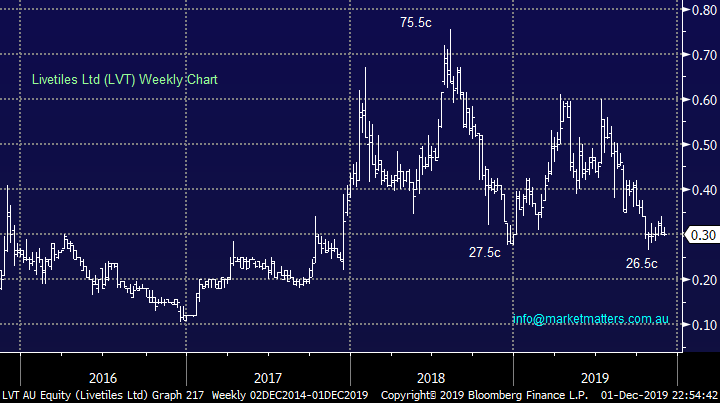

Subscribers questions (FMG, WBC, OTW, AMP, SUN, LVT, S32, MVP, LYC, JMS, MSB, VUK, IEM)

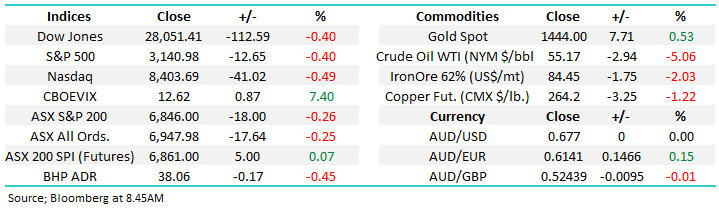

The ASX200 made new all-time highs on Friday morning before drifting lower throughout the day courtesy of the antagonistic actions of the US and President Trump towards China as they supported the protestors in Hong Kong – poor timing considering markets are expecting a “trade war” resolution at least of sorts this month. Not surprisingly we still believe the old British colony is the obvious canary in the coalmine for equities into 2020.

Fresh news was again relatively thin on the ground over the weekend with some good and bad numbers for investors to ponder this morning:

1 – Yet another extremely strong weekend of property auction results with Sydney returning to the boom levels of 2017, the anticipated further rate cuts by the RBA to 0.25% must be catching some buyers attention.

2 – Exports by South Korea tumbled -14.3% compared to this time last year, registering its 12th straight monthly decline – the trade war is clearly biting in some countries.

3 – Conversely China’s manufacturing unexpectedly improved in November moving back into expansion mode as government support has helped the economy post its first growth number in over 6-months - a great platform if we get a trade resolution.

MM is bullish the ASX200 while it can hold above 6800.

On Saturday morning the SPI futures were pointing to a flat opening following the Thanksgiving Day shortened week in the US.

Thanks again for the question – please excuse the brevity in our answers at time due to the volume for a Monday morning.

ASX200 Index Chart

Last Monday we pointed out our short-term concern for equities due the weakness in Junk Bonds, a phenomenon which has previously preceded pullbacks as illustrated below. Interestingly as if on cue corporate bonds rallied last week to close the gap, we’re not yet convinced their drop can be ignored but another couple of strong weeks would be a positive sign for equities.

MM believes investors should be open-minded to a ~5% pullback in stocks.

S&P500 v iShares High Yield ETF (Junk Bond) Chart

No change around bonds, MM believes US bond yields have shown their hand and are headed lower e.g. US 10-years to test ~1.4%.

The close back below 1.85% has triggered sell signals for MM targeting a test and probable break of 1.4%, this is very likely to produce a period of outperformance by defensives – a move MM will fade as we believe bond yields are “looking for a low”.

However deeper worries out of Hong Kong and / or a quick correction in stocks would probably send bond prices higher / yields lower i.e. falling bond yields is not always a positive for stocks.

US 10-year Bond Yields Chart

Question 1

“Hi Guys, following my previous question email it appears that FMG has shot up with the recovery of the Iron Ore price and therefore could it continue to a $11 or $12 price in the short to medium term. We missed the boat but should we get back on and when.” - Regards Errol K.

