Getting exposure to electric cars (ORE, GXY, PLS, MIN, KDR, CLQ, WSA, IGO)

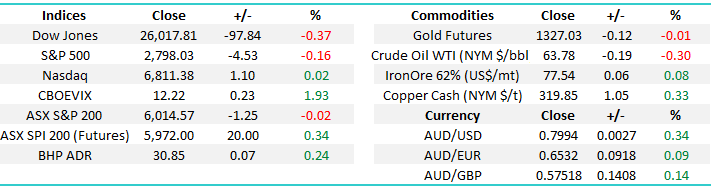

The ASX200 has now struggled for the last 7 trading days, declining -2.2% from its monthly high with most sectors contributing to the losses. It’s felt like the local market has been a quasi-sell for fund managers who want to offset bullish exposure elsewhere globally. However, this morning US stocks are trading lower as I type away - but the SPI futures are pointing to a mildly higher open for the Australian market – potentially our noticeable underperformance may be ready for a pause at the very least.

The ideal technical area for us to step up and start putting our large 23.5% cash position to work for the Growth Portfolio would be in the 5900-5950 region, or another 1-1.5% lower. Today we are going to look at a few Australian stocks who benefit from the boom in battery production following the launch of a specific hedge fund in the US targeting that thematic. Companies with lithium, cobalt, nickel and copper will be on the menu of the estimated $US250m Electric Metals Fund.

ASX200 Daily Chart

The below seasonality chart shows that the last 2 weeks decline by local stocks should not come as too much of a surprise, it’s basically “the norm”. If we are going to follow a typical path in 2018 the market should bottom out in the next week before advancing before the classically weak April / May period.

This adds a degree of comfort to us with any purchases of the current weakness.

ASX200 December Seasonality Chart

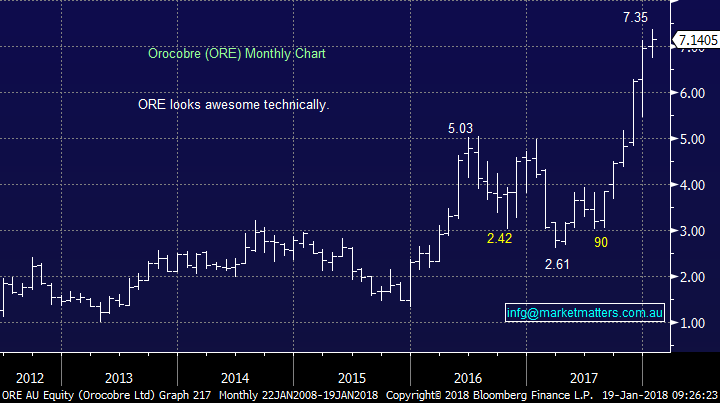

Thanks to Tesla, it’s clear that the electric car revolution is no longer a pipe dream. We have recently seen Toyota pay for a large holding in Orocobre (ORE) as they strive to secure inputs for electric car batteries in the future, a trend which should have much further to run in time. While the battery sector has clearly been “hot” for a while, today we will look for opportunities that may still remain from a solid risk / reward perspective.

Lithium

Global lithium demand is currently forecast to rise from 170,000 tonnes in 2015 to ~550,000 tonnes in 2025, with lithium-ion batteries accounting for around 70% of the demand uplift. There are now a number of lithium producers / explorers to choose from on the ASX which during the lithium price boom during 2016 often doubled / tripled in some cases. Today we have covered 5 of the growing list.

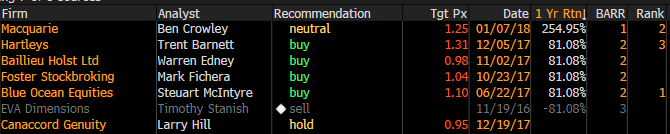

1 Orocobre (ORE) $7.14

MM has discussed ORE recently and we will be watching its price action closely when it recommences trading following its capital raising. The A$361m raise, including A$282m from Toyota was done at a premium to the market but that probably because the deal including exclusive marketing rights for the second stage of production. All in all, we think the deal is a good one however reasonable corrections in ORE are not uncommon. Current broker calls sourced from Bloomberg

We are looking to buy ORE into weakness under $7 following its recent capital raising.

