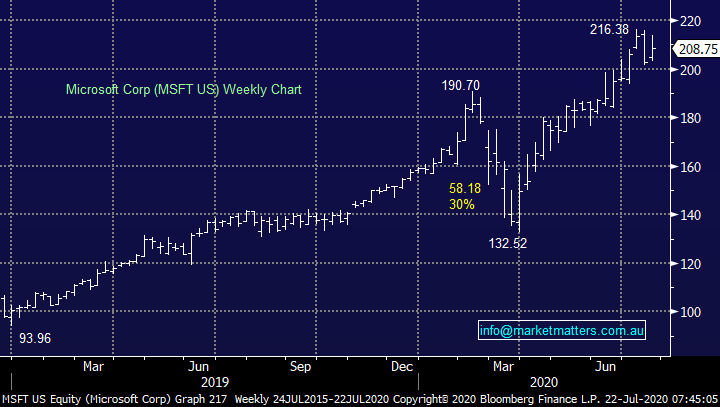

Overseas Wednesday – International Equities & Global Macro ETF Portfolios (FMG, MSFT US, AAL LN, ANTO LN, GOLD US, SLV US, ETPMAG)

The ASX200 roared over +2.5% higher yesterday posting its best gain for a month while taking the index within striking distance of a fresh 19-week high, just a matter of time in our opinion. The ducks all aligned yesterday, and the sellers beat a hasty and painful retreat as over 90% of the index closed up on the day, including an impressive 33 stocks which rallied by over 5%. On the news front it was a trifecta as Oxford University appears to making major strides towards a COVID-19 vaccine, the Liberal government has extended a tweaked JobKeeper by 6-months and Europe has finally bedded down their deal on a recovery fund. We find it interesting / informative how stocks have largely ignored worsening virus cases only to rally strongly on some glimmers of economic hope i.e. investors / fund managers are clearly underweight stocks.

When the buying is so unrelenting and broad based, we have to bore a little deeper to find any snippets of interest on the stock / sector level:

1 – The IT Sector was again best on ground with Afterpay (APT) rallying 8% within striking distance of its all-time high, only days after correcting 14.4%, the sector does still feel stretched to MM but the outperformance trends is holding on, just.

2 – The market still feels fickle as both stocks & sectors rotate in / out of favour almost daily, there’s no doubt there’s plenty of opportunities for the “Active Investor”.

We have stuck to our guns over the last 6-weeks targeting an aggressive “pop” above 6200, this suddenly feels just around the corner and due to our basically full exposure to equities we are considering where, when and how to move back down the “risk curve”, thus following the plan to increase cash levels into strength we’ve been discussing over the month i.e. our 2020/21 mantra “sell strength and buy weakness with a net bullish bias”, by definition MM is in “sell mode”.

MM remains bullish equities medium-term.

ASX200 Index Chart

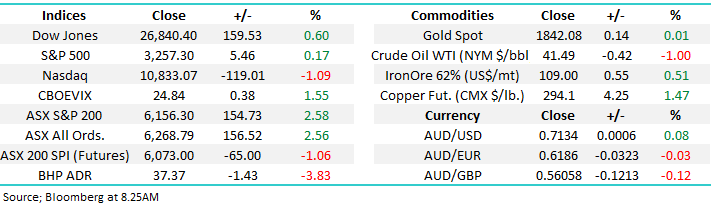

The $A made fresh 15-month highs yesterday, great going for a currency that’s regarded as a growth proxy while the worlds fallen into a virus driven global recession. The chart below shows how the $A started falling in January generating warning signals for risk assets in the process – so far since March all the local currency has provided is buy signals, great news for fully invested managers like ourselves although we aren’t complacent and will watch the $A for signals a pullback is looming.

MM remains bullish both the $A and ASX200.

Arguably the most important market unfolding at present for MM is the EUR breaking higher against the $US which carries with it a couple of significant market “clues”:

1 - If The EUR continues to outperform then European & Australian stock markets should finally start to outperform US stocks which by definition implies the high flying tech stocks are at least due a rest – we’ve seen hints of this over recent sessions.

2 – A weakening $US strongly supports our bullish “reflation trade” / outlook, theoretically great for the Australian Resources Sector.

