Reporting season ramps up, Eclipx cops a hiding (ECX, CBA, TCL, IFL)

WHAT MATTERED TODAY

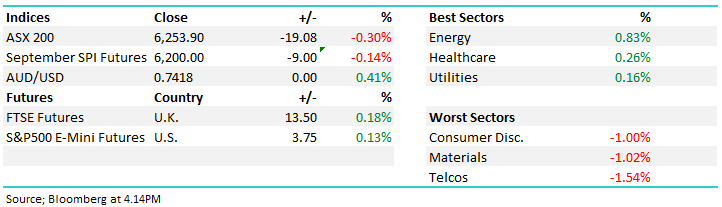

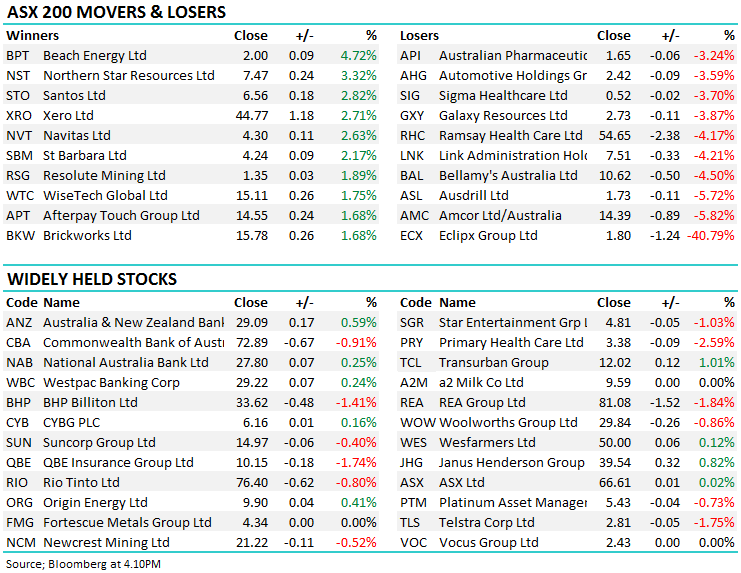

Reporting season continued to dominate the news flow today while the RBA also captured some airtime mid-afternoon following their monthly meeting on rates, which remained at 1.5% as expected. Looking further out, markets are not pricing a rate rise in Australia for another 12 months as the economy remains reasonably well balanced. Asian markets were strong today, outperforming our market by a reasonable clip, even the Chinese market adding more than 1% as Asian investors shrugged off early news flow that played on the theme that China won’t flinch in a trade war.

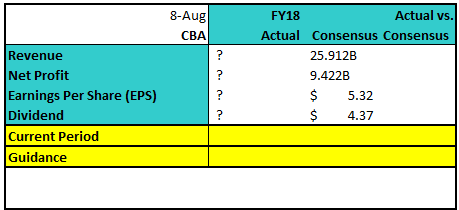

Reporting kicks up a gear tomorrow headlined by Commonwealth Bank (CBA) – a stock we hold in two of our portfolios.

Commonwealth Bank (CBA) was sold off today, ending down -0.91% ahead of their full year results tomorrow. CBA has been the worst performer of the big four this year and is the only major bank to report in August. It’s also the first full-year earnings report for new Chief Executive Matt Comyn as he reshapes the future for the bank. The risk in this result is if Comyn re-bases expectations after taking the helm, setting himself a better platform for future growth. Also watch compliance and funding costs which could play into the result.

The market is expecting full year revenue of $25.91b dropping down to a net profit of $9.422b, a big number while the dividend will likely be around $4.37 for the full year (which equates to $2.37 for this period). We remain keen on CBA leading into the result, however given the above mentioned factors, a negative surprise has a higher probability this time around than usual. CBA should be out pre-market tomorrow and we hope to include a review in the AM note tomorrow.

Market Expectations - CBA

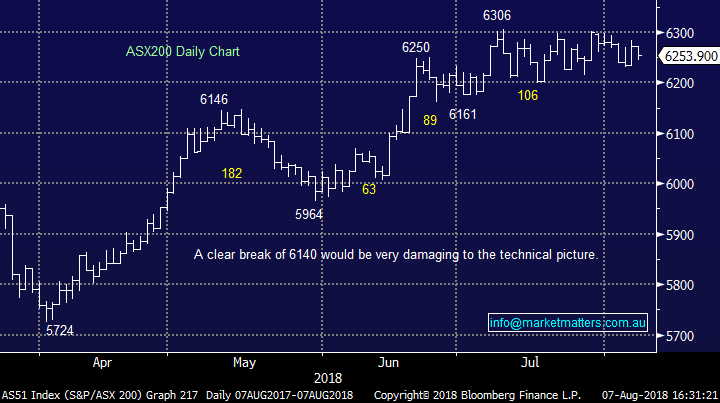

Overall, the ASX200 fell -19points today or -0.3% to close at 6253

Australian Reporting season continues – for a full list of company reporting dates – click here

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Brokers were fairly active today, ECX obviously a disappointment however although Citi downgraded to hold, they maintained a $3.17 price target while JP Morgan maintained their outperform call and $4.40 target. The stock closed today at $1.80 on massive volume – we discuss more below.