“Adam - I followed MM when they sold FMG.. I sold 4700 FMG shares n was going to buy back in at suggested price at what MM believes to be $7.00 What happened in the deal I lost about $5000.00. I haven't seen MM give any later advice on FMG as to where they think its heading! All FMG done was climb after MM said they were selling. I know this sometimes u get caught out, but MM is usually a lot closer to the mark.” - Thanks Terry K.

Hi Guys,

We didn’t really miss out on FMG more a case of taking $$ too early or leaving some $$ on the table. However as we can see below FMG which usually follows the bulk commodity price very closely was trading well under $7 the last time iron ore was at current levels.

MM likes the FMG business but believes the stock has got ahead of itself from a risk / reward perspective with iron ore beneath $US85/MT.

MM likes FMG but believes its dislocation from the iron price clouds the waters short-term.

Fortescue Metals (FMG) v Iron Ore ($US/MT) Chart

Question 2

“Good morning, just wondering why you have a buy on Westpac. Do you see limited downside from here even given the risk of a huge fine?” - Thx Richard A.

“G’Day, do you still intend to take up the SPP offer? I am thinking I will but would like to know if you agree please. Can you please reply to this email as next week will be too late I suppose.” – Waz.

“Hi MM, Question on WBC retail placement, it announced today that retail investors who have their money invested into the WBC placement can be withdrawn. Considering the current price is below its placement price, would it be wise for the retail investor like myself to redeem? Understand that you can only give general advice, can I rephrase the question as – Given the current WBC scandal, is the current price a good entry price, if not, at what price ?” - Thanks, Jacky l.

Hi Guys,

Our view on WBC is a Buy at current levels although a “washout” spike under $23 cannot be discounted considering the awful news flow around AUSRTRAC and subsequent looming fine.

We have decided NOT to take up our SPP entitlement because of our relatively large position at this point in time i.e. 9%. However if we had no position today we would be buyers at current levels leaving some ammunition on the table to average into another leg below $23.

The offer closes at 5pm today, however a withdrawal option is open until the 6th December at 5pm

MM remains long and positive Westpac (WBC).

Westpac Bank (WBC) Chart

Question 3

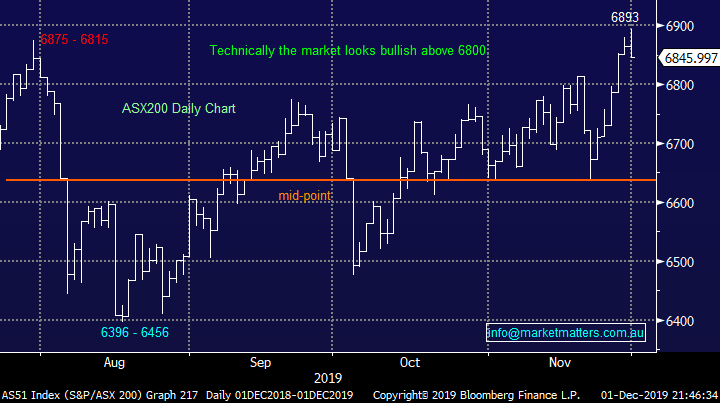

“Hi James and team, I noticed directors getting out of some stock. Albeit a portion of their large holdings. Given your dislike of this happening, I am wondering if you are still keen on OTW? This might be of wider interest to MM readers.” - Kind Regards, Peter H.

Hi Peter,

Telco and data centre business OTW still looks good to us and an eventual push towards $6 feels likely. As you say ED Brett Paddon sold $4.6m worth of shares around $4.60 but directors still hold a healthy +$130m worth of shares hence at this stage no great concern on that front.

This $260m business is not an option for MM because of its very low day to day liquidity.

MM is bullish OTW.