“Aussie” $A v ASX200 Chart

As we touched on earlier MM is effectively in “sell mode” because we’re long stocks, as opposed to being bears, but we are looking for areas to consider reducing risk into strength. Iron ore is one especially catching our attention because we’re very overweight the bulk commodity through BHP Group (BHP) and RIO Tinto (RIO) in both of our core Growth & Income Portfolios’ but we have an interesting quandary:

1 – The sector appears to have got ahead of itself as we can see below with high beta play Fortescue Metals (FMG).

2 – However we are still bullish the reflation trade which suggests the uptrend has much further to travel.

MM remains cautious iron stocks at current levels, but we are bullish resources in general - we may reduce but not cut our exposure.

NB The most likely scenario is we switch within the resources space.

Fortescue Metals (FMG) v Iron Ore (CNY/MT) Chart

Overseas stocks

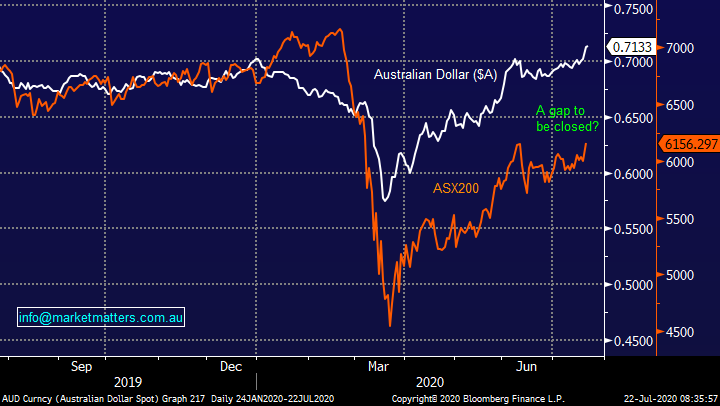

Overnight we witnessed another trading session when the high flying tech stocks struggled with the NASDAQ falling -1.1% whereas the small cap Russell 2000 rallied +1.3%, considering the huge sector influence of stocks like Apple (AAPL US) and Amazon (AMZN US) it remains a solid performance that the broad based indices still closed firm. There are a couple of important scenarios unfolding which MM believes should be kept in mind into Christmas, especially during any short-term spikes in volatility:

1 – US stocks are slowly losing momentum from a breadth perspective plus a new multi-year low in the CBOE put/call ratio is a leading indicators that a pullback is around the corner but importantly we believe it’s one to buy, not sell.

2 – The next Fed meeting could be the catalyst for such a correction in early August, especially as we appear immune to any troublesome news around COVID-19.

3 – However based on the May/June strong rally with healthy market breadth, investors are remaining way too cautious as the market continues to climb the proverbial wall of worry plus the nicely evolving reflation trade on the macro side (bearish USD) we remain strategically 100% bullish equities i.e. any increase in cash levels will be with a view to buying pullbacks, as MM simply looks to add value / alpha around the edges in typical Active Investor fashion.

MM remains bullish US stocks medium-term but tech does feel “tired”.

US Russell 2000 Index Chart

MM International Portfolio

Currently MM is only holding 10% of our International Portfolio in cash but we do have a 20% exposure to the FANG’s via Apple (AAPL US), Microsoft (MSFT US) and Google Alphabet (GOOGL US) but very little direct exposure to Europe which is a contradiction to how we see market performance over the next 12-18 months. The 2 charts below illustrate the huge outperformance by the US S&P500 compared to Europe both since the GFC and just in 2020, one of MM’s core views moving forward is the US market will enter a period of underperformance against both Europe & Australia – it’s been a while!

MM International Portfolio : https://www.marketmatters.com.au/new-international-portfolio/

Hence the obvious question we asked ourselves today is what, if any, stocks should we be considering switching bearing in mind we are bullish hence we don’t want to increase our 10% cash level. We came up with a couple for the action / watch list.

