Subscribers questions (APT, QHL, ORA, ADH, SGM, BBOZ, SFR, ALL)

Happy new year everybody and we start with the obvious question, can the ASX200 maintain its excellent start to 2019 over the new 2019/20 financial year?

On the weekend the news appears very positive which is likely to at least kick off July with a bang as President Trump and his Chinese counterpart Xi Jinping reached a trade truce at the G20 meeting in Japan. While the markets feel likely to breath a bullish sigh of relieve in the short-term, pushing risk assets like stocks higher, we feel the agreement did not lay any major foundations for a lasting solution to their underlying fundamental differences i.e. MM would not be surprised to see US-China trade issues to once again worry markets in 2019. US futures have opened this morning up 1% highlighting the positive undertones.

The second and very meaningful tailwind for stocks in 2019 remains bond yields / interest rates with most economists forecasting the RBA will cut interest rates twice more in 2019, potentially starting this week. If we reach Christmas and the cash rate is sitting at 0.75% we will undoubtedly have a very supportive back drop for stocks assuming that the monetary stimulus is working and the Australian economy is not slipping into a recession. The second part of the equation remains inflation but this economic phenomenon which would certainly challenge the decade long bull market has remained dormant since the GFC.

At MM we remain in “sell mode” for our Growth Portfolio but not in an aggressive manner with our cash level now elevated to 17%. A potential pop higher this morning may allow us to take one, or two more profits this week before we sit back and evaluate if the market has become too euphoric having rallied almost 24% from its December low.

MM remains bullish the ASX200 while it can remain above the 6580 area although overseas indices are rapidly approaching our target area.

Thanks again for the great questions this week, at MM we are extremely excited by the new financial year having achieved a few major milestones over the last 12-months:

1 – MM launched two Separately Managed Account (SMA) portfolio’s that are based on the Platinum & Income Portfolios published on the website. Both portfolios have outperformed their relevant benchmarks in FY19. For more information click here

2 – MM has recently launched its International Equities Portfolio with the Global ETF Portfolio to follow this Wednesday, for positions in either go to the Portfolios tab on our website of click here

ASX200 Index Chart

The currency market have taken the positive comments from the G20 meeting in its stride with the Australian Dollar trading up only 0.2% at 6am this morning. Considering global equities remained firm into the weekends G20 meeting my feeling is the concillatory outcome was anticipated by most market players implying any positive reaction early this week might be a little muted, well should know by ~11am.

MM remains bullish the $A in 2019/2020 targeting the 80c area.

Australian Dollar ($A) Chart

Our medium-term target for the US S&P500 has been the 3000-3050 area and with this now only a few % away we have no interest chasing strength assuming it does unfold over the coming days.

MM will move from our bullish to neutral stance for US stocks if we see a test of 3000 this month.

US S&P500 Chart

Question 1

“Hi James & MM team, My first question is regarding Afterpay (APT). I was caught off guard by the 10% correction that played out on Friday afternoon after reaching all-time highs earlier in the day. Do you think the threat from Visa is significant and could destroy Afterpay? I also have concerns over the European branding strategy where they are using ClearPay due to issues with Afterpay trademark in that jurisdiction. What do you feel is the likely market reaction on Monday morning that people have had the weekend to consider the Visa announcement? Would you be selling now and potentially buying back later once the competitive threats have been fully understood? My second question is regarding Quickstep (QHL). Do you consider their business model viable? They seem to have a good technology, some good customers, Perpetual has taken a substantial holding, yet the share price has traded sideways for nearly two years.” - Cheers Craig L.

