Subscribers questions (CCP, RHC, MQG, BHP, IGL, FPH, XRO, KKC)

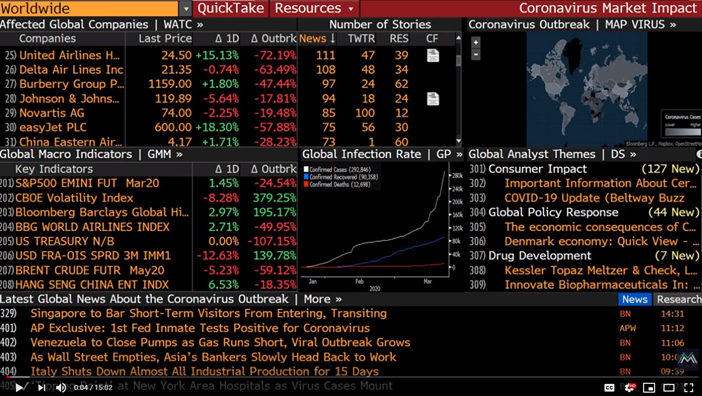

The world has suddenly taken COVID-19 very seriously over the last week after underestimating its powers throughout most of 2020, at MM we were guilty of believing the outbreak would follow a path more akin to South Korea than Italy, unfortunately Europe is now going through nothing short of hell and Australia is rapidly becoming scarred of whose footprint we will walk in – unless of course you live around Bondi! Today we go into lockdown with pubs, restaurants, cafes, churches, casinos etc all closing for what’s likely to be months, let’s all hope we can show the traditional Aussie spirit to come out the other side sooner rather than later.

It now appears to be a relatively simple equation: Australia & mankind has a huge battle on its hands which we can undoubtedly win if we all pull together and follow the logical and sensible precautions – time for social interaction at home, good old fashioned cards & board games. The number of confirmed cases globally is now well above 300,000 having almost doubled since last Monday’s report, those numbers should sombre even the most blasé optimist. We should remember to pay special attention to our elderly and health impaired family and friends with the statistics showing that the average age of people dying in Italy is just shy of 80 with almost all cases having previous health issues.

Last night I recorded a quick video update: DIRECT FROM THE DESK – CLICK HERE

It’s hard at times to focus on matters of finance but we do all have to consider our future and the likelihood is many of us will actually have more time on our hands to consider this issue in the weeks / months ahead: MM will remain open to support our subscribers, we are fortunate that as a business we can comfortably abide by social distancing.

ASX200 Index Chart

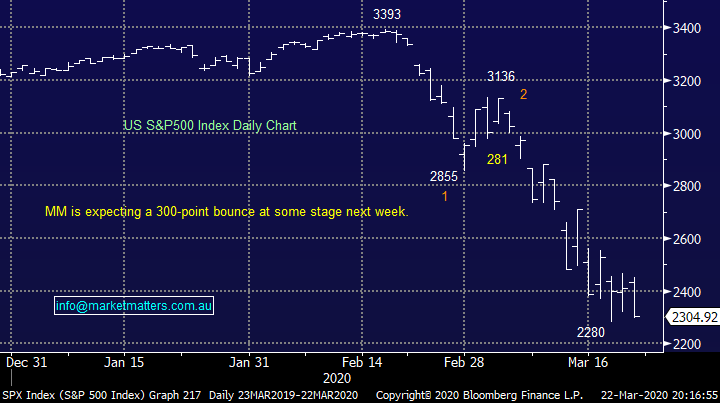

On Friday night US stocks gave up some solid early gains in an almost 1500-point turnaround by the Dow as it plunged aggressively into the “Triple Witching Hour”, finally closing down over 900-points / 4.55%. A couple of interesting trends have unfolded during the last few weeks huge volatility, there actually is some rhyme and reason within this unfolding panic with the one catching our eye being - Monday has tended to move in the opposite direction to Friday, whether the week ended strongly or poorly but we note 3-4 weeks is only a small data set.

If subscribers are wondering of the potential social impact of the current huge economic collapse, we should listen to none other than Brad Pitt! In the movie the “Big Short” which I reckon is worth watching with a very scary line within it - “every time unemployment rises by 1% in the US 40,000 Americans die”, of course this might be using some poetic licence but the point is relevant for a country with limited social support.