Over The Wire Holdings (OTW) Chart

Question 4

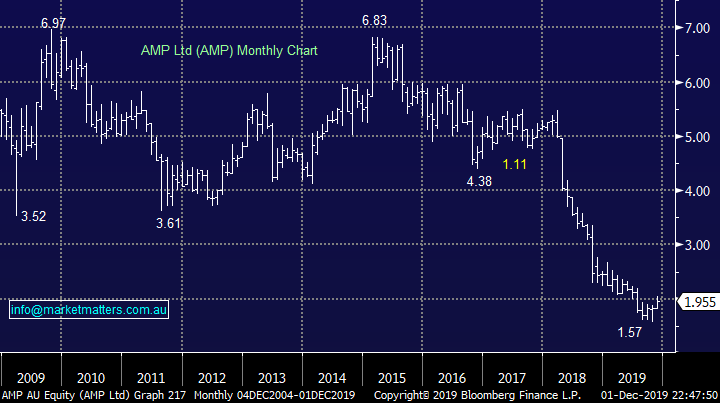

AMP Capital Notes 2 - “Interested in your thoughts for the Income Portfolio?” - Regards, Scott D.

Hi Scott,

We discussed last week in our Income Report and we are adding it to the income portfolio here.

The book build was heavily overbid, from my insight, about 2.5x.

AMP Ltd (AMP) Chart

Question 5

“I have noted on a number of occasions you have been quite negative on the outlook for Suncorp with a price target of around $11/12.00. What negative factors are you seeing in the stock as opposed to say Bell Potter who have a 12 month price target of $14.80.” - Thank you Ian C.

Hi Ian,

Suncorp (SUN) has been one of our favourite vehicles for MM since the company’s inception with the company following our fundamental and technical outlook well to-date, until it falls out of this rhythm we won’t fight it:

1 – MM is not keen on regional banks or insurers at present, SUN’s banking arm is under the regulators microscope at present and with the issues around weather related claims pressuring insures the stocks simply too hard in our opinion.

2 – Technically we called the spike up towards $16 for years followed by a correction back under $12, this has been following our playbook so far hence again we see no reason to own SUN.

MM is neutral / bearish SUN.

Suncorp (SUN) Chart

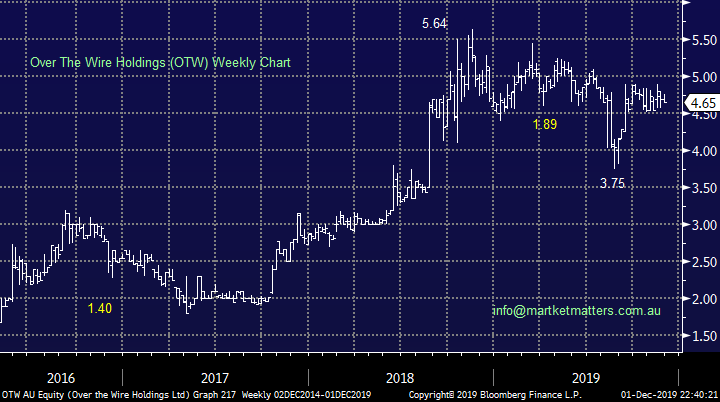

Question 6

“To James & The Team, I am a recent contributor to MM and The information flow and insights are fantastic. My question is about LVT, a stock that appears to be full of promise but endures constant selling and results in a stock that is difficult to own. Soon to turn cash flow positive might be the catalyst for a re-rating. They forecast a great year ahead. Can you give me your take on the story?” -Thank you, kind regards John H.

Hi John,

Firstly welcome to MM and thanks for the kind words, we’re really excited for 2020 with plans to make our offering substantially better!

For those unfamiliar with LVT it’s a software business with a market cap just under$250m whose share price has clearly been on a rollercoaster ride in 2018/9. We believe the company’s prospects could be exciting, it already enjoys over $40m of annualised reoccurring revenue (ARR) and although clearly a ”specie” at current levels it feels a reasonable “punt”.

We met management a few months ago, and came away thinking they would raise capital, something they have now done. That cum-raise hangover has now gone and some clear air is now possible if they produce decent numbers i.e mkt simply not thinking they are about the raise.

MM likes LVT as an aggressive play around 30c.