Morning Craig,

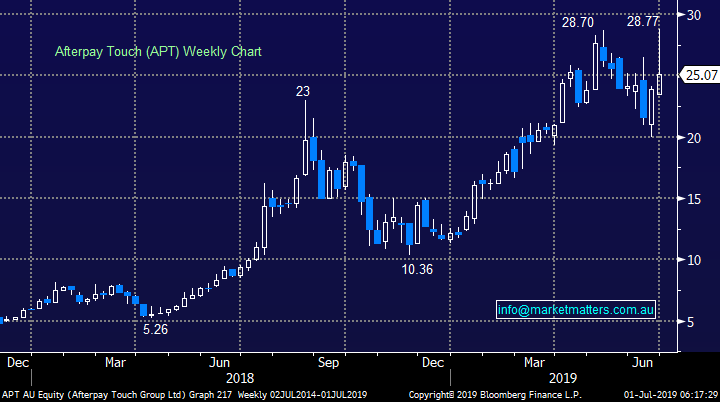

We discussed our view on Afterpay Touch (APT) last week following the Visa announcement:

“Visa is making it easier to provide shoppers the ability to choose how they pay before, during or after purchase with the introduction of a suite of Visa’s instalment solutions APIs. Through a pilot program, participating issuers and merchants will be able to offer their customers an instalment payment experience at checkout using a Visa card they already have in their wallet. With Visa’s instalment solutions, Visa cardholders will have the option to divide their total purchase amount into smaller, equal payments over a defined time period on qualifying purchases, at the store and online or while traveling abroad…and importantly as we said it sounds very much like APT to us!”

Visa are obviously a big player globally and two trains of thought could be taken here. 1. It validates what APT have created or 2. It signals growing competition from big players which is a significant negative for APT’s US ambitions.

There are differences in APT’s model v what Visa is planning to roll out, and importantly Visa essentially just greases the wheels for the banks to be the credit issuer and this will take time, plus Visa are saying that the pilot program will not be rolled out until 2020, however it’s clear that competition is likely to intensify in this growing market, much favoured by the millennials, and our concern for APT is its valuation into negative news, especially as increasing competition is likely to impact its already “rich” merchant fees. A reduction to these fees would have a painful material impact to APT’s revenue and profitability. Short-term stocks move with a large degree of randomness and we see no reason to be chasing APT at this juncture.

MM is bearish APT initially targeting another ~10% downside.

Afterpay Touch (APT) Chart

Quickstep (QHL) holdings manufactures a wide range of composite materials primarily used in the aviation industry but although the business has acquired some decent contracts the shares continue to struggle badly. This small cap stock only has a market cap of $61.8m taking it off the radar as a potential investment vehicle for MM hence our comments are only from a technical perspective.

Technically MM looks ok with stops below 7.5c but the trend is undoubtedly down.

Quickstep Holdings (QHL) Chart

Question 2

“MM thoughts on ORA at $3.24 for a long-term hold?” - Chris G.

Hi Chris,

Packaging company Orora (ORA) operates in the same sector as Pact Holdings (PGH) which we averaged last week as it surged almost 20% in just a few days. There is little doubt that ORA currently is a better business than PGH and certainly has a better balance sheet, however in our view it’s not a 60% better business which is what the relative valuation between the two stocks implies. We would put ORA in the group of solid but not exciting stocks and we see more upside potential (and risk) with PGH during 2019. To specifically answer your question we see no reason to dislike ORA long-term but it’s not particularly exciting.

MM is currently neutral Orora (ORA).

Orora Ltd (ORA) Chart

Question 3

“Hi guys, recent subscriber with a question about ADH. Recently they announced a marginal downgrade to earnings. The stock dropped from $1.80 to $1.30. Director bought some at $1.38 from memory. I noted the downgrade did highlight very recent sales. This makes me worried about the guidance. I am not a holder, but it's on my radar. Technically I believe it looks great. Fundamentally, that's where I need your help! Do you have any thoughts?” - Thanks, Richard H.

Hi Richard,

Home furnishings retailer Adairs (ADH) followed many companies exposed to the indebted Australian consumer by downgrading earnings last month. The business is experiencing both volatile sales and margin contraction with the company now expecting total sales ~$340m with gross margin guidance lowered to around 60%. To compound the downgrade the surprise and sudden departure of their CFO is another concern. MM has remained out of the retail space believing there’s a strong possibility of an almost panic like washout in the sector over the next 6-12months, this view has not changed.

Technically, we are actually neutral ADH requiring a solid close above $1.55 to become bullish.

MM is neutral ADH at this point in time.

