Should we buy regional banks for yield?

We’ve seen a wave a selling in the two regional banks since Bendigo released first half results on the 11th February - Bendigo Bank (ASX:BEN) has fallen from $11.15 pre-results to close yesterday at $9.83, a fall of nearly 12% while Bank of QLD (ASX:BOQ) initially fell in sympathy with BEN however the selling kicked up a notch when they downgraded guidance a few days later showing similar trends to their southern cousins. BOQ has now fallen from $10.66 the day before BEN reported, to close yesterday at $8.81, a drop of ~17%. Over the same period, the sector generally has been fairly flat while CBA has more of less held its $2.00 per share dividend.

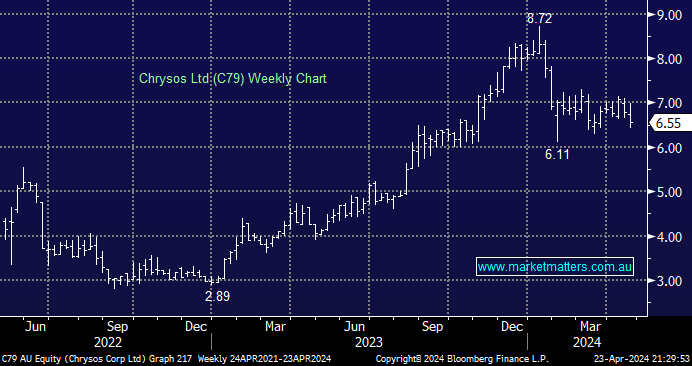

Bendigo Bank (ASX:BEN) Chart