Healthcare’s coming off the boil, where should we accumulate? (CBA, CSL, COH, RHC, ANN, RMD, FPH)

The ASX200 may have closed basically unchanged yesterday, after swinging between up and down more than +/-1%, however the action under the hood was bordering on the amazing for a day when the index fell only 0.1%. Stocks were either in or out of favour with the neutral middle ground the most sparsely populated area e.g. more than 20% of the ASX200 rallied by over 3% while 12.5% of the market declined by the same degree, the difference in performance between Australia’s two largest stocks was more than 11% with Commonwealth Bank (CBA) rallying +4.9% whereas CSL Ltd (CSL) tumbled -6.4%. I could go on with a long list of superlatives, but the bottom line was we saw another strong day for stocks correlated to a “V-shaped” economic recovery. In terms of the “V”, this morning we’ve had the management team from Eclipx Group (ECX) in the office talking car leasing, they’re a big player in the space with 50-100k cars out at any one time and they deal with a lot of ASX 100 companies on a daily basis, the clear message they are getting is that most are well and truly back to business!

The chart below makes it very easy to see the huge relative outperformance of CSL over CBA during the last 2-years hence when some fund managers believe it’s time for a little reversion moves can be very pronounced like yesterday, we can break down our current thoughts on the 2 stocks as below:

1 – As MM has outlined this week, we believe fund managers are underweight the banks, in a market where investors are cashed up looking for bargains this creates a void of sellers and a subsequent squeeze higher. I know of 2 people who have sold houses on Sydney’s North Shares in the last few days for prices that simply delighted them implying interest rates are trumping COVID-19 concerns but the markets been pricing the banks to take a proverbial bath on their loan books because of the pandemic i.e. as we’re currently witnessing the risks appear clearly on the upside, in the last 48-hours CBA has rallied +9% and Westpac (WBC) +14.9%.

2 – Conversely we have mentioned over the last few months that investors “feel’” complacently long CSL, a dangerous position in any market. A number of these players have clearly bailed in recent weeks with CSL falling -13.8% since mid-April while the underlying index has continued to grind higher. The fact CSL is now owned by growth managers, value manager and index managers makes it vulnerable in our view.

Over the last month MM has held onto stocks like NRW Holdings (NWH) and Emeco (EHL) after they’ve surged higher only to see a portion of these gains slowly eroded which is obviously frustrating but we’re not in the game of intra-week trading although the current whips in stock sentiment on a weekly basis has taken many months to unfold in previous years. At this stage we’re sticking to our guns with both of the market heavyweights – CSL we now see back under $260 while CBA is initially targeting the $70 area.

On a side note Morgan Stanley hosted a call with CSL management yesterday which left some pundits a little uninspired, not ideal for a heavily owned stock.

Commonwealth Bank (CBA) & CSL Ltd (CSL) Chart

The ASX200 again made fresh 11-week highs yesterday but the follow through was unconvincing as we saw enormous variations of performance across the market. Theoretically we are now seeing the lower quality stocks play some catch up and squeeze the index higher, commonly the characteristic of the tail end of a market’s advance, but a couple of points should not be forgotten:

1 – Markets have a habit of squeezing higher than many hope or expect e.g. with the banks, the harder they rally the more underweight fund managers become it becomes a self-fulfilling issue until valuations get too extended and some people take a stand, usually after panic buying has led to many investors chasing too hard and “getting long at the top”.

2 -The recovery from Marchs lows has not been embraced by retail and professional investors alike suggesting pullbacks will remain fairly shallow for a while.

MM remains bullish equities medium-term but were still adopting a more neutral stance short-term.

ASX200 Index Chart

A few people have asked me where I thought gold was headed over the next few months, my answer was as is often the case more around the risk / reward as opposed to a specific area. We’ve seen with our markets of late how there’s been significant mean reversion between stocks and sectors, hence my thinking of why not gold? Importantly this is not a prediction as such but more a feeling of a move that wouldn’t surprise me in todays environment.

The ideal pullback area to provide a solid risk / reward buying opportunity in gold is ~$US1500, or around 12% lower.

