Subscribers questions (OZL, SFR, FBR, BIN, ALF, TLS, BOQ, NST, NWH, WAM)

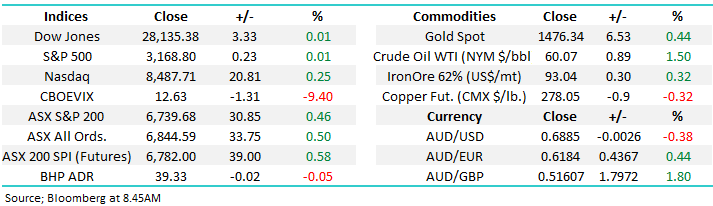

The ASX200 was higher last week by 0.5% thanks to positive developments on the trade front and a resounding victory by Boris Johnson in the UK election, providing certainty around Brexit. That gain was a little lacklustre given the positive moves overseas however local futures are pointing to a positive open this morning.

Fresh news was thin on the ground over the weekend as we wind down for Christmas, although MM will be providing reports up until Christmas Eve given this is generally a positive period in markets and keeping ones finger on the pulse is important.

MM is bullish the ASX200 looking for a test of 6900

On Saturday morning the SPI futures were pointing to a positive opening this morning, up over +0.6%.

Thanks again for the questions, some great ones that help us further articulate our views on the market.

ASX200 Index Chart

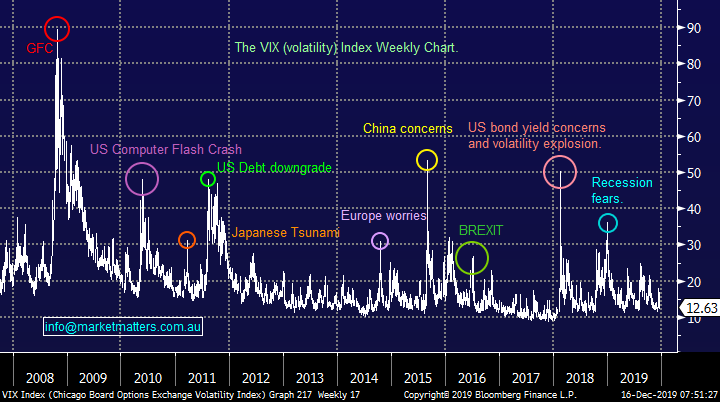

US stocks outpaced our own last week and volatility continued to slide lower with two clear risk factors taken off the table. The volatility index at just 12.63 implies a growing level of complacency in the market. Over the weekend, Trumps twitter account was in full swing with the topic of impeachment getting a lot of airtime. Markets are fickle and once one worry is overcome (trade) another one often takes its place (impeachment). Expect more on this over the coming weeks, although the details of the trade deal will also continue to bubble away in the background.

Volatility Index (VIX) Chart

Question 1

"HI MM, It was probably included in your previous emails but I could not find it but what is your target price for OZL? Recent Bell research (Oct 19) had 10.69, where OZL is hovering currently. What is MM's view?" James D

"Hi Team, I am keen to understand the rationale behind the large % increase in OZL today and what further upside you see." Jeff F

Hi James & Jeff,

Oz Minerals (OZL) has been a strong performer in the MM Growth Portfolio. The chart below shows the price of Copper which rallied another +2.6% last week breaking well above its medium-term downtrend in the process. The Copper price is a bell weather for the markets outlook on growth and clearly this has become more positive in recent weeks. OZL has been supported by the rise in their underlying commodity.

MM is bullish both Copper and Oz Minerals (OZL), in the case of OZL, we are targeting another ~10% higher in the first instance.

Bell Potters PT is $10.69 and consensus is $10.81. Peter O’Connor at Shaw has a PT of $11.50 while Macquarie have a $12.50 PT.