Orocobre (ORE) Monthly Chart

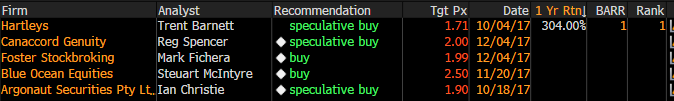

2 Galaxy Resources (GXY) $3.80

GXY has become a heavyweight in quick time, it has grown through a combination of developing its large Mt Cattlin mine in WA and through acquisitions of projects in Canada and Argentina. GXY is undoubtedly a volatile stock which looks good risk / reward buying ~$3.50, a correction of over 20% which seems a lot, but is well within the realm of possibility. Current broker calls sourced from Bloomberg

We are looking to buy GXY around $3.50 as an aggressive play.

Galaxy Resources (GXY) Weekly Chart

3 Pilbara Minerals (PLS) $1

Pilbara Minerals is widely acknowledged to be sitting on one of the world’s largest new lithium ore deposits only ~120 kilometres from Port Hedland in the Pilbara region of northern WA. It’s expected to be low cost with a long mine life (30+ years) on 2mtpa footprint. The mine is currently under construction and once fully ramped up by 2020 should produce 10% of the worlds lithium. Current broker calls sourced from Bloomberg

We are looking to buy PLS around 88c as an aggressive play.

Pilbara Minerals (PLS) Weekly Chart

4 Mineral Resources (MIN) $20.18

MIN has a joint venture with Neometals and Chinese Lithium producer Jiangxi Ganfeng Lithium. The resource estimate is now over 60 million tonnes, way above the previously thought 23 million tonnes. Also worth noting that MIN provides Iron Ore exposure as well so is not a direct play on Lithium. Current broker calls sourced from Bloomberg

We are looking to buy MIN under $17, a moderate risk play in the lithium space.

Mineral Resources (MIN) Monthly Chart

5 Kidman Resources (KDR) $2.02

KDR owns the significant Earl Grey Lithium deposit. Current broker calls sourced from Bloomberg

We are looking to buy KDR around $1.75 as an aggressive play.

Kidman Resources (KDR) Weekly Chart

Cobalt

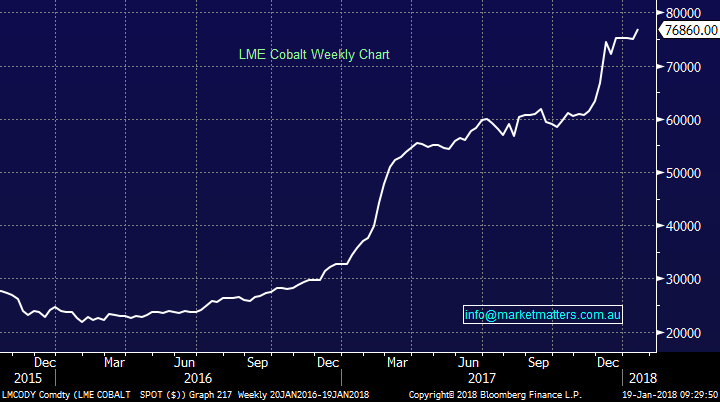

The lithium-ion battery actually contains more cobalt than it does lithium meaning that the boom in batteries is huge for cobalt with close to 50% of the metal used in this manner. The cobalt price has had an amazing rally over the last 2-years but a pullback for a buying opportunity now feels a high probability.

LME Cobalt Weekly Chart

There are a number of junior miners looking to benefit from this boom in cobalt but they are very speculative, often with market caps well under $50m.

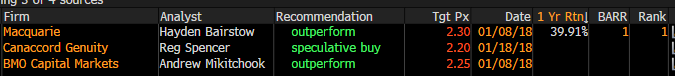

6. Clean TEQ Holdings (CLQ) $1.49

CLQ owns nickel, cobalt and scandium projects in NSW, which they claim is one of the best nickel / cobalt deposits outside of Africa, with current reserves that should sustain almost 40-years of operation. CLQ has a market cap of $865m but has obviously had a stellar run since early 2016, similar to most resource stocks but we feel offers more “real” value than other stocks in the sector. Current broker calls sourced from Bloomberg

We are looking to buy CLQ under $1.20 as an aggressive play.