Adairs Ltd (ADH) Chart

Question 4

“Hi James & MM, could you please give me your analysis on Sims Metal SGM, it has been creeping up for a while now and looks like getting to its previously recommended M&M buy level of $11.50. Do you see this trend continuing and if so can you recommend to me a dollar exit level.” - Cheers Tony K.

Hi Tony,

Sims Metal (SGM) continues to chop in an unpredictable manner between $9 and $12 with the stock currently in the middle of the range. If we were holding SGM our exit levels would be at $12 and $13 with a scale out approach feeling the likely strategy

MM is neutral SGM.

Sims Metal (SGM) Chart

Question 5

“Hello, A question for James. Commsec are showing a new item called TraCRs (transferable Custody Receipts) these are originated by Chi X and allows you to trade some of the largest shares on the NYSE, but in $aud. I have been in there and it seems there is poor liquidity, with market makers on the other side but at large spreads, can you give your thoughts on this, if it was to gain traction it’s a great idea as it gets over the currency hurdles but without liquidity support it’s just too hard.” – Richard R.

Hi Richard,

Yes, liquidity is important and I think this market will become more liquid in time however also worth noting that given market makers are there liquidity off the screen is a lot more than the liquidity showing in the screen. A broker can help with this.

The other aspects to consider when thinking about an investment product like this are: Does is provide what I’m after (i.e. direct exposure to overseas shares), do I have beneficial ownership of the underlying (can I actually take delivery of the shares if needed) and what are the fees and charges, both headline an imbedded.

Exposure: The TraCR’s do provide direct exposure to overseas shares, currently the names listed below with the only variance being they are currency hedged.

Beneficial ownership: The owner of the TraCR does have beneficial ownership of the underlying overseas stock and can take delivery of the stock if need be

Fees: Brokerage obviously charged to transact however there are holding and administration fees taken from any dividends paid from the underlying.

More information available https://www.tracrs.com.au/ however as always, holding something directly if possible is the best approach in our view

Question 6

“Hi there guys, hope you are all well. I just wanted your thoughts on BBUS and BEAR, would you be exploring this option of yet?” - Thanks so much Sharon B.

Hi Sharon,

The BBOZ has fallen by over 40% as the ASX200 has recovered from its panic December low illustrating the risk with buying this negative facing ETF too early. We are looking for at least a correction from the local markets almost straight line appreciation but we need an inflection point / catalyst to consider buying so we are able to quantify our risk – watch this space. For now we are comfortable adopting a more conservative stance with our Growth Portfolio into current market strength and leaving the aggressive shorting until later but it’s certainly being considered.

MM is still watching carefully but not pushing the trigger on these negative facing ETF’s.

BetaShares Leveraged Bearish ETF (BBOZ) Chart

Question 7

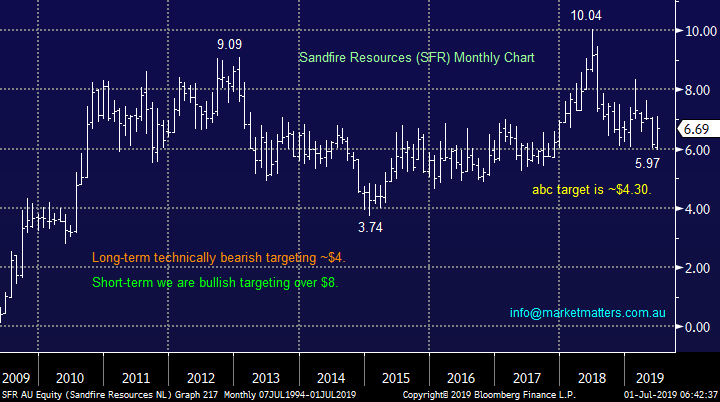

“Sandfire buyout of Mod Resources at 45c. Current price is 42c. Is copper a strong future play with self-driving cars etc, should I take shares or cash.” - Many thanks Alan N.

Hi Alan,

Copper producer Sandfire (SFR) has made a more successful second attempt to get its hands on MOD Resources (MOD) executing a $167million deal to acquire the Botswana-focused explorer. Under the scheme, each MOD shareholder will elect to receive either a scrip consideration of 0.0664 Sandfire shares for 1 MOD share or cash of $0.45 per share up to a maximum of $41.6 million. The offer represents a healthy 45% premium to MOD’s last closing share price and MOD’s board has unanimously voted in favour of the scheme.