US S&P500 v EURO STOXX 50 Chart

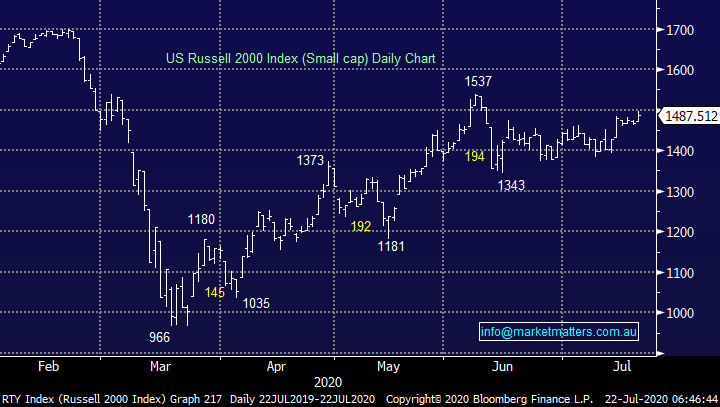

Microsoft (MSFT US) $US208.75

Microsoft is MM’s largest exposure to the US tech space after we’ve built up a large 8% holding in 2020, we are currently showing an almost 30% paper profit on the holding. From a purely money management / portfolio structure perspective we are considering reducing the position back to the same 6% we hold in both Apple (AAPL US) and Google Alphabet (GOOGL US).

MM is considering trimming our MSFT holding from 8% to 6%.

NB, We remain bullish stocks but are looking for outperformance from Europe hence we are not keen to lose our entire position in MSFT.

Microsoft (MSFT US) Chart

Anglo American (AAL LN) GBP1949.20

Diversified global miner AAL is perfectly positioned for our reflation outlook and while we have a short-term target ~25% higher if our core view is correct this could easily prove to be conservative.

MM is bullish AAL initially targeting 25% upside.

Anglo American (AAL LN) Chart

Antofagasta Plc (ANTO) GBP1037

Both technically and fundamentally MM likes copper stock ANT, it may have already run fairly hard but we remain very bullish which coincides nicely with our reflation outlook.

MM is bullish ANTO initially targeting 15-20% upside.

Antofagasta Plc (ANTO LN) Chart

Barrick Gold (GOLD US) $US28.23

We remain bullish Gold however as is the case in our domestic growth portfolio, we’re still pondering ideal entry levels.

MM is bullish GOLD

Barrick Gold (GOLD US) Chart

MM Global Macro ETF Portfolio

Currently MM has 24% of our Global Macro Portfolio in cash with a few areas that we are looking to tweak.

1. Our more bullish view on Europe relative to the US which can be played through a pairs trade. Not one for today however this is very much on our radar as discussed above

2. Increasing exposure to the reflation outlook with silver the ideal candidate.

MM Global Macro Portfolio : https://www.marketmatters.com.au/new-global-portfolio/

iShares Silver ETF (SLV US) $US19.67

An excellent and simple way to gain exposure to silver as a commodity without risking underlying company performance is the SLV and as a $US10bn ETF it’s certainly got some decent depth, as the chart illustrates below it basically mirrors the silver price, again this is listed in the US.

MM is bullish the SLV ETF.

iShares Silver ETF (SLV US) Chart

Alternatively, the easiest way for local investors to play the theme is through the ASX listed Physical Silver ETF from aptly named ETF Securities. This tracks the Silver price minus the 0.49% pa management fee and is unhedged, so a higher AUD does detract from performance however that’s the case with the ETFs above given they’re listed overseas. The security is underpinned by Silver bars held in a vault and is known as an exchange traded commodity (ETC). It can be bought / sold like a normal share, using the 6-letter code EPTMAG or on some platforms EPTMAG.AXW.

MM is considering buying this for both our domestic Growth and Global ETF portfolios.

ETF Securities Silver Bullion ETF (ETPMAG) Chart

Conclusions

MM is looking to tweak both of our International & Global Macro Portfolios as outlined above.

Watch for alerts.

Overnight Market Matters Wrap

· Optimism around a coronavirus vaccine is still providing a tailwind to markets, although the tech heavy Nasdaq 100 sold off in comparison to the Dow and S&P 500.

· Energy stocks starred overnight after crude oil rallied, hitting US$42/bbl.

· All metals rallied on the LME with aluminium and nickel leading the way, both up around 2% a piece

· BHP is expected to underperform the broader market after ending its US session off an equivalent of -3.83% from Australia’s previous close.

· The September SPI Futures is indicating the ASX 200 to lose 65 points lower, testing the 6075 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.