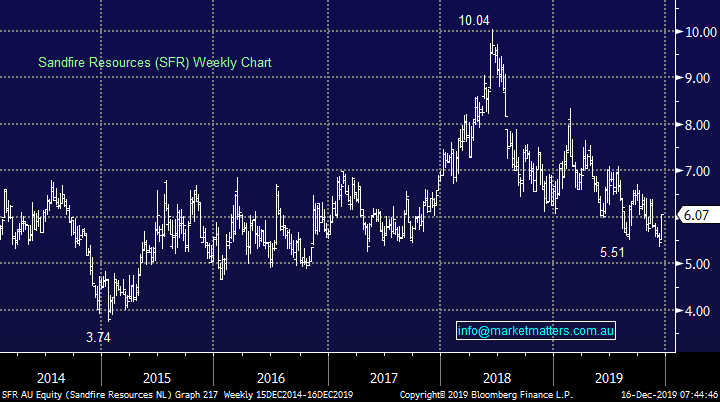

As an aside, the more leveraged play on Copper is through Sandfire Resources (SFR). While SFR have had some operational issues, and we have elected to stay at the higher quality end of town, SFR is looking bullish for a ~15% advance.

MM is bullish both OZL and SFR

Copper Futures ($US/lb) Chart

Oz Minerals (OZL) Chart

Sandfire (SFR) Chart

Question 2

"Hi, Great note – always of great value. When you say portfolios should be structured in favour of cyclical value as opposed to growth / bond proxies. What stocks are we looking to restructure into that are classed as cyclical value?" - Regards Brett

Hi Brett, A good question given we’ve been harping on about this in recent notes. Firstly, most stocks like falling interest rates - lower interest rates mean stock valuations will generally be higher given a ‘risk free’ rate is applied in valuation models. The sectors that really enjoy falling rates are high P/E growth stocks and defensive ‘bond like’ stocks that carry high levels of debt that underpin defensive predictable cash flows. Rising rates are a headwind but even stable rates remove the obvious tailwind.

Cheaper cyclical stocks on the other hand like resources, mining services, building companies, packaging etc. and their associated service providers have a positive correlation to interest rates. These sectors are more influenced by economic activity and the markets expectation of economic activity can be shown through interest rates. Remember, markets price 6-12 months ahead so if rates at least stop falling now, it implies investor expectations around future growth are improving. Cyclical’s are cheaper at this point in the cycle and MM is positive the sectors above.

We believe bond yields are ‘looking for a low’ which is bullish for cheaper cyclicals

Australian 3-year Bonds v Official RBA Cash Rate Chart

Question 3

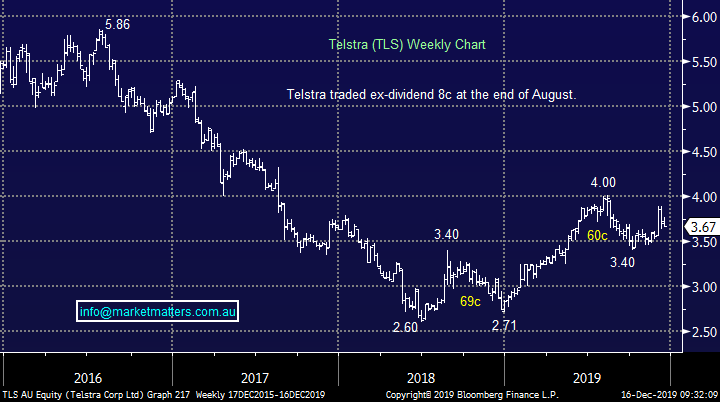

"Just read your Sunday Report (required weekend reading over a late breakfast). As an income investor who held on too long to Telstra Shares through the NBN period high and has since been hoping for the TLS share price to appreciate so I can 'get rid', I read your comments on fading the bond yield bear market with interest. Do we still consider TLS as a bond proxy share? If not, I read your comments as likely bad news for TLS moving in to 2020 - do I read you correctly? Keep up the good work MM!" - Karl B

Thanks as always for the thumbs up Karl. In short, no, we don’t view Telstra as the bond proxy it once was given they are now paying less out as dividends and reinvesting more into the technology opportunity in front of them. The underlying dividend yield for TLS is currently 2.72% however they are also paying a special dividend thanks to NBN payments which bumps up the current yield to 4.35% fully franked. The 16cps dividend which creates the 4.35% yield based off current prices is what investors should expect out to at least 2022.