While it’s hard to envisage stocks moving anywhere but down in this environment, MM is looking for a decent bounce from oversold levels this as large fiscal measures come into play, remember lows are often formed when things look and feel there worst.

S&P500 Index Chart

Question 1

“Hi, what is the explanation in the steepening of the 2/10y US and Au yield curve and general rise in yield in the last couple of days?” – thanks Jin O.

Hi Jin,

The yield curve is the focus of many professional investors at present, by definition being the differential of 2 different duration bond yields it’s made up of 2 halves:

1: 2-year bond yields are trending down towards zero as they follow the Fed’s aggressive cutting of official interest rates, no surprises here.

2: 10-year bond yields have bounced strongly surprising many who expected a classic flight to quality / safety of US bonds; note not MM, we called longer dated bond yields to rally. The down turn in these longer dated bonds which sent the inversely correlated yields higher we feel has initially been fuelled by the “dash for cash” as redemptions flowed through financial markets, secondly there is the supply issue as central banks will need to issue huge tranches of bonds to pay for their massive stimulus measures and lastly we see inflation being an issue in the coming years which is likely to send longer dated bonds higher.

NB Central banks are also considering QE which effectively means buying longer dated bonds to maintain order and decent prices in a market where they are trying to issue fresh paper, sounds messy and it is!

MM expects the yield curve to continue steepening.

US 2 & 10-year Bond Yields Chart

Question 2

“James CCP was a former market darling with strong valuations all sitting between $30 to $35. As at the release of 1H20 at the end of January, all was rosy. Updated their FY20 guidance and the Balance Sheet was excellent. Since late February they have underperformed the market and lost around 60% from peak to 17/3 close. What's driving the price down beyond the market performance of -33%? Recession? Concerns about replicating the GFC LVR problems??” – Philip WW.

“Hey just wondering if you have any insight into why CCP is continuing to tank despite many shares giving some hints of green. You made a comment about CCP early last week and I would really appreciate your thoughts re CCP’s future performance please?” - Thanks, and kind regards Tamzin H.

Morning All,

My answer today is very similar to what I wrote for the Income Report on Wednesday when the stock was over $13, or well over 20% higher – CCP is simply in the too hard basket in today’s environment.

The stock peaked on 21st February at ~$38 and closed on Friday at $9.83, down ~75%. CCP now trades on an Est P/E of 6.5x and is projected to yield ~7% fully franked over the next 12 months based on about a 50% historical payout ratio. This is a stock the market has traditionally loved with a consensus target still sitting at $33.88, although that hasn’t changed since before the rout, so I understand why so many asks are if the aggressive re-rate on huge volumes is justified?

A few things at play here however the main issue is debt / balance sheet strength. The stocks that have been most heavily sold are those that carry higher debt and CCP fits that bill. At last reporting date in January they had net debt of $206m with gearing of 30%, however they have a covenant in their lending arrangements which says that they need to keep gearing at less than 60% of financial asset carrying value. The takeaway here is that this is a leveraged business where debt is higher than we’d like and the value of the assets underpinning that debt has likely declined.

Collection House (CLH) is one of their competitors and in mid-February they were suspended from trade with an alarming announcement. In short they effectively said that collection practices were too aggressive and need to be changed, The change would result in lower earnings from their purchased debt ledgers (PDLs) and that in turn would reduce the value of the PDLs on their balance sheet. That move seems to have triggered an issue with senior lenders. In short, we think CLH is in a world of trouble and that has focussed attention on CCP.

While CCP is a higher quality business than CLH, it seems clear that traditional debt collection practices are under the microscope and this could have a negative impact on the value of their inventory (which is essentially purchased debt). If the carrying value of inventory changes it puts pressure on the balance sheet at a time when the market is very focussed (and rightly so) in financial strength rather than growth. I can also remember CCP during the GCF, it traded down to ~60c and very nearly went out the back door.

MM still has no interest in CCP despite the sharp decline

Credit Corp (CCP) Chart

Question 3

“Hi Helpful Guys! With all the health woes now and forecast, what is your view on the health sector? RHC has hit rock bottom, may be! But is there an upside with the pressure being applied to hospitals etc.?” - Keep up the good work. Kind regards, Ted K.