Gold ($US/oz) Chart

Overseas markets

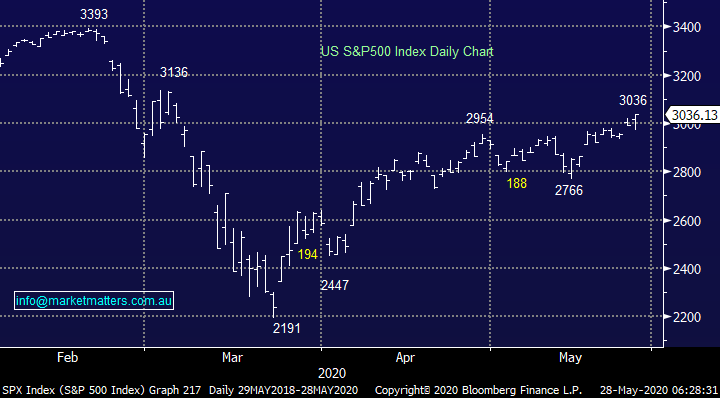

US stocks enjoyed another strong night overseas with the Dow catching the eye for a change rallying over 550-poiints / 2.2% while the NASDAQ only managed a +0.55% gain, the big difference was similar to looking in the mirror of the ASX i.e. it was all banks.

MM remains bullish global stocks medium-term but short-term they still feel “rich” or vulnerable to a pullback.

US S&P500 Index Chart

Where & what to buy in the Healthcare Sector

The US Healthcare sector has tracked a comparable path to the tech-based NASDAQ index shrugging off the coronavirus pandemic, impressively the US health stocks are currently less than 5% below their 2020 all-time high. I have used the US Index as opposed to our own which is dominated by heavyweight CSL Ltd (CSL), locally it’s become a $130bn gorilla in the room. We are bullish US Healthcare stocks anticipating fresh all-time highs into 2021 but after bouncing 36% from their March lows the risk / reward is not exciting at todays levels, our best guess would be the market needs to spend a few months in its current area before regaining the strength to surge through towards the 1250 area.

Overall healthcare stocks like many of their tech friends look perfectly positioned for their new post COVID-19 working and living environment plus they revel in a low interest rate environment which looks unlikely to change dramatically over the next few years. Hence if we are going to see some of the Australian quality names like CSL experience decent pullbacks we should identify where to consider catching the proverbial falling knife.

Hence today MM has briefly looked at 6 major players in the Australian Healthcare Sector specifically with an eye on where to start buying, of course if at all.

US S&P500 Healthcare Sector Index Chart

Overall we’ve been deliberately relatively conservative with our targeted areas because MM feels Australian investors are very long this “go to” sector which could exaggerate any pullbacks but as with all over our views they will be constantly evaluated – we saw in Q4 of 2018 how quickly this sector can unravel when the music stops playing the growth / healthcare melody.

1 CSL Ltd (CSL) $288

Blood plasma company CSL needs no introduction especially after we touched on the stock earlier. Our main concern with CSL is it is too well owned whilst being a touch expensive for such a large company whose growth prospects moving forward will struggle to vaguely match its history. I was chatting with a well-known value manager recently; I had read his book many years ago and was surprised to hear that CSL has become one of his largest positions. When value managers trundle through a ‘valuation’ argument for CSL it concerns me. This is a great company, which has done incredibly well increasing 10-fold since the GFC, but I think the register is filled with complacent holders.

MM likes CSL but only 10-15% lower.

CSL Ltd (CSL) Chart

2 Cochlear Ltd (COH) $187.93

COH has fared far worse during the pandemic which makes sense as this hearing implant business suffered as the global economy ground to a halt i.e. a few weeks ago the company announced a 60% decline in sales for April although on the positive side China was recovering relatively fast. Importantly on these numbers COH is cash flow negative and is likely to remain so for at least the next few months.

The company raised $1.1bn from investors in March at $140 as they saw the looming issues early but by definition more shares as always means diluted earnings. We like the companies long term prospects, but we don’t see any reason to chase the stock short-term.

MM likes COH ~8% lower.

