Retail does its best to dampen a solid day (KGN, CTD, BWX, CAR)

WHAT MATTERED TODAY

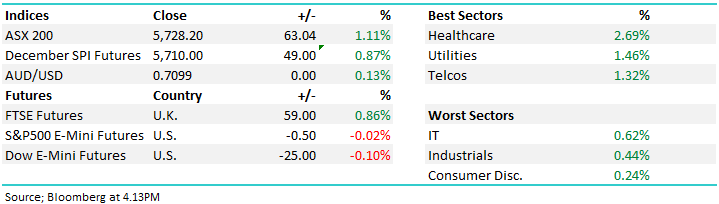

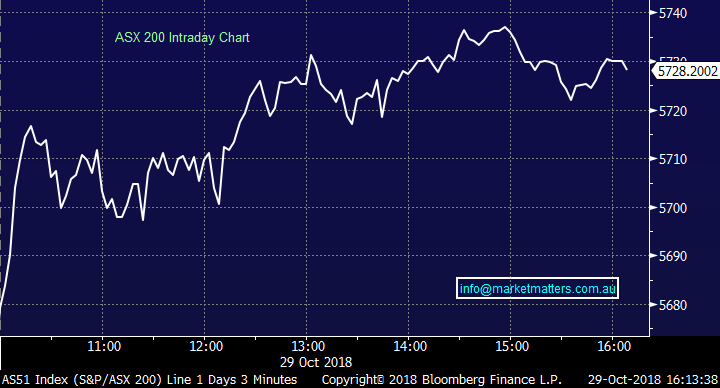

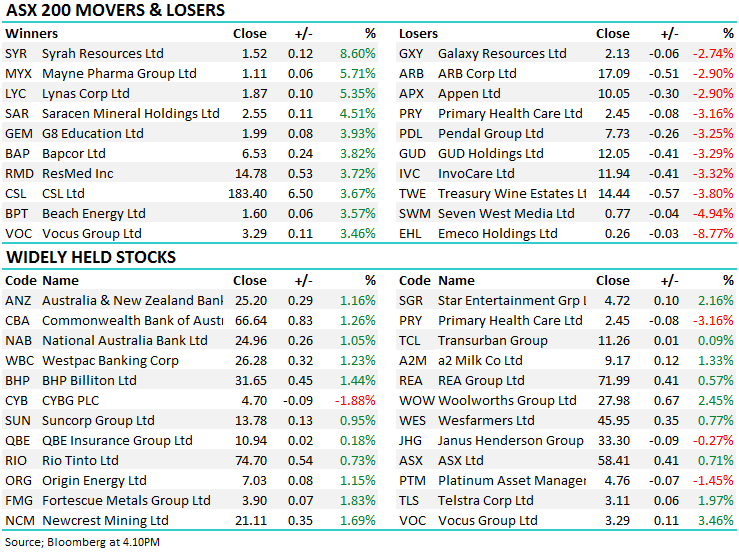

A grind higher today on the local market as the bourse pushed back above 5700 – we have now already bounced 100+ points from Fridays lows of 5624, a solid effort however I doubt it will receive much fanfare given the recent volatility. Despite all sectors closing higher, buying wasn’t across the board, with some stocks still languishing despite a lack of news flow. The old BT, now Pendal Group (PDL) wasn’t deemed cheap enough, falling -3.25%, BREXIT is still playing on the markets thoughts with CYB and JHG both falling against a solid tide of Financials buying. Resources were also mixed despite the materials sector moving strongly higher – lithium names the most notable weakness here, and the related mining equipment company Emeco (EHL) continued its slide, off -8.77% today and -25.7% over the past fortnight.

Pockets of buying did hoover up some battered stocks– the higher PE CSL jumped 3.67% as well as the safe haven Newcrest (NCM), up +1.69% helping to offset some of Friday’s big fall. Banks all pushed higher, but it was Healthcare (supported by the aforementioned CSL) which performed the best. Consumer discretionary did well to end in the black despite some negative news flow for a number of names in the space – we speak about the downgrade from BWX, soft guidance from Kogan.com and the short thesis on Corporate Travel below.

Elsewhere, both Seven (SVW & SVM) stocks were soft as rumblings of a deal with Foxtel gathered pace. Ramsay Healthcare (RHC) pushed higher on confirmation he takeover of France’s Capio will progress. Beach Energy (BPT) closed strongly higher after maintaining guidance at the first quarter report. Nickel / copper name Independence (IGO) also closed in the black following their reasonable quarterly. Lynas (LYC) jumped +5.35% following an update to the market regarding the Malaysian regulatory issues – the company saying they have been granted an extension of permission to store the disputed residue known as NUF at the site. The heavily shorted Syrah (SYR) popped +8.6% today as they edge closer to returning to full production with their replacement primary classifier unit now on site.

