Is it time to reconsider the embattled the lithium sector? (FLT, WEB, EEM US, LIT US, ORE, GXY, PLS)

The ASX200 fell 46-points yesterday following the previous bad night on Wall Street but this morning we look set to regain basically all of those losses following a strong night in the US – the choppy rollercoaster continues. On the stock level yesterday we saw over 70% of the index close down although the IT sector was surprisingly strong with over two thirds of that index closing up, a good call by investors as overnight the IT focused NASDAQ was the standout US index rallying by over +1.1% but again the more speculative small cap Russell 2000 underperformed only gaining +0.5%, still a bearish indicator that investors are finding solace in the well-known large cap stocks.

Yesterday we saw Australian consumer confidence hit a fresh 4-year low as ironically people start to question why interest rates are being slashed so hard, the old adage of there’s no smoke without fire is clearly entering our minds. Just to add fuel to the fire markets are pricing in an almost 50-50 chance of a rate cut next month or an 85% chance of one in December, like the rest of the world we appear to be headed towards zero interest rates. It feels like it might need property prices to rise higher / faster to get the Australian consumer out shopping in earnest this Christmas.

The vital US - China trade talks commence in Washington tonight on an optimistic footing as China is apparently ok with a partial trade deal assuming we see no further threats of tariffs by President Trump. Also China sounds comfortable to increase purchases of US commodities in an olive branch style gesture but as we all know what mood the US President is on the day is likely to dictate the outcome and hence short-term market direction – another toss of a coin event!

Short-term MM remains comfortable adopting a more conservative stance towards equities.

Overnight global stocks bounced on trade hopes with the US S&P500 closing up +0.9%, the SPI futures were calling the ASX200 to open up ~40-points this morning, although an early 1% drop by US Futures implies we’ll now open down.

This morning we have again turned our attention to the lithium sector as Mineral Resources (MIN) and Orocobre (ORE) were the worst performing stocks in the ASX200 yesterday apart from Flight Centre (FLT).

ASX200 Chart

As we said Flight Centre (FLT) was the worst performing stock in the ASX200 yesterday following a disappointing trading update. The business is experiencing subdued trading both in Australia and the US travel while BREXIT uncertainty is understandably a headwind in the UK. The conditions coincides with the consumer confidence data, not an ideal backdrop for FLT and other businesses looking for the discretionary dollar.

The almost 12% fall on the news is no surprise to MM considering analysts were looking for ~10% growth. It’s hard to see a catalyst for the consumer to again start spending as property prices have already been improving for a few months, perhaps we all need a nice summer and less negative press telling us how bad things will be next year, otherwise the talk of a recession will become self-fulfilling!

Fortunately MM recently sold FLT in our Income Portfolio for a good profit at higher levels but importantly we are not considering re-entering before we see their updated guidance at their AGM in November the t

MM can easily see FLT another 10% lower.

Flight Centre (FLT) Chart

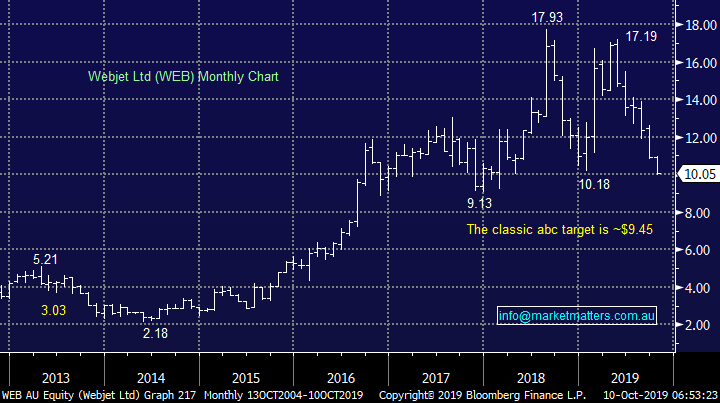

We’ve been discussing FLT’s on-line rival Webjet (WEB) over the last month following the demise of its trading partner, the worlds oldest travel business UK based Thomas Cook. The weak trading issues impacting FLT are extremely likely to be flowing into WEB’s profitability hence there was no surprise to see the stocks downside momentum continue yesterday, their shares fell an additional 2.7%, taking its decline for the year close to 30%.

MM can easily see WEB another 5% lower.

Webjet (WEB) Chart

One of our favourite (clearest) charts and market indicators for MM at present is the Emerging Markets Index ETF (EEM) - a mid/large cap based ETF that currently holds 4.4% in Tencent (700 HK), 4.3% in Alibaba (BABA) and 3.7% in Samsung (005930 KS).

If we are correct the ETF which has been falling for almost 2-years still needs another ~10% spike lower to finish its decline and washout any remaining weak bulls hence we are holding back on our Asian facing targets for the MM International Portfolio. Also while the EEM appears so bearish we are comfortable giving our negative short-term opinion on the ASX200 the benefit on the doubt.

