Strong employment data & a rising currency puts the kibosh on the market (WTC, IFL, BHP)

WHAT MATTERED TODAY

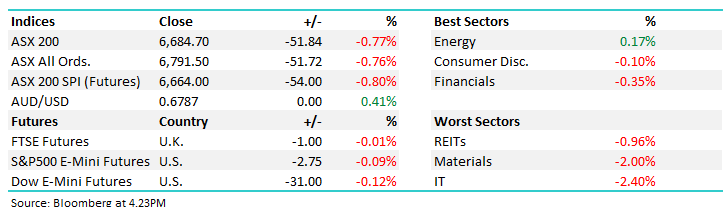

An interesting day on the desk with the market opening fairly flat ahead of the October index expiry this morning before sellers kicked into gear at 11.30am following better than expected local employment data. That caused a spike higher in the Aussie dollar (less chance of rate cuts) and as per recent trends, the market has traded inversely to the currency (higher AUD = negative for local equities). Goes to show how important monetary policy is at the moment.

The unemployment rate fell to 5.2% today thanks to a strong rise in full time jobs of +26k - a strong result and the catalyst that underpinned strength in the currency, which settled at 67.86c around the close.

Soruce: Bloomberg

There was also a barrage of stock specific news out today and the IT sector was front and centre. Wisetech Global (WTC) hit 10% before going into a trading halt following a scathing short report, more on that below, while the sell-off in the buy-now pay later sector continued, AfterPay (APT) down another 5.72% and Z1P Co (Z1P) down by 11.11%, these moves no doubt exacerbated by the WTC trading halt, although in fairness, the aggressive sell-off had started yesterday. This is a hot sector, and hot money sits in hot stocks…This looks like a major inflexion point for some of these names.

Elsewhere, the consumer staples sector continued higher in a weak market while the resources were sold off again, BHP now sub ~$35 after reporting production numbers today, US Futures were fairly flat during our timeframe while Asian markets were mostly higher

Overall, the ASX 200 closed lower today, off -51pts or -0.77% to 6684, Dow Futures are trading down -31pts/-0.12%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

Wisetech (WTC) -10.18% before entering trading halt: At around midday today, WTC had a pause of trade before entering a trading halt, they say they’ll be off the boards till Monday however I wouldn’t be surprised if its longer. J Capital, a US based short seller published a report that hits WTC from multiple sides, calling out overstated revenue and profits, dodgy accounting practices and poor governance. I spent some time today reading their thesis and its scathing. While its worth pointing out that JCAP are talking their own book, will have inherent biases and the information they have presented could ultimately be wrong, mud generally sticks in some capacity, and there was plenty thrown at WTC today. WTC will no doubt rebuff the claims and this has more to play out, with JCAP expected to release a follow up report shortly. On first read through, many of the assertions appear we’ll founded and the report itself is well researched. While WTC is a stock we’ve only ever been spectators in, after reading the report today we’re happy to be on the sidelines here – a lot more to play out with this one.

Wisetech (WTC) Chart

BHP Group (BHP) –3.27%; was lower today, but more or less in line with its resources peers which were generally weaker today. The big Australian was out with their quarterly which was generally weaker than the first quarter of last year given an increase in maintenance work. Iron ore production was down marginally, while petroleum and coal were substantially lower. Copper and nickel were up 5% and 1% quarter on quarter. They didn’t budge on guidance for the full year given maintenance had already been factored in, while the company said costs remained in line with guidance based on exchange rates of 70c AUD/USD. We like BHP, all segments seem to be tracking on or near guidance in what is a seasonally a weaker quarter.

BHP Group (BHP) Chart

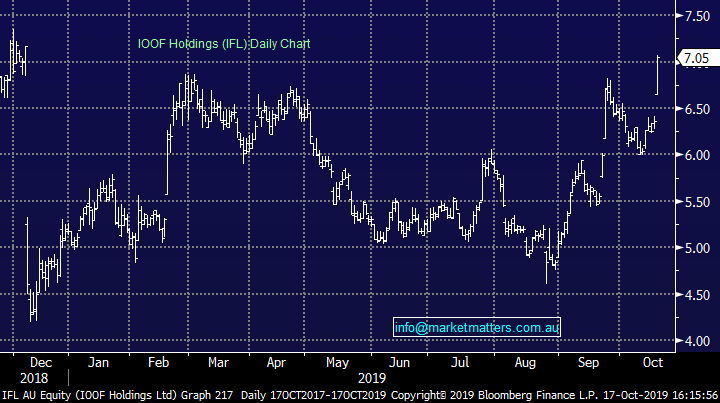

IOOF (IFL) +10.85%; rallied against a weak backdrop as the recent turnaround continues. IOOF was out with an update on their acquisition of ANZ’s OnePath Pensions & Investments business which was feared to be dead in the water following regulatory issues which has dragged the acquisition process out over 2 years. Today IOOF was out alongside ANZ to announce that the price of the deal would be lowered by $125m to $825m. Both parties also agreed to extend the termination date of the transaction if conditions had still not been met from today out to 31 December. The lower deal cost may mean IFL gets to buy back stock at a decent discount to the 2017 raise price of $10.60.

The last hurdle will be APRA sign off which carries some risk given how they have handled IOOF in recent times. IFL has ripped over the last few months as they show progress on FUM flow and with the ANZ transaction.

IOOF (IFL) Chart

BROKER MOVES; WHC weakness losing steam.

· NAB Raised to Buy at Bell Potter; PT A$30.50

· Netwealth Cut to Hold at Ord Minnett; PT A$9

· Pendal Group Cut to Hold at Morningstar; PT A$7.70

· Independence Group Raised to Hold at Morningstar; PT A$5.50

· Soul Pattinson Cut to Sell at Morningstar

· Brickworks Cut to Sell at Morningstar

· OZ Minerals Cut to Underperform at Credit Suisse; PT A$8.50

· Telstra Raised to Buy at New Street Research; PT A$3.90

· Boral Cut to Neutral at JPMorgan; PT A$4.80

· South32 Raised to Hold at Shaw and Partners; PT A$2.60

· Whitehaven Raised to Hold at Shaw and Partners; PT A$2.99

· Qantas Cut to Neutral at Evans & Partners Pty Ltd; PT A$6.53

OUR CALLS

After a very bullish session yesterday and close for the ASX 200 above 6700, this morning we tweaked our market view and turned bullish the ASX 200 from a technical standpoint – always nice before the market drops ~50pts! At this stage we took no action across portfolio’s as a consequence of this change and for now we retain 18% cash and a 5% leveraged short position in the MM Growth Portfolio.

Yesterday the market squeezed higher on weakness in the currency and what seemed to be decent overseas buying. It was a bullish day no doubt however markets can often squeeze in one direction or another ahead of index expiry, which happened this morning. As we suggested in the AM note, although we feel some tweaks might be required we’d wait to see how the market traded after expiry – ultimately it was weak and sustained selling played out through the session, with a close back below the 6700 trigger point, hence for now at the index level at least, we’ll sit tight and retain our short position.

On the buy side we like NWH & SSM around current levels - Watch for alerts in the coming days.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.