Hi Ted,

Thanks for the vote of confidence in these tough & testing times, we actually discussed the healthcare sector in the latest Weekend Report and RHC was one of 3 stocks we liked along with stalwarts CSL Ltd (CSL) and Cochlear who we believe will maintain their competitive advantage post COVID-19.

In terms of hospital operator Ramsay Healthcare, the main issue will be the deferral of elective surgeries in their hospitals given the outbreak. While I hear that RHC is still pushing these to be done, it seems also inevitable that if the outbreak spreads more widely then they will struggle to keep that stance.

The Healthcare sector currently represents 13.3% of the ASX200, although the MM Growth Portfolio has no exposure given valuations were too high previously. That has changed somewhat into this pullback and the sector is now well and truly on our radar.

MM likes RHC below $50.

Ramsay Healthcare (RHC) Chart

Question 4

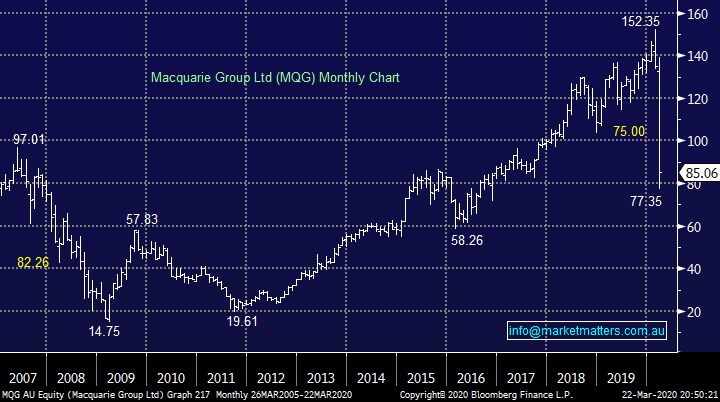

“I’m disappointed you recommended Macquarie recently - no mention of substantial funds in the airline industry. I understand it’s tough and prepared for ups and downs but bought BHP at $37 recently (your recommendation) and you’re slow on Macquarie.” - Margaret.

Hi Margaret,

Obviously, we also aren’t happy with our timing of both our Macquarie (MQG) & BHP Group (BHP) recent purchases, but we do like both respective business, and especially BHP at today’s prices. However as we’ve said earlier and over the last few reports we have underestimated the coronaviruses impact on both life and the market but this is the time to look forward not back as from a financial perspective some once in a decade opportunities appear to be slowly presenting themselves:

Macquarie Bank (MQG) - MQG showed us that they emerge strongly from a crisis and while they might take a while to regain investors’ confidence due to their strong correlation (Beta) to the underlying index we do believe it’s still a great stock to be accumulating into weakness. We have gone a bit early and hence may trim back our exposure into the next given position size in our Growth Portfolio, however if we had no position we would be buying into current weakness.

BHP Group (BHP) – MM is very keen on BHP at current levels, they have small debt levels while the stock is trading at a ~30% discount to its historical valuation. Plus China’s economy the ultimate destination for so many of BHP’s commodities is cranking up slowly but surely, as they are at least a few months ahead of the western world with regard to COVID-19.

MM still likes MQG and BHP into weakness.

Macquarie Group (MQG) Chart

BHP Group (BHP) Chart

Question 5

“My questions are easy. Should I look at buying Ramsay and should I buy more BHP? And what has happened with IGL?” - Thanks Dale.

Hi Dale,

We have covered the first 2 points earlier but in summary:

1 – MM likes Ramsay (RHC) below $50.

2 – MM likes BHP at today’s prices i.e. around $27.

