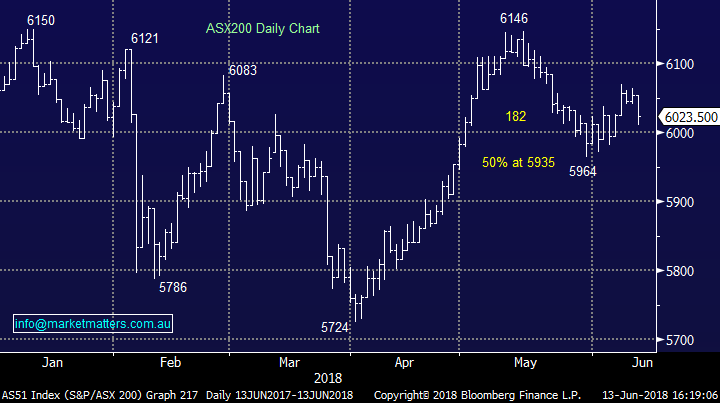

Gateway Lifestyle (GTY) $2.10 / +14.75%; The residential park and retirement community developer received a takeover bid from rival Hometown today at $2.10/share – 14.7% premium to yesterday’s close price ($1.83). While the bid is still dependant on a due diligence process, it seems well supported by shareholders with four large holders of Gateway already being courted by Hometown in supporting the bid. Shareholders have had a rough time in GTY which has fallen from a 12-month high of $2.24 in November last year, to a low of $1.68 last month following a series of earnings and outlook downgrades with development settlements lighter than expected.

There are many things to consider when thinking about a takeover particularly given the risk lying in the Gateway business. Recent downgrades could suggest trouble brewing below the surface and Hometown pulling the bid after reviewing the books remains a possibility. In saying that, the offer could attract others to the party (the bid is at a very slim premium – we think the stock is worth around $2 without a takeover premium) and there is the chance that it creates a bidding war - we think that’s a strong possibility. That said, we’re always cautious in a takeover scenario - the recent weakness in HSO and STO after each received takeover bids which failed provide a clear warning!

Gateway Lifestyle (GTY) Chart

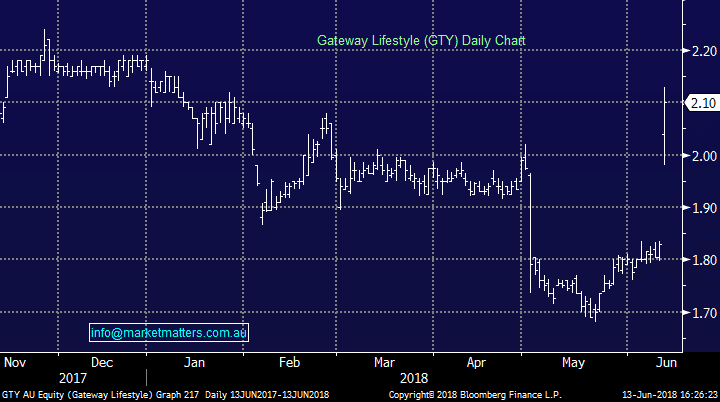

Kogan.com (KGN) $7.31 / -6.88%; Whacked today on (funnily enough) news that both Ruslan Kogan and David Shafer – the founders of the company have sold 6m shares a $7.00 a pop totalling $42m. We talked about this topic last week saying that clearly, these guys are in sell mode but what has a bigger smell about it is the announcement yesterday the company was going into the whitegoods segment. A positive announcement with ‘more financial detail to come’ just before the founders try to offload stock – about 10m shares if reports are correct – their biggest line yet.

Today the statement said they had an unsolicited bid that they took and they were disappointed to sell at such a low price…An unsolicited bid post last weeks solicitation that failed to yield any result. The go onto say… Mr Kogan and Mr Shafer remain fully committed to the business and continue to have the vast majority of their personal wealth invested in Kogan.com.

After doing $42m today, but trying to do $100m last week, certainly implies to me that they are a likely seller of $58m worth a stock. What large buyer will step up, in the screen and buy KGN here? Not many in our opinion

Kogan.com (KGN) Chart

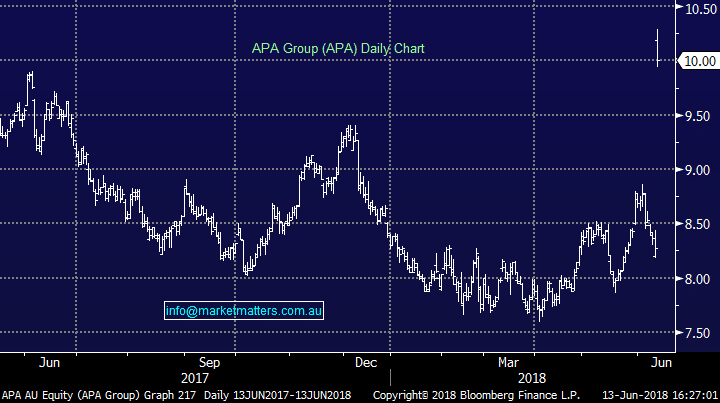

APA Group (APA) $10.00 / +20.92%; Hong Kong firm Cheung Kong Infrastructure – CKI – has lobbed a sizeable offer at gas infrastructure business APA at $11/share. The bid represented a 33% premium to yesterday’s close price as the Asian infrastructure giant seeks to get a larger handle in the Australian energy market. The deal has two hurdles to get through – first is the APA board and shareholders (likely satisfied with the initial bid as the board was quick to grant due diligence to the suitors in light of the premium being offered), and secondly it will need the Foreign Investment Review Board’s (FIRB) approval, a much harder process.

APA’s assets are critical to Australia’s much discussed energy market and FIRB is likely to want a number of conditions and guarantees met if it is to approve the bid at all. CKI has a history with acquisitions in Australia – some good and some bad. The bad being a failed attempt at Ausgrid back in 2006 when Scott Morrison turned the $11b deal down. The good being the successful acquisition of DUET group which FIRB approved back in August last year – its unsure whether this deal will now help CKI, drawing on the experience in dealing with FIRB, or if the acquisition of APA would potentially grant CKI too much ‘power.’ The market is clearly pricing in the risk of the deal falling over, APA closed at $10 today, 9% below the bid of $11.

APA Group (APA) Chart

OUR CALLS

We took a nice ~38% profit in Webjet (WEB) today while we also sold Independence Group (IGO) for around breakeven. Both positions were in the Growth Portfolio.

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/06/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here