Is China flying a red flag for global equities? (BHP, OZL)

The ASX200 saw another day where early optimism was sold into and the index tracked lower into the close, although the selling was far from aggressive, particularly compared to the ongoing route in Chinese equities which fell another 2.9% yesterday to trade at their lowest levels in over 2 years. Our mining stocks gave back some of their recent gains while the banks were in consolidation mode. BHP remains stuck in a ~$32 / 34.50 trading range since it peaked in the middle of May while using Commonwealth Bank (CBA) as a proxy for the banking stocks, it’s rallied +11% from its June low and is now chopping around in a ~$72/$74 short term trading range.

ASX 200 Chart

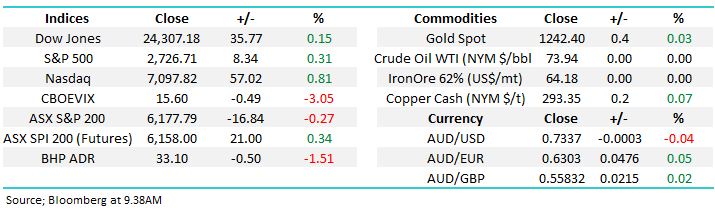

Overnight stocks were mixed with Europe closing generally lower while the US managed a small bounce courtesy of the technology stocks - the NASDAQ leading the charge adding 0.76%. Crude Oil was lower overnight down 2.44% thanks to Mr Trumps tweet around Saudi’s Oil production capabilities on Saturday morning. We can’t help but think he’d love the fact his tweets are moving markets around the world!. Saudi Arabia have an extra 2m barrels per day capacity and Trump is putting pressure on them to start using it, which would put downward pressure on Oil prices.

However, Saudi Arabia, the leader of OPEC, wants crude oil to remain firm given they’re trying to IPO up to 5% of their State owed Oil behemoth Aramco in either London or New York. Valuations have been touted around $2 trillion - the equivalent to around six Exxon’s hence easily making it the most valuable company in the world. When we consider Saudi’s influence and the rising tensions in the Middle East it’s hard to see crude oil falling anytime soon but share prices look 6-months+ into the future.

This morning, SPI Futures are indicating a rise of around 0.5%, however with BHP set to open down ~1.5% at $33.09 the banks will need to do the heavy lifting

· Short-term MM is neutral the ASX200 with a close below 6140 to switch us bearish, however we remain in “sell mode” overall.

Today’s report is going to focus on whether or not the large drop in Chinese equities is a canary in the coal mine.

Is China flying a red flag for global equities?

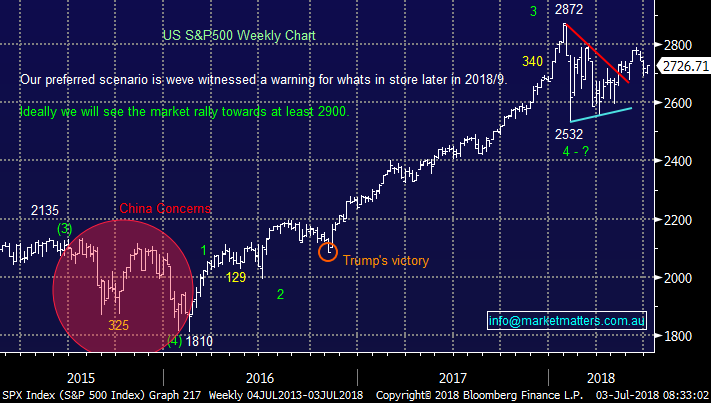

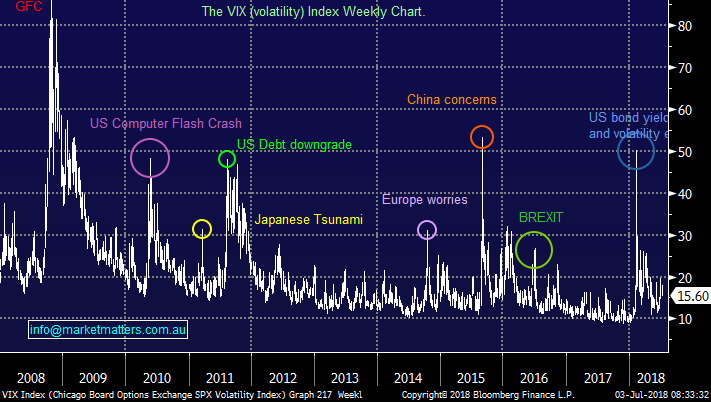

Chinese stocks are now trading below the level they were in 2015 when they caused major global uncertainty and a massive uptick in volatility after they lost 30% in a few short weeks. The concern then was that a slowdown in the world’s economic growth engine would lead to a new financial crisis. The VIX traded to its highest level since the height of the GFC and we saw US stocks drop by around ~10% towards the end of 2015. Markets subsequently settled down and recovered before another bout of anxiety took hold in early 2016 following economic growth numbers that were below market expectations. That triggered another drop in global equities, this time around ~14% for US stocks however volatility remained below the 2015 levels.

