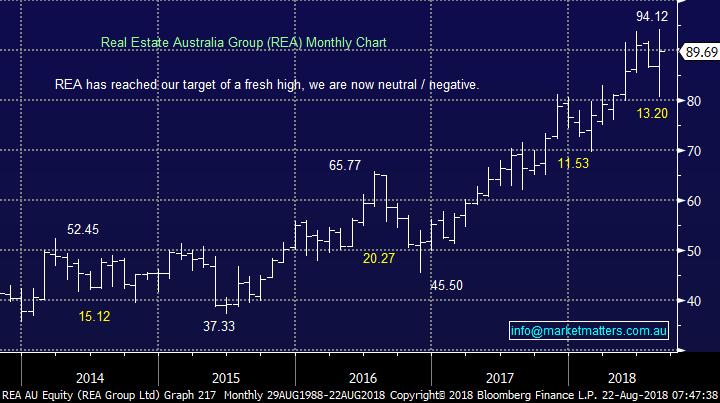

MM has a few moves in our cross-hairs (QBE, BBUS, ELD, XRO, REA, AMC)

A big day on the reporting front with some first thoughts below;

A2M – looks strong, revenue inline at $922m however EBITDA a beat at 283m v 277m expected, NPAT at 195.7m v 189m expected and margins were slightly ahead of expectations, plus they guided to margins remaining there in FY19

WTC – slight miss on profit (41m v 43m expected) and FY19 EBITDA guidance at 100m-105m vs market expectations of 106.5m may be a slight disappointment

CAR – Inline on revenue, slight miss on EBITDA and NPAT however only marginal. No firm guidance given, just more growth, which the market already has priced in, with EBITDA growth in FY19 tipped pencilled in at 19%

LLC – Revenue inline, profit a big beat at 792.8m v 769m expected, however this is a notoriously difficult / complicated result – no guidance provided which is usual for LLC

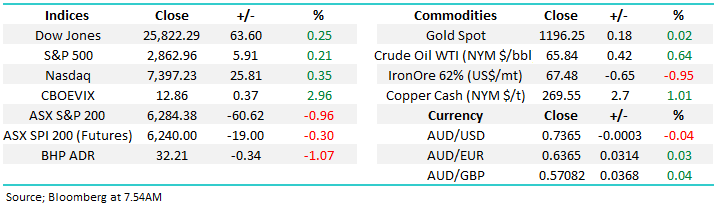

The ASX200 was clobbered yesterday with some uninspiring company reports plus further domestic political turmoil receiving most of the blame. Whatever your personal views on how our glorious country should be run I’m sure most subscribers like myself are becoming frustrated with the ongoing bureaucratic antics out of Canberra. Tony Abbott is my local member and clearly he is orchestrating significant destabilisation within the Government, something he said many times he would not be party to. Come on Tony, pull your head in!

- Australia has now witnessed 6 changes of Prime Minister in just over 10-years with another now appearing imminent, this lack of stability is farcical. Run the country as you were elected to do!

Two contradictory characteristics of yesterday’s trading caught our eye:

- The market fell easily and failed to receive any meaningful buying throughout the day – not that common this year.

- The volatility of the XJO puts failed to rally implying that professional investors do not believe the days weakness will follow through to any great extent.

Technically we regard yesterday’s decline as damaging but as we all know one-day does not make a summer, todays appetite for local stocks will be interesting. SPI Futures are down here + US Futures are down around 0.50% since our futures market closed this morning. A negative start is expected.

· We remain neutral here while the index can hold above 6240 however we remain in overall “sell mode”.

Overnight stocks were firm but closed well below their highs with the US S&P500 finally making fresh all-time highs before surrendering most of the gains. BHP closed down over 1% in the US, around $32.20 on the US ADR market.

Today’s report is going to again be split into 2 halves:

- 3 potential actions that MM is considering for the Growth Portfolio.

- 3 stocks that caught our eye yesterday following company news / reports.

ASX200 Chart

As we’ve discussed a few times recently the best vehicle to identify a downturn in the Australian market at this time of year is the September futures (SPI) and we believe it’s time to pay attention.

· MM has received a technical “sell signal” from the SPI following decent volume trading below 6250.

ASX200 September SPI Futures Chart

The MM Growth Portfolio

1 QBE Insurance (QBE) $10.90

QBE has taken us on a tough journey over the last ~2-years but the recent 20% recovery has certainly lightened the load to shareholders, somewhat.

While we like the direction QBE appears to be headed internally + the macro backdrop of rising rates is supportive, we feel that our 7% weighting in QBE plus an 8% weighting in Suncorp affords us very little flexibility towards a sector we like, but one that’s reasonably volatile.

QBE reported results recently and it was clear beat – the stock rallied strongly as a consequence. We are using this strength to reduce our weighting to the insurer.

· MM is considering reducing our holding by 3%, leaving around ~4% in the position.

QBE Insurance (QBE) Chart

2 BetaShares BBUS Bear ETF

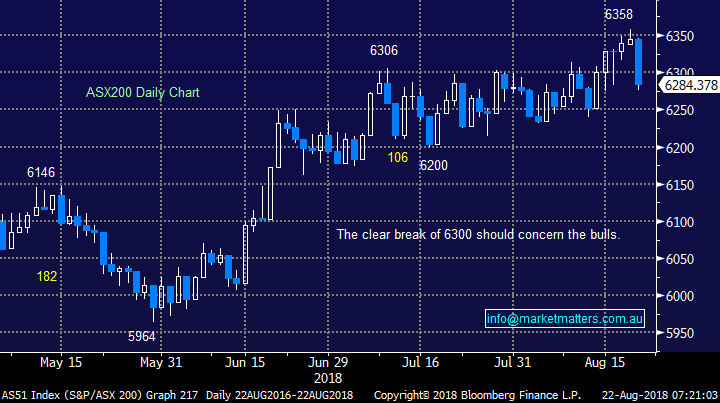

We’ve been patiently waiting for the S&P500 to make fresh all-time highs with our preference that failure then follows. Last night the US market made fresh ail-time highs before giving back most of its gains, we remain committed to our view that the next decent move for US stocks is now down and believe this is an opportune time to “top up” our short US ETF position.