· Eclipx Downgraded to Neutral at Citi; PT A$3.17

· Cochlear Rated New Buy at Wilsons; PT A$225

· LendLease Upgraded to Buy at Goldman; PT A$25.20

· Regis Resources Upgraded to Hold at Morgans Financial; PT A$4.40

· oOh!media Upgraded to Buy at Canaccord; PT A$5.30

· Santos Resumed at Morgan Stanley With Overweight; PT A$7

· ResMed GDRs Upgraded to Buy at Wilsons; PT A$16

· Vicinity Upgraded to Outperform at Credit Suisse; PT A$2.79

· Seek Upgraded to Hold at Morgans Financial; PT A$20.24

· Nufarm Rated New Outperform at Taylor Collison; PT A$8.86

· Insurance Australia Downgraded to Hold at Bell Potter; PT A$8.15

Eclipx Group (ECX) $1.80 / -40.79%; After market yesterday, ECX came out with an earnings downgrade and the stock has been walloped in trade today– down around ~40% on a downgrade that was closer to ~10%. The diversified industrial business that does fleet management, vehicle rentals and online auctions (it owns Grays Online) said that profit would be in the range of $77- 80m for FY18 which implies growth on FY17 of 13-17% versus prior guidance for growth of +27-30%.

The current issues are around their Right2Drive brand and Grays Online which both have performed below expectations. The core leasing business remains strong. ECX say these are short term cyclical factors given a lack of delinquencies through banks (which supports the sale of equipment through Grays) and longer utilisation of equipment given the level of infrastructure build playing out across Australia.

While ECX has a September year end, market consensus for profit sat at $88m for the year, so assuming the midpoint of the new guidance is achieved (implies $78.5m) this is an ~11% downgrade to market numbers. We’ve seen two brokers out with notes post the update with Citi downgrading from buy to hold and reducing their price target from $4.50 to $3.17 which is still a long way from the $1.80 the stock is trading at now. JP Morgan have maintained the rage keeping their $4.40 PT and overweight call. While today’s announcement was clearly weak, the SP reaction was significant. We hold ECX in the Income Portfolio with a 3% weighting and today’s SP move in that stock had around a -1.2% influence on overall performance of the income portfolio. We have a bias to add to the position around current levels rather than cutting the holding

Eclipx Group (ECX) Chart

IOOF (IFL) $8.84 / -1.89%; This morning IFL reported their full year results with the stock initially trading down, then marginally higher before sellers worked their way back in through the afternoon. A few interesting elements to the current result however what’s more important here is their commentary about the future and the acquisition benefits derived from their purchase of ANZ’s wealth business – and whether or not we believe them!

On today’s result, they missed slightly on EBITDA and profit relative to consensus however there are some wide ranges in terms of analyst numbers on this one. The final dividend was in line with consensus at 27cps however that equates to a 98% full year payout ratio which is clearly unsustainable. Anyway, we’ll call it an inline result for FY18!

Of more interest was their commentary on the future and the trends we’re seeing across platform earnings following industry wide pressure to cut fees. For FY18, they delivered a platform revenue margin of 54bps which was down -10% from this time last year (60bps) while we also saw some pressure on their advice revenue margins which were 38bps, down from 41bps. The other parts of the business are actually doing well with Funds Management and the Trustee Business chugging along nicely, however the biggest leverage in the business going forward is advice, an area that is clearly under the microscope. Interestingly, they didn’t provision for any increased regulatory costs associated with the Royal Commission.

IOOF is cheap, it pays a good dividend and it has scale in the wealth management area, however the near term headwinds for margins and regulation are high. At some point, when the dust settles IFL will become a buy, however right now we see too many risks on the horizon.

IOOF (IFL) Chart

Transurban (TCL) $12.02 / +1.01%; Toll road operator Transurban has announced a blockbuster result this morning only to see the stock trade lower from the outset, before buying picked up as the day went on. Revenue grew 21%, while the net profit line more than doubled last year’s figure, however the company downplayed the pipeline for growth, and investors seem to be questioning the progress on WestConnex.

The result was broadly in line, most importantly the dividend met expectations both in the current period and guidance into FY19. This appears to be the pressure point for investors, as while the dividend met guidance, the company claimed future dividends will not be impacted by a successful WestConnex bid –the company is looking to continue to grow, while paying a reasonable dividend which ultimately means increasing debt significantly, or raising capital.

In any case, Transurban has a number of high quality, long life assets which is great to invest in, but bond-like returns will come under pressure as rates rise. A Catch-22 scenario is appearing for Transurban at the moment – either hurt investors looking for a bond like equity by dropping the dividend to invest in growth, raise capital to invest or maintain the status quo and increase the risks in the business. In our view, whether it is for WestConnex or any number of other projects that Transurban may look to get involved in to maintain growth, a capital raise could be on the cards and shares will struggle until some more clarity is given.

Transurban (TCL) Chart

OUR CALLS

No trades across the MM portfolios today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here