Today, the ASX 200 closed up +63 points or +1.11% at 5728. Dow Futures are down 25points or -0.1%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

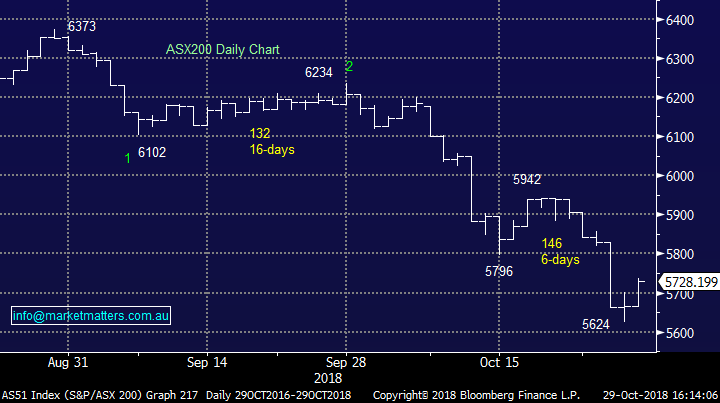

Broker Moves; Both UBS & Macquarie turned positive on Carsales following the AGM on Friday, despite both houses admitting the event was less than entertaining. The AGM showed a soft start to the year, with commentary from the company holding a weaker tone than was set at the full year results. Since then, however, the share price has pulled back now putting CAR on a undemanding PE in the low 20s, giving investors a chance to buy at a reasonable price – or so they think.

Carsales.com (CAR) Chart

Elsewhere;

· Carsales.com Upgraded to Buy at UBS; PT A$13.50

· Carsales.com Upgraded to Outperform at Macquarie; PT A$13.90

· REA Group Upgraded to Neutral at UBS; PT A$75

· Woolworths Group Upgraded to Buy at Deutsche Bank; PT A$31

· Independence Group Upgraded to Neutral at Macquarie; PT A$4.30

· Sandfire Upgraded to Buy at Bell Potter; PT A$7.55

· Sandfire Upgraded to Buy at Hartleys Ltd; PT A$8.47

· Automotive Holdings Cut to Underweight at Morgan Stanley

· Seven Group Upgraded to Hold at Morningstar

· Vocus Upgraded to Hold at Morningstar

· Challenger Upgraded to Buy at Morningstar

· Australian Pharma Upgraded to Buy at Morningstar

· ResMed GDRs Upgraded to Outperform at Credit Suisse; PT A$15.10

· Blackmores Upgraded to Neutral at Credit Suisse; PT A$115

· Pendal Group Cut to Underperform at Credit Suisse; PT A$7.10

BWX Limited (BWX) $2.80 / -16.17%; The skin and hair product company suffered today with a downgrade contributing to investor discomfort. The company announced they expect EBITDA growth to be non-existent through FY19, “broadly in line with normalised FY18 EBITDA of $40.3m.” Analysts’ consensus had growth of around 16% to $47m. Not helping the company’s cause, management see a large second half skew of 70% to carry the result, larger than the normal skew of around 60/40. The failed management buyout launched in September has clearly contributed to the poor performance, disrupting the momentum the company had built up. The stock has been on the slide since the start of the year as growth slows and the retail market takes a hit. There is still a lot of work to do in the second half to save this financial year’s result – even though the quarter marker has only just passed.

BWX Limited (BWX) Chart

Kogan.com (KGN) $3.11 / -32.97%; Online retailer has slumped today on a less than impressive business update to the market. Despite showing user numbers growing 40% over the past 12 months, as well as double the users on Kogan’s mobile offering, the market has focussed on falling margins and a decline in revenue from non-exclusive brands. The exclusive brands revenue for the first quarter rose 15.7% compared to 1Q18, and partner brands revenue jumped 73% however the lift in sales was offset by rising costs and a 27% fall in sales from global brands, blamed a falling Aussie dollar hurting as well as compliance with GST laws hurting their competitiveness.

The market caught the jitters on an increase in spending and investment despite the lack of growth. For the year, analysts’ consensus suggest 44.4% EBITDA growth on an 18.1% increase in revenue for a 67% lift in profit. Margins are clearly key to performance in FY19. Now almost 70% from highs earlier this year, the stock has suffered continuous blows from poor updates like this, as well as insider selling.

Kogan.com (KGN) Chart

Corporate Travel Management (CTD) $27.64 / unch; The travel administration firm Corporate Travel will spend the first part of this week in a trading halt as it responds to a scathing research report by investment firm VGI Partners. The 176 page report names 20 ‘red flags’ that VGI have used to justify a heavy short position on the stock which until recently had experienced an uninterrupted climb since listing in late 2010. CTD has fallen -18.4% since it’s early September highs.

The report lists reasons such as low interest income, growth through acquisitions, ‘non-existent’ offices, suspect accounting practices with a long-serving auditor and high management turnover (except for the CEO & CFO) in its reasons for the negative view, as well as noting the significant number of management share disposals over the past few years. . Potentially this is a case of “throw it against the wall and see what sticks” with VGI already short the stock, however a small review of offices shows numbers may be overstated, particularly in northern Europe.

Corporate Travel Management (CTD) Chart

OUR CALLS

No changes to the portfolios today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 29/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.