Growth again leads ASX higher (ALL, BIN, APT)

WHAT MATTERED TODAY

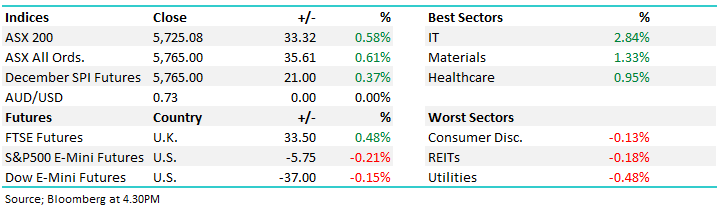

A strong night in the US thanks to comments from the Fed Chair insinuating interest rates were approaching neutral, or in other words – lower for longer. As we showed in the income note yesterday, the market is applying a nearly 80% probability of a hike in December, however it seems given the recent trends around inflation thanks to a weak Oil price and overnight rhetoric from the Fed, that implied probability is high. Less interest rate hikes are a positive for the market and we saw that play out overnight and to a lesser degree on our market today.

We opened firm this morning however peaked around 11am and tracked lower into the close. The last hour was choppy given stock options expiry today – Alex who focusses on our insto flow put in the hard yards this afternoon!!

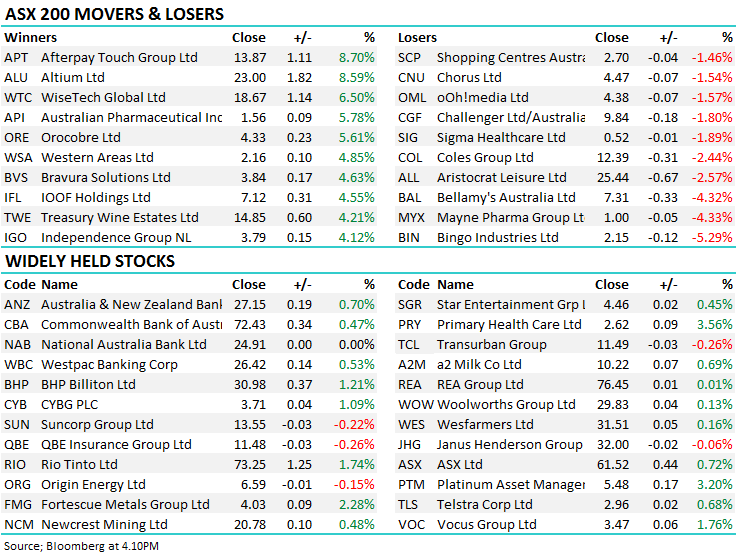

Aristocrat (ASX:ALL) a stock we hold in the Growth Portfolio was weak today, down -2.57% after missing earnings expectations for FY18 – more on that below although buying came into weakness and we still like the stock, while some the growth names we’ve added recently were strong, Altium (ALU) the best of them adding +8.59% to close at $23.00 while Xero (ASX:XRO) added +3.05% to close at $40.56

Overall, the ASX 200 closed up +33 points or +0.58% to 5758. Dow Futures are currently down -40 points or -0.22%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; Laf from Bells – the big bull on AfterPay (ASX:APT) wrote -- Rapid increase in customers in the U.S, with the growth rate outpacing Australia & New Zealand, as well as a regulator review into the sector being as expected are both seen as positive developments for Afterpay – he upgraded his PT today to $23.63 versus todays close of $13.87.