· MM is looking to increase its BBUS position from 3% to 5% now we’ve seen marginal fresh all-time highs for the S&P500.

US S&P500 Chart

3 Elders (ELD) $6.45

Rain is due to hit Australia in a major way this week with Sydney likely to be on the receiving end – we have received less than 2mm this month compared to an average of ~55mm!

While one weather system won’t break the drought it does feel like the worst may / hopefully be behind us and the 33% fall in the ELD share price looks attractive on a simple risk / reward perspective. Farming is a cyclical business with the weather clearly a major contributor, I’m sure most would agree that its currently feeling like we are close to the bottom of the cycle.

· MM is considering allocating 3% of our Growth Portfolio into ELD at current levels as a short term trade

Elders (ELD) Chart

3 Stocks catching our eye

Obviously the big story yesterday was BHP’s result that we covered in the afternoon report (click here) – we are looking to buy BHP sub $30, or about 10% lower.

Looking at 3 other stocks that caught my eye yesterday.

1 Xero (XRO) $49.01

XRO rallied strongly yesterday gaining over 3% in a weak market. We have been targeting this $50 area for a few weeks and the online accounting business has not let us down. However our “gut feel” is the stock now corrects ~15% although no sell signals will be generated until XRO breaks below $47.50.

· XRO has hit our upside target switching MM to neutral / bearish but no sell signals are in place at present.

Xero (XRO) Chart

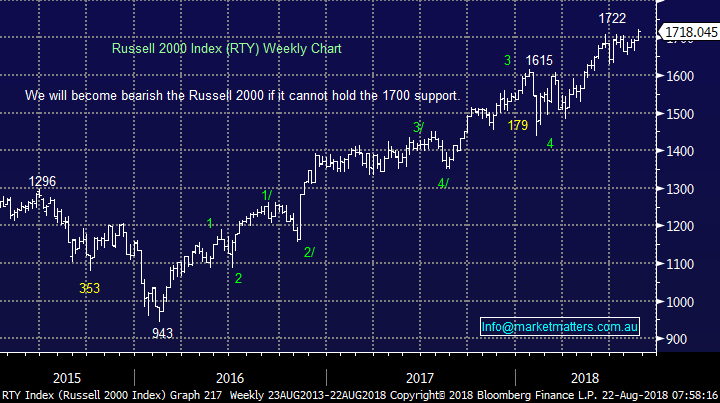

2 REA Group (REA) $89.69

Similarly to XRO real estate business REA made fresh all-time highs this week but yesterday it then quickly turned south to generate sell signals.

Also, we note CEO Tracy Fellows has sold all her REA shares except 12 shares, never an encouraging sign.

· MM is bearish REA initially targeting the $80 area.

REA Group (REA) Chart

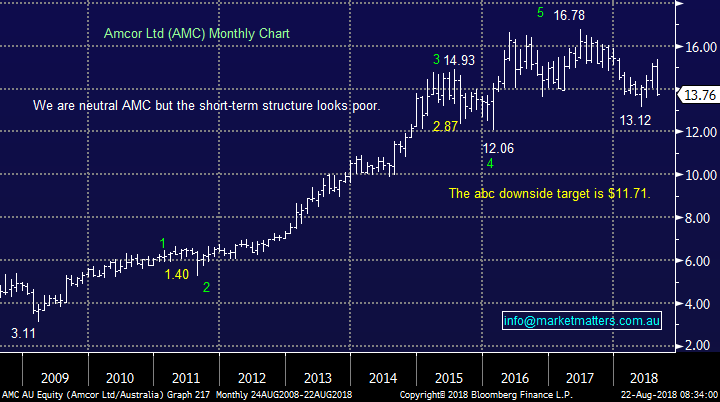

3 Amcor (AMC) $13.76

AMC shares tumbled -3.6% yesterday after the company announced a weak full year result, if it wasn’t for help from favourable currency moves the revenue and NPAT would both have been down on the year.

· MM remains bearish AMC with a potential target around $12, or well over 10% lower.

Amcor (AMC) Chart

Conclusion

We feel it’s time to consider tweaking the MM Growth Portfolio:

· Cut our $US ETF position, reduce our QBE holding, add Elders (ELD) and top up our BBUS negative facing US ETF position.

Overseas Indices

Both the US S&P500 made fresh all-time highs last night although the rally was subdued and almost failed in the S&P500.

We believe there is a strong possibility of failure over the next 1-2 weeks.

Russell 2000 Chart

Another thing that caught my eye yesterday was local weakness while Asia rallied which added weight to my opinion that we have received some “safe monies” recently while the emerging markets have been getting slammed.

Shanghai Composite Chinese Index Chart

Overnight Market Matters Wrap

· The major US indices ended its session with little change overnight, following the broader S&P 500 hitting record highs intraday on earnings in the consumer sector.

· On the commodities front, oil climbed as a US plan to sell strategic oil reserves brought concerns about tightening global supplies, while gold futures also rallied ahead of the FOMC meet tonight.

· The September SPI Futures is indicating the ASX 200 to open 8 points lower towards the 6275 level this morning, however expect more weakness than this given a sell-off in US Futures.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 22/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here