At their last update in November, TLS guided to a lower capex number than the market was expecting and that led to a pop in the share price and upgrades across the analyst community – a clear positive however it shows how sensitive the fate of Telstra is to their cost base. Clearly, they either need to grow at the top line and / or strip more costs out of the business to improve earnings, something we think is very achievable as they part with older legacy systems and improve integration across the business.

MM is positive TLS expecting a slow grind towards $4.50

Telstra (TLS) Chart

Question 4

"Hi Guys, Could I get an update on your intentions with the NWH SPP? It looks good to me, and I remember in late November your position was to participate in the institutional offer." - Thanks, Richard

"I was wondering if you plan to take up the Share Purchase Plan for NRW Holdings Ltd? Do you still think there is further upside for NRW?" - Laurence

Hi Richard & Laurence,

MM intends to participate in the share purchase plan (SPP) – the current share price is $3.23 versus the SPP offer price of $2.85 which represents a ~12% discount to current market prices. As a refresher, holders of the stock at the record date of 27th November can buy up to $15,000 worth of shares at $2.85 as part of the company’s capital raising to buy BGC contracting - a good acquisition. We may get scaled back here given they are capping the SPP component of the raise to $10m

The timetable is below, with the offer closing on the 2nd January.

NWH trades on an estimated P/E of 14.3x with strong earnings growth forecast for the coming years.

MM remains bullish NWH

NRW Holdings (NWH) Chart

Question 5

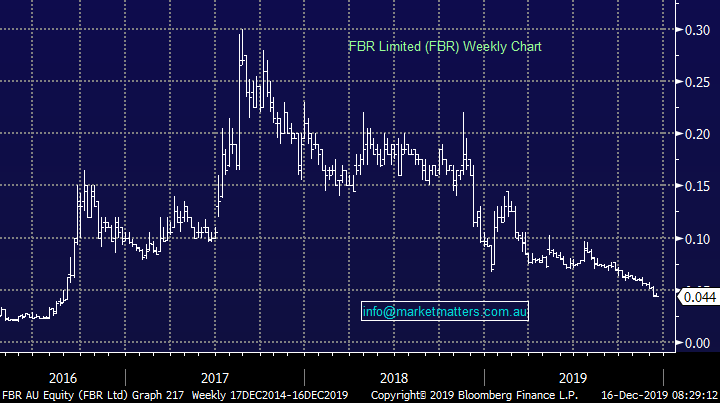

"Thanks for the interesting and informative analysis of the requests from investors. I was wondering if you had a position on FBR Limited (FBR). They appear to be locked into a downward spiral even though they seem to have enormous potential." - Wayne L

Hi Wayne – I remember the hype when this stock was coming on the ASX, through a backdoor listing from memory back in 2016. For those not familiar, FBR developed an automated bricklaying technology that was tipped the revolutionize the age old art of laying brick. An optimistic task that ultimately required a lot of capital. Today the share price is languishing at just 4.4c valuing the company at ~$74m, a far cry from the initial hype.

The main issue here is they don’t generate earnings, they just raise capital, the latest being a $5.5m placement through Bell Potter at 4.5c. Management salaries went from $1.35m in 2018 to $2.45m in 2019 while the company lost $9.1m, up from a $7.1m loss in 2018. Not a company we would invest in.

MM believes FBR is simply all too hard

FBR Limited Chart

Question 6

"Hi, Please what are your thoughts on buying into WAM looks like a good divi." - Many Thanks. Alan.

Hi Alan, WAM is a listed investment company run by Geoff Wilson, whom I have a lot of respect for. A broker turned successful fund manager, and a very successful one at that. Geoff tapped into the boom of investors looking for sustainable and consistent dividends by developing a listed investment company that could smooth out the bumps in the dividend road by holding back retained earnings in good periods affording them the opportunity to top up dividends in weak periods. This means the dividend has been very stable and growing over time which looks good on face value.

At the end of November, WAM had an after tax NTA of $1.90 while it currently trades at $2.23. This means that WAM trades at a 14.7% premium to value of its portfolio.

We penned an article this time last year titled: Why we’d sell WAM (click here) and the rationale remains relevant today.

MM is neutral / negative WAM

WAM Chart