Considering we are not medium / long term excited by SFR if we held MOD shares we would be inclined to take the cash but short-term SFR looks to have ~15% potential upside hence investors need to weigh up their individual risk profile.

MM can see a bounce in SFR but are less optimistic medium-term.

Sandfire Resources (SFR) Chart

Question 8

“Hi James, Interested in your thoughts on most cost efficient way to protect USD investments against rise in the AUD given your bullish view on the Aussie dollar v greenback. Have built up over time a portfolio of US stocks and note your analysis of recent times. For example how does the likely cost of an XDA Call option purchase match up against any bearish USD ETF investment and what leverage factors are available through various ETFs to allow protection against current value of US portfolio. Would be interested in any specific ETFs that facilitate this efficiently if these are the best vehicle to use.” - Thanks Peter O.

Hi Peter,

We would be inclined to use an ETF and are considering such a position when we launch our ETF Portfolio on Thursday.

The BetaShares Strong AUD ETF gives investors a geared exposure to the $A, it’s important to understand the gearing with the ETF rallying over 5% from its monthly low while the $A has bounced closer to 3%. Also remember the $US currently yields more than the $A hence any position will be slowly eroded over time if the $A fails to rally.

BetaShares Strong AUD Fund ETF Chart

Question 9

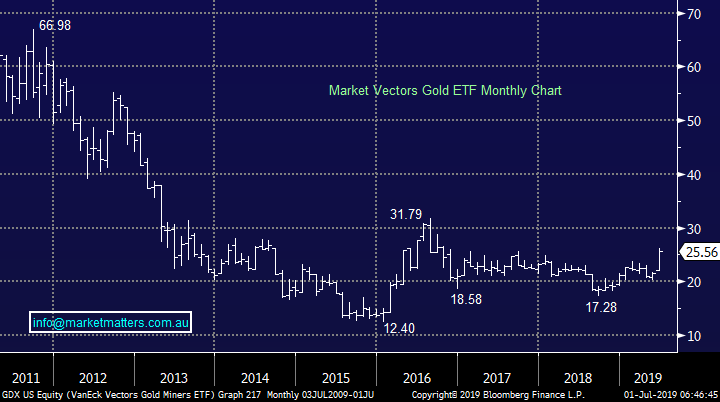

“Following our purchase of Newcrest Mining: Would u also buy gold as well? – Tim W.

Morning Tim,

MM likes the whole gold complex but as we now believe the $US is likely to experience a relatively tough 2019 buying an ETF with exposure to US / Canadian gold miners makes sense – we particularly like the VanEck gold miners ETF (GDX).

MM is now bullish the US domiciled GDX ETF.

VanEck Vectors Gold Miners ETF (US GDX) Chart

Question 10

“Should I sell all ALL holding, or just a portion?” - Many thanks, Hoa L.

Hi Hoa,

That decision is certainly one for you to make individually. At MM we simply write about what we’re doing and each subscriber can make up their own mind.

Technically MM can still see ALL testing above its 2019 high.

Aristocrat Leisure (ALL) Chart

Overnight Market Matters Wrap

· The US equity markets were optimistic leading up to the meeting between Presidents Trump and Xi at the G20 summit in Osaka over the weekend and are currently right, with US S&P 500 futures up 0.9% this morning as I type.

· They agreed to resume trade negotiations which had broken down in May. The US will not impose tariffs on the remaining $US300B of Chinese exports and will ease some restrictions on the sale of equipment to Huawei. China has in turn agreed to buy more US agricultural products.

· The RBA meets tomorrow with many pundits tipping a 25 basis point cut to 1%, with more cuts to come, potentially bringing the cash rate to 0.5% later this year.

· BHP is expected to outperform the broader market after ending its US session up an equivalent of 0.48% from Australia’s previous close.

· Metals on the LME were mixed without any big moves, while iron ore increased marginally higher.

· The September SPI Futures is indicating the ASX 200 to 23 points higher towards the 6645 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 01/07/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.