In the ~9 years since the GFC, China has been the cause of the biggest drop in equities and the highest spike in volatility.

S&P 500 Chart

Volatility Index Chart

This prompts the obvious question, why is the market ignoring the growing anxiety in China?

Shanghai Composite Chart

Yesterday we saw Chinese equities book their 5th largest decline for the year as concern around a potential trade war escalates. China has the most to lose in this tussle given that the US is the region’s biggest export market + China is the biggest exporter of goods globally. A reduction in global trade overall shrinks China’s addressable market for their products which is obviously a negative influence on Chinese economic growth. The last two Chinese led declines for global equities came on the back of growth concerns.

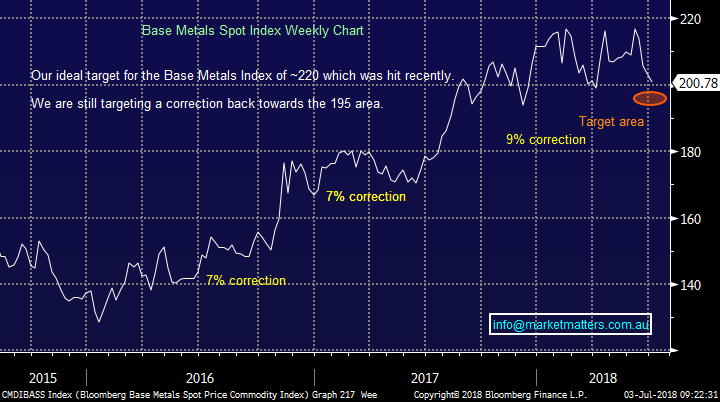

Chinese equities are now down 13.06% over the past 12 months, with the lion’s share of those falls coming in the last few months. The most obvious exposure to Chinese growth for Australia is borne through resources which have been frustratingly strong in the last few weeks. We’re now very underweight the sector looking to buy weakness which has proven elusive to date, however the overnight moves across the commodity complex and the weakness we’re seeing in the Chinese market has us more confident that we’ll be able to get set back in the resource stocks into further weakness.

Base Metals Spot Index Chart

The first 2 resource stocks MM are looking to buy into weakness are BHP & OZL.

1 BHP Billiton (BHP) $33.60

No surprises following our recent reports that BHP is our number one pick with capital returns coming soon and they are likely to be huge. The stocks fairly volatile and even while its doubled in the last 2-years it’s still managed retracements of 18.7%, 21.1% and 12.5% - a ~16% correction from the 2018 high which is well within these degrees of recent corrections.

MM is looking to buy BHP below $30.00, or ~10% lower

BHP Billiton (BHP) Chart

2 OZ Minerals (OZL) $9.48

We’ve been looking at Oz Minerals since we took profits too early from our last foray in the Copper stock.

MM likes OZL below $9, where it was trading back in April

Oz Mineral (OZL) Chart

Conclusion (s)

The bubbling trade war between the US and China is having a bigger impact on China at present

Chinese equities have been very weak which should be a warning sign for our commodity stocks, and markets more generally

We’re likely buyers of BHP and OZL into further weakness

Overnight Market Matters Wrap

· The US equity markets recovered from an early selloff, to end its session marginally higher overnight as fears of an escalation in global trade wars continued to weigh on investor sentiment. European markets however slumped on concerns that the Merkel government may lose its minority power base after a senior minister threatened to resign.

· Adding fuel to the trade fires, Europe is now threatening tariffs on up to $300bn worth of US imports if the Trump administration proceeds with threatened levies on European car exports to the US.

· Commodity prices are increasingly feeling the heat of trade war fears, with copper hitting a 7 month low overnight as risks grow of Chinese demand being hurt. Most key commodities were in the red overnight with even the oil price retreating nearly 2.5% from recent highs.

· The weaker sentiment saw BHP in the US to close down an equivalent of 1.53% to $33.09 from Australia’s previous close, while the A$ slumped back to its recent lows of US73.3c.

· The September SPI Futures is indicating the ASX 200 to open 32 points higher, above the 6200 resistance this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 03/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here