Livetiles Ltd (LVT) Chart

Question 7

“I understand that Shaw & Co are co-ordinating the float of Open Pay (OPY) in mid-December. Am I able to request an allotment?” Thanks Wayne M.

Morning Wayne,

Yes, Shaw is on the ticket for Open Pay. The bookbuild for wholesale / institutional investors happened last week. If you are a wholesale client with an account at Shaw we can assist for future issues. At this stage, it would be best to apply through the prospectus. Happy to have a chat to you about getting access to future deals through our desk. James - (02) 9238 0561

Question 8

“HI MM Team, is South 32 still on your watchlists?? Also your thoughts on Fortescue , the chart of FMG comparing to the price of iron ore if you could show again. Medical Developments International (MVP), very high P/E but maybe something to look at in the near future? Finally I know a lot of questions but where do you get the live Dalian Iron Price Futures Price?” - Thanks Tim C.

Hi Tim,

We covered the FMG part of your question earlier while the simple answer on S32 is yes but we are deliberately being patient with regard to increasing our resources exposure due to our view that bond yields are poised to make another low into 2020 which implies resource stocks will be neutral at best over the coming weeks – assuming of course we are correct.

With regard to the Dalian Iron Ore Price I believe to get a live feed you have to pay a data provider, we get ours through Bloomberg.

South32 (S32) Chart

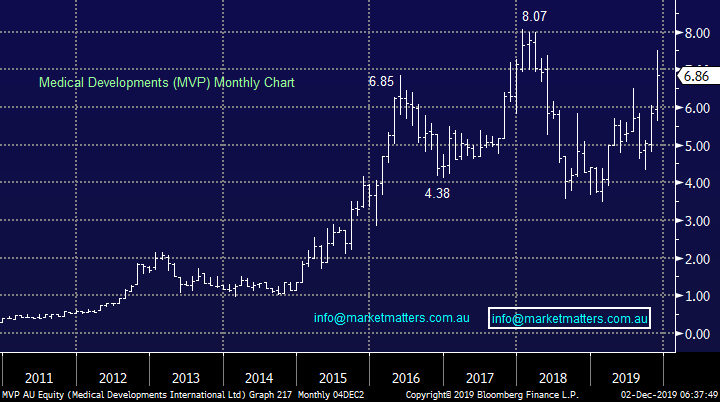

Healthcare business MVP is clearly a volatile stock but overall its enjoyed 2019 following positive results from its Penthrox product with a potential launch in the US not far away.

On balance MVP is ticking all the correct boxes and although the stock is indeed trading on a huge P/E it will be cheap if it launches in the US and China in the years ahead. Technically the shares look good with stops below $6, over 12% risk.

MM likes MVP as an aggressive play.

Medical Developments (MVP) Chart

Question 9

“Hi James – do you have an opinion on LYC and JMS shares.” - Cheers, Pam

Morning Pam,

Firstly rare earth company Lynas (LYC) is well positioned for an increase in global demand although the stocks still trading under the cloud of Wesfarmers backing out of its takeover bid for the business earlier this year. However for the aggressive investor we believe if / when LYC trades back under $2 it will offer some solid risk / reward for the brave.

MM likes LYC as an aggressive play under $2.

Lynas Corp (LYC) Chart

Manganese and base metal business Jupiter Mines (JMS) is struggling this month as the manganese-ore price remains under pressure – often the best time to buy cyclical miners.

JMS jointly owns the world’s largest manganese mine in South Africa and it’s a nice cash cow but obviously the price of the underlying commodity determines how much. The company’s latest half-year report showed a slight reduction in production but the board is optimistic they are well positioned moving forward. The stocks showing little optimism at present trading on a Est P/E for 2020 of just 5x while its variable yield looks set to fall along with the manganese price.

MM likes JMS as a play on the turnaround in Manganese

Jupiter Mines (JMS) Chart

China’s Manganese Ore Price Chart

Question 10

“Hi James, thanks as always for your terrific insights through the newsletter. Just wondering whether you could make comment about the prospects of LYC and MSB. Also some commentary around the recent results of VUK and their prospect going forward from here …would be greatly appreciated” - Many Thanks Don H.

