Macquarie announces new CEO, Fortescue production numbers (MQG, FMG)

WHAT MATTERED TODAY

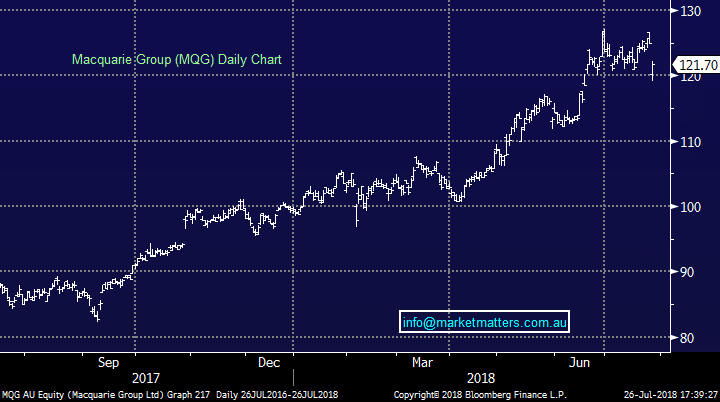

A busy day on the desk today with stock options expiry – the market opening down and selling off fairly hard early thanks in part to weakness in Macquarie (MQG) following the departure of well-regarded CEO Nicholas Moore, but probably more importantly they guided to flat earnings for FY19 versus market expectations of around 5% growth – still, the weakness early was bought into however there looked to be a lot of stock through on the match which pushed it up +30c on the close – the stock eventually ending at $121.70, down 2.59% on the day. More on that below.

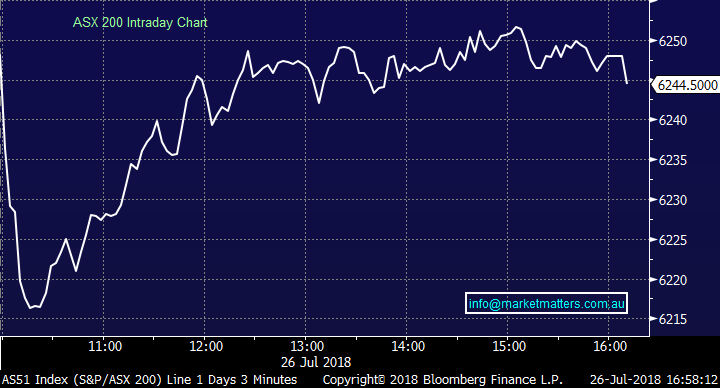

So – not a bad come back from early session lows with the index hitting 6214 at the worst before putting on a quick +30points to end only marginally in the red. Overall, the ASX200 lost -3points or -0.05% to close at 6244 – Dow Futures are currently trading up 31pts. We remain neutral here, with the trigger to turn more bearish at 6140 on the XJO.

Elsewhere, some corporate activity heating up with Nine merging with Fairfax – although it looks and smells more like a takeover to me – FXJ up +8.44% while NEC fell -10.32% while news doing to rounds that Oaktree is circling the beaten up Blue-sky (BLA) – the stock up +9.25% as a consequence.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves

· Cleanaway (CWY AU): Rated New Buy at CCZ Statton

· Domain Holdings (DHG AU): Rated New Overweight at JPMorgan; PT A$3.50

· Midway (MWY AU): Midway Rated New Buy at Bell Potter; PT A$3.20

· Rio Tinto (RIO LN): Downgraded to Underperform at RBC; Price Target A$65

Macquarie (MGQ) $121.70 / -2.59%; we touched on Macquarie in this morning’s report, however by way of update, it was a very volatile day for the stock as the market reacted to the AGM. In the past the AGM was a catalyst for the stock to move higher as the company has used this as an opportunity to upgrade forecasts above than the standard “in line with previous financial year” comment quoted in previous full year results.

There was a change of tune this year however – CEO Nick Moore to be replaced by head of asset management Shermara Wikramanayake (not totally unexpected, over a decade in the job, Nicholas was due for a rest and Shemara was always touted as the heiress), the headline was no upgrade to previously mentioned “in line with previous financial year.” The market thought this was not good enough (had +5% growth built in) and sent the stock to an early low of $119.11, 4.7% below yesterday’s close.

Yesterday our $118 target seemed a pipedream, but by 10.10AM it was a stone throw away with the market expecting 5%+ growth only to be told there would be none. By the time the dust settled, MQG recovered somewhat as everyone accepted the donut (Macquarie) wasn’t going to donut (nothing), and donut (zero) growth was likely an understatement for which Macquarie is well known for. We do expect some selling to continue, and are looking for the $118 to start building a position. (Harry dreaming of Donuts by the sound of it this afternoon!!)

Macquarie (MQG) Chart

Fortescue (FMG) $4.39 / -3.73%; Fortescue was supported earlier in the day, before buying dried up and shares sunk despite what we view as a reasonable quarterly report. It was another record quarter to round out the financial year, Fortescue shipped 46.5Mt of iron ore, and kept costs under wraps at an average of $US12.47/t average over the year. What we found most promising was the slight uptick in realized price vs. the iron ore price – a 63% discount to the normal 62% iron ore price index. The improvement to last quarter justifies our view that this is a cyclical trend and the lower quality ore that FMG produces will not be priced out of the market.

Source; Shaw and Partners

All in all, production, cost and price guidance was all inline, and we see FMG as a viable iron ore player long term. We are watching the iron ore price closely for an ideal entry point back into FMG.

Fortescue (FMG) Chart

OUR CALLS

No trades across the MM portfolios today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 26/07/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here