RATINGS CHANGES:

· Tower Rated New Outperform at Macquarie; PT NZ$0.90

· Aurelia Rated New Outperform at Macquarie; PT A$0.90

· oOh!media Downgraded to Hold at Morningstar

· Coronado Global GDRs Rated New Outperform at Credit Suisse

· Coronado Global GDRs Rated New Buy at Goldman

· Coles Group Rated New Neutral at JPMorgan; PT A$13.25

· Wesfarmers Downgraded to Underweight at JPMorgan; PT A$29

· Link Administration Raised to Outperform at Credit Suisse

· Xanadu Mines Reinstated Speculative Buy at Bell Potter

Afterpay (APT) Chart

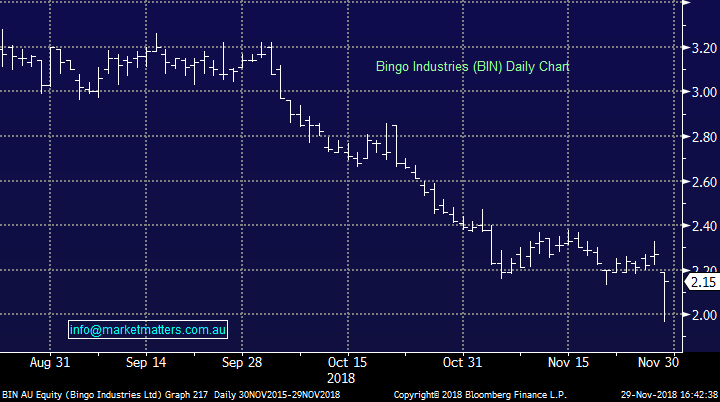

Bingo Industries (ASX: BIN) $2.15 / -5.29%; The Waste Management business has taken another hit today, trading down nearly 6% after the ACCC voiced concerns over its proposed takeover of Dial-a-Dump. Specifically, they said "Our preliminary view is that the acquisition would remove Bingo’s most substantial competitor for B&D waste processing, particularly in the Eastern Suburbs and inner Sydney. Although alternative facilities exist, our current view is that many are not viable alternatives as they either will not accept third party mixed B&D waste, charge significantly more for heavy loads, or are too far away to constrain Bingo from increasing prices. The acquisition would remove future competition between Bingo’s and Dial-a-Dump’s dry landfills, which may lead to higher gate fees than would be likely without the acquisition.”

As you can imagine, the company strongly disagrees with the decision however unfortunately (for them) their interpretation is less influential than that of the ACCC. While this is a blow, the actual decision is not scheduled until the 21st February 2019. The Bingo share price has been weak for some time, trading from $3.28 in August to a low today of $1.965 – a 40% decline. BIN raised $425m in new capital in August on the expectation the deal would be done, however it seems the market ‘sniffed out’ the ACCC’s reservations and sold ahead of the latest news. We like BIN into this ‘blow off’ low as the move to appease the regulator ahead of the final decision in February now commences.

Bingo (ASX: BIN) Chart

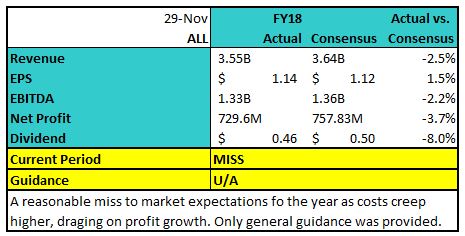

Aristocrat Leisure (ASX: ALL) $25.44 / -2.57%; the gaming company Aristocrat is trading lower today following a less than impressive full year result announced this morning. Full year profit growth of 34% to $730m was below the markets expectations of $757.8m with the miss attributed to rising costs. The uplift in profits was also supported by acquisitions of Big Fish & Plarium for a total close to $2b.

Design & development was the biggest driver of increased costs, jumping over 50% to be 11.4% of total revenue. The poker machine maker doesn’t plan to stop its spending there, with the company flagging further investment to acquire more users. We like Aristocrat and although the result is slightly soft, we see upside on the back of it. Costs can be stripped however there is clearly an opportunity to outpace cost increases with revenue generation which the company is doing a good job off. The market also turned less negative, with the stock rallying throughout the afternoon. We own ALL in the Growth Portfolio.

Aristocrat Leisure (ASX: ALL)Chart

OUR CALLS

No changes today.

Have a great night

James/ Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.