Morning Don,

Thanks for the positive always much appreciated, we covered LYC earlier so I’ll look at Mesoblast (MSB) now.

Biomedical company MSB reported 36% growth in revenue last month for the quarter but the company’s still losing $$, just at a reduced rate. This is almost a $1bn business with a number of positives moving forward including a partnership with Grunethal and upcoming FDA filing. Technically the stock looks ok with stops below $1.50.

MM is neutral / bullish MSB.

Mesoblast (MSB) Chart

After its horrendous decline VUK was always going to bounce from somewhere!! and that area has turned out to be ~$2. The old Clydesdale bank, and prior to that the UK arm of NAB, has seen its shares rocket higher following their full year result the stocks now up over 70% from recent panic lows set on hard BREXIT fears and earnings problems. We covered it the afternoon of the result saying….the result itself was a long way from the FY18 result but curbed a multitude of fears the market had from the UK based deposit taker. Underlying profit before tax came in at £539M, around about in line with consensus but 7% below last year.

The statutory after tax figure fell into a significant loss of -£268M thanks to climbing remediation costs from claims against the bank. Net interest margin continued to come under pressure, coming in at 166bps for the full year, but as low as 160bps in the last quarter. Funding costs are rising and the home loan book earnt 8bps less. The result reads poorly, but when shares are priced at around half of NTA, a little goes a long way. Clearly there is trouble within the business, but the market was positioned particularly negative heading into the result. The Virgin Money integration is coming along well, and will complement the business long term if it can be executed properly. A big part of this will be costs, with plenty of fat on the bone here for VUK to carve into.

MM is now neutral VUK.

Virgin Money-CDI (VUK) Chart

Question 11

“MM 1/12/19: if bonds top out (yields bottom) stocks will lose a major tailwind of the last 12-montths, and more than likely experience a correction.: what have I missed? I thought the lower the bond yield the greater impetus to stocks.” - Chris G

Hi Chris,

Agreed the lower bond yields / higher bond prices have been a huge tailwind for stocks as the below chart clearly illustrates. What we are saying is bonds are close to an inflection point, or top, hence if they pullback yields will rise pressuring parts of the stock market.

ASX200 v Australian 3 Year Bonds Chart

Question 12

“Emerging Markets - would you please explain or give me a rundown of what this section really covers.” - Cheers Clive B.

Hi Clive,

The Emerging Markets Index (EM) we regularly show below is the EEM ETF listed in the US which predominantly holds large to mid to large cap EM stocks – at the moment its largest holdings include Alibaba, Tencent, Samsung, Ping Insurance, Reliance Industries, Naspers and Taiwan Semiconductors. Making China, Taiwan, Korea South Africa and India being the heavy influences. I can see why people would say these countries are no longer emerging but have arrived but that’s how the market still terms them.

Further details can be found here : https://www.ishares.com/us/products/239637/ishares-msci-emerging-markets-etf

There is a locally listed variety which trades under code IEM, and this ETF simply invests in the EEM but hedges the currency

Emerging Market ETF (EEM US) Chart

Overnight Market Matters Wrap

· The SPI is up 5 points despite a weaker trading session on Wall Street. The Dow and S&P 500 both closed down 0.4%, while the NASDAQ fell nearly 0.5% on a shortened trading session a day after the Thanksgiving holiday.

· Chinese manufacturing data surprised to the upside in November with the official manufacturing PMI printing at 50.2 which was the first reading above 50 in over six months. The Caixin China Manufacturing PMI is due at 12.45pm today with analysts expecting a reading of 51.5.

· US consumption is now the main component of growth, so analysts are watching how the holiday shopping period fared. Black Friday online results showed an increase of nearly 20% on last year, however big retailers were some of the worst equity performers on Friday.

· Nickel fell more than 2% again on the LME to hit its lowest level in four months as steel production in China continues to decline and the effect of an Indonesian export ban diminishes. Oil fell 5%, the biggest drop in over two months, while iron ore fell to $US87.46/t.

· The September SPI Futures is indicating the ASX 200 to open 13 points higher towards 6859

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.