MM remains bearish the Emerging Markets ETF targeting ~10% downside.

iShares MSCI Emerging Markets ETF (EEM US) Chart

Reviewing the lithium sector.

Australian lithium stocks were all the rage back in early 2018 as investors extrapolated the volume of electric vehicles hitting our streets in the years ahead while they ignored the industry’s ability to significantly increase supply to meet the rising demand. As is so often the case when optimism and euphoria gets way ahead of itself things crash back to earth with a thud, the lithium ETF shown below has fallen by over 40% over the last few years – the question now is has the elastic band stretched too far on the downside.

This years Noble Prize in Chemistry has been awarded to 3 scientists credited with inventing the rechargeable lithium-ion battery illustrating how topical the subject has become. These batteries are now used in many of our everyday lives from mobiles to the afore-mentioned electric vehicles but from an investment perspective it all comes down to the simple and enigmatic supply & demand equation for the underlying highly unstable metal – actually the lightest metal on planet earth.

There has been an avalanche of fresh supply to hit the market while China, the worlds largest user, has seen a lower take up of electric vehicles (EV) than most people were forecasting. However we like most analysts believe demand will continue to strengthen but it won’t necessarily translate to higher prices as has been demonstrated over the last 2-years i.e. its relatively easy to ramp up the supply of lithium. The short-term glut of lithium may be a short-term oversupply aberration but it may take some time to rebalance, many pundits believe by 2030 we will see a shortage of supply but that’s a decade away!

MM doesn’t see any meaningful increase in the lithium price over the next few years.

Hence stocks who can make a profit at these relatively depressed prices are where investors should be focused i.e. low cost producers.

Global X Lithium ETF (LIT US) Chart

Today we have looked at 3 major Australian lithium stocks to see if any value or clear risk / reward opportunities are presenting themselves.

1 Orocobre (ORE) $2.41

ORE has suffered like the whole sector with the declining lithium price and I’m sure Toyota are not happy with their large purchase well above $7. Only back in August did the ORE management upgrade its full year profit guidance while it also implied that higher lithium prices were around the corner – the markets clearly not convinced.

At least the stocks making a profit and guiding positively but sentiment towards the sector clearly remains challenging. ORE is the 3rd most shorted stock on the ASX with almost 16% of the stock short sold telling us that the professional traders see no short-term light at the end of this tunnel.

MM would look at ORE around $2 as a very aggressive play.

Orocobre (ORE) Chart

2 Galaxy Resources (GXY) 93c

GXY is down over 50% for the year with no obvious bottom in sight, its certainly only a stock for the brave and we currently classify it as a trading stock. GXY is currently the most shorted stock on the ASX, statistically a negative sign for investors.

MM has no interest in GXY at present.

Galaxy Resources (GXY) Chart

3 Pilbara Minerals (PLS) 30.5c

PLS has a very similar ~$600m market cap as ORE while unfortunately also struggling badly over the last 2-years. The stocks not as shorted as the other 2 with only a 7% position. They have just raised 55m in new capital at 30cps, plus there is a share purchased plan (SPP) that closes tomorrow. For those looking at the SPP, the price will be set at the lower of 30cps or a 10% discount to the 5 day volume weighed average price (VWAP) leading into the close of the offer. The VWAP for the first 3 days of the period is 30.57cps, meaning the SPP price would be set at a 10% discount to that, although there are still 2 pricing days to go.

MM is neutral PLS.

Pilbara Minerals (PLS) Chart

Conclusion (s)

ORE may offer a trading opportunity around $2 but otherwise MM feels there’s no hurry to pick a bottom in the lithium space.

We often like stocks / sectors that are very out of favour but the underlying fundamentals are too much of a headwind for us with regards to lithium, at least short-term.

Global Indices

No real change, we are looking for a move to the downside but recent weakness has failed to follow through with any meaningful momentum.

US stocks look vulnerable to the downside but the trend remains sideways.

US Russell 2000 Index Chart

Similar to US indices European indices feel bearish technically but there’s no commitment in either direction at this point in time.

Euro Stoxx50 Chart

Overnight Market Matters Wrap

- The US equity markets surged on optimism that the US and China can come to some sort of agreement regarding trade, with the tech. heavy, Nasdaq 100 outperforming its key peer indices.

- A Chinese official said they are still open to a partial trade deal as long as no tariffs are added. They are prepared to commit to more purchases of US agricultural products in exchange for the US not adding any more tariffs. Beijing, however, is not confident a wider agreement can be reached.

- Minutes of the Fed’s latest policy meeting showed most officials were in support of the latest cut, but were divided about where to next for rates. Chairman Powell said that while the economy is in a good place, there are some risks.

- Aluminium fell 1% on the LME, iron ore dropped ~4%, while crude oil rose marginally on geopolitical tensions.

- BHP is expected to outperform the broader market after ending its US session up an equivalent of 0.64% from Australia’s previous close.

- The December SPI Futures were indicating the ASX 200 to open 35 points higher this morning, towards the 6580 level, however a 1% drop in US futures on open will likely see us open worse off.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.