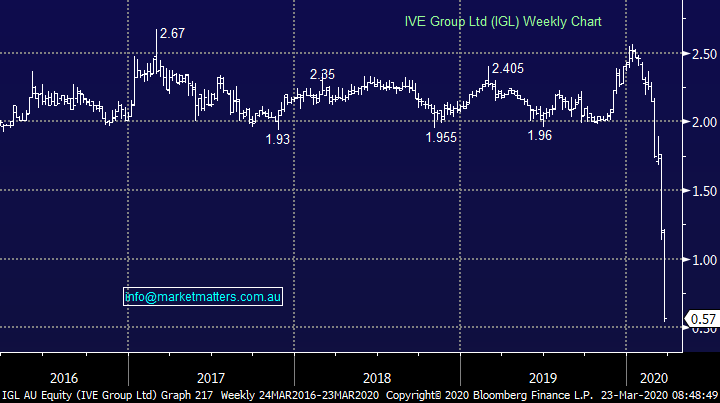

With regard to IVE Group (IGL), the integrated marketing business has fallen since reporting and is now in a trading halt pending an update on the business impact of COVID-19. Clearly, this is not a positive development however this is what we know:

1. 5 Directors have bought stock this month, the Chairman spent ~$1m, not a small amount, hardly likely if the business was is financial difficulty

2. They refinanced debt in November of last year and don’t have any refinancing requirements for a couple of years.

3. Marketing spend from their customers will take a hit (clearly) and this is a fairly complicated business, I presume the share price decline (albeit on low volume) has taken them by surprise and they will release a comprehensive update to the market shortly

4. Debt is the one concern I have here, and in an environment like this, there is a chance that covenants could be breached, however I would be very surprised if these are enforced.

We will update as / when information comes out; they are due out of trading halt tomorrow.

IVE Group (IGL)

Question 6

“James, I am thinking there is not a lot of green ahead for us for a while. I am happy to hold solid companies, BHP, maybe Telstra, BIN, and a few others, but I also feel that targeting companies that could potentially prosper from this nightmare might be worth a punt ... healthcare (Fisher Paykel health), maybe online learning (OLL)? And what about the negative facing ETFs? Every day that we get more bad news in on virus spread and subsequent shutdowns, BBUS and BBOZ go up 10-15%. With the US now spinning out of control. Their curve being even steeper than the Italians, there are without doubt more days of bad news ahead for us all.” – thanks, Charlie N.

Morning Charlie,

We must look from today and how much bad news is already priced into today’s fall, we believe a decent bounce is close at hand for equities, similar to that experienced late February / early March – in our opinion if this unfolds it would be an opportune time to consider negative facing ETF’s like the BBOZ.

Healthcare companies like OLL (market cap only $30m) and Fisher Paykel (FPH) have run hard we feel making the risk / reward unattractive at today’s levels.

1 – MM likes FPH below $22, in today’s market such 10-15% pullback could unfold in a few hours!

2 – MM would consider ETF’s like the BBOZ if / when the ASX bounces 10-15%.

Fisher & Paykel (FPH) Chart

Question 7

“Hello, The world outlook seems to be going from bad to worse. But you know that and have written about it coherently. My question: We have a SMSF and we are in pension draw down mode, If the Government wants to help retirees perhaps relaxing the mandatory drawdown (when share dividends are being slashed, interest rates are zero and share prices - if we have to sell to meet obligations - are low)? Are you or your "buddies" lobbying on this issue" - thank you, Cheers John T.

Morning John,

This is obviously a very fluid issue, over the weekend was saw the government announce some people will be able to access their super early as huge strides are made to ensure Australians don’t suffer too badly in these unprecedented times, of course on the flip side liquidating some of your super after a +30% stock market correction does not feel ideal, or opportune.

I think this is a very good point and something that should be considered if it hasn’t been already.

ASX200 Chart

Question 8

“Excellent Weekend Report thanks team, as I was starting to look at the various sectors myself and you have provided a good, short analysis.” - Cheers Tim L.

Hi Tim,

Thanks for the thumbs up for the Weekend Report, I believe as investors we need to be on the front foot in these volatile and worrying times, MM believes the below framework which came out of the Weekend Report will put us in a good position moving forward. Importantly we don’t believe this is the time to despair and run away from equites:

Buying: Cochlear (COH), CSL Ltd (CSL), Xero (XRO), Altium (ALU) and Woodside (WPL).

Adding: Service Stream (SSM), OZ Minerals (OZL), RIO Tinto (RIO) and NRW Holdings (NWH).

Selling: Western Areas (WSA), Sims Metals (SGM)

Reducing: Westpac (WBC), Macquarie Bank (MQG), and Emeco Holdings (EHL).

Xero (XRO) Chart

Question 9

“Just finished reading your weekend report. You have 5 stocks you are considering s