Clean TEQ Holdings (CLQ) Monthly Chart

Nickel

Nickel clearly has not enjoyed the exponential rally of cobalt but it’s still up ~30% from this time last year. The two nickel stocks which generally garner the most attention are Western Areas (WSA) and Independence Group (IGO). At MM we’ve enjoyed 2 nice profits in IGO over recent years and it remains a sector we like at the correct levels.

LME Nickel Spot Weekly Chart

7. Western Areas (WSA) $3.23

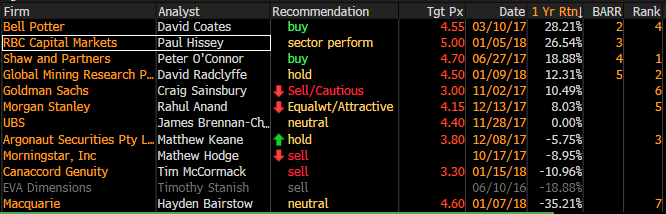

We like WSA into weakness and it’s definitely a stock that is not unaccustomed to volatility. Current broker calls sourced from Bloomberg

We are looking to buy WSA under $3.

Western Areas (WSA) Weekly Chart

8. Independence Group (IGO) $4.86

We like IGO under $4.50 and ideally closer to $4. We had 2 pullbacks in 2017 of ~20% so these targets are not unrealistic. Current broker calls sourced from Bloomberg

We are looking to buy IGO under $4.50.

Independence Group (IGO) Weekly Chart

Conclusion (s)

We have outlined a reasonable number of stocks that are exposed in various ways to the development of electric cars. While many have already rallied strongly, this area of the market will likely have strong tailwinds over the coming years, and having these on our radar makes sense. While we have discussed our BUY levels, clearly we won’t be buying all of these names at any given time. Watch for alerts for actual purchases in the MM Portfolio.

Just to recap, we like

Lithium – ORE, GXY, PLS, MIN and KDR.

Cobalt – CLQ.

Nickel – WSA and IGO.

Global Indices

US Stocks

US equities closed lower overnight as the psychological levels of 26,000 for the Dow and 2800 for the S&P feel likely to at least lead to a period of consolidation / rest for this rampant bull market.

Overall there is no change to our short-term outlook for the US market, where we would advocate patience ideally targeting a ~5% correction for the broad market to provide a decent risk / reward buying opportunity.

US S&P500 Weekly Chart

European Stocks

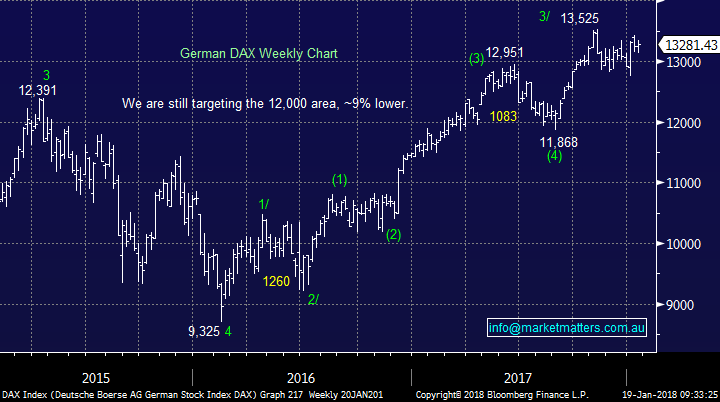

No major change with our preferred scenario for the German DAX a 9% correction back towards the 12,000 area for excellent risk/reward buying – a pop over 2017 highs first still feels likely.

German DAX Weekly Chart

Overnight Market Matters Wrap

· The US equity markets had a breather overnight following the previous all-time highs session as quarterly corporate earnings takeover the scene.

· The US treasury market traded weaker however (bond yields higher), with investors reducing bond exposure from the possibility of a government shutdown due to an increased chance of temporary funding by 19 January looks apparent.

· The March SPI Futures is indicating the ASX 200 to open 10 points higher towards the 6025 area this morning.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/01/2018. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here