Cochlear Ltd (COH) Chart

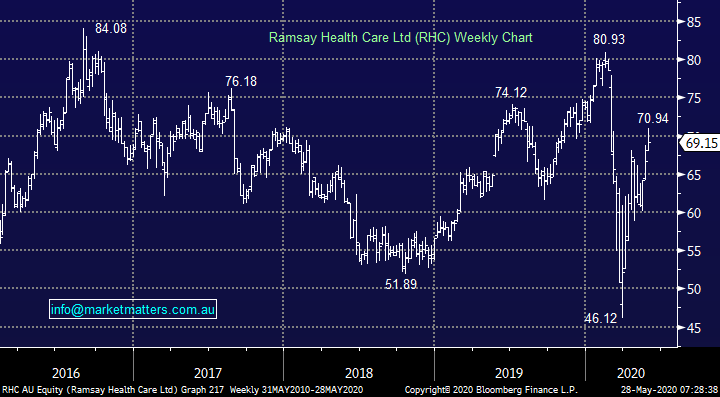

3 Ramsay Healthcare (RHC) $69.15

RHC is the leading private healthcare operator with approaching 500 facilities through 11 different countries, not a bad position in today’s new world. MM already owns RHC in our Growth Portfolio and with a target of fresh all-time highs, so we see no reason to be tweaking at present. However for investors looking buy / accumulate this quality business we would be targeting sub $65 at this point in time.

MM likes RHC under $65.

Ramsay Healthcare (RHC) Chart

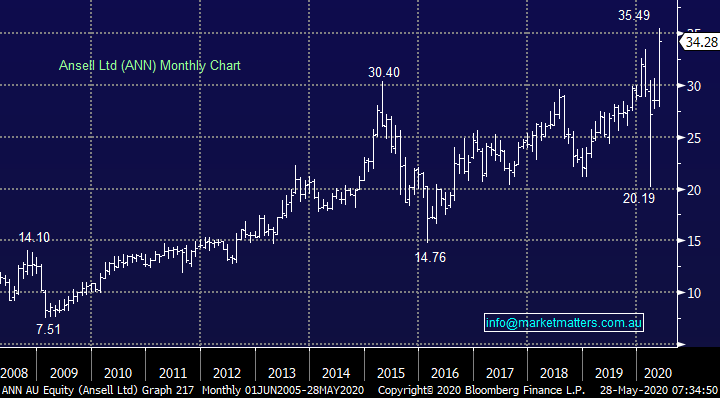

4 Ansell Ltd (ANN) $34.28

ANN has certainly found itself in the right place at the right time, this health & safety business which makes surgical rubber gloves amongst other things, has soared to fresh all-time highs during the pandemic. We believe the current “sugar hit” that ANN is enjoying from COVID-19 will remain as people become far more virus conscious moving forward hence we feel this stock is now a solid longer-term investment.

MM likes ANN around $33.

Ansell Ltd (ANN) Chart

5 ResMed (RMD) $24.14

Sleep disorder company RMD has not been impacted in a major way by the coronavirus although like all growth stocks its revelling in the low interest rate environment. Although we are targeting fresh all-time highs in the year ahead from a risk / reward perspective the stocks not attractive just here but ~5% lower would change the picture.

MM likes RMD around the $23 area.

ResMed (RMD) Chart

6 Fisher & Paykel (FPH) $28.70

In a similar way to ResMed respiratory business FPH looks poised to make fresh all-time highs in the year ahead but the risk / reward is not particularly exciting at current levels. We are keen accumulators into weakness.

MM likes FPH under $27.

Fisher & Paykel (FPH) Chart

Conclusion

MM likes the 6 Healthcare Stocks we looked at today but from a risk / reward perspective all at lower levels – see above for specific targets.

Note as we have outlined over recent weeks, we might overlook some of these stocks if we see an overall market pullback leading to the IT sector also offering improved entry levels.

Overnight Market Matters Wrap

- The US markets continued Australia's lead overnight with all 3 key major indices rallying as investors across the globe forecast further easing of the coronavirus lockdown.

- Crude oil slid from its 11-week high following reports of an inventory build, currently off 6.2% to US$32.22/bbl.

- The June SPI Futures is indicating the ASX 200 to gain 50 points, testing the 5825 level this morning with May Equity options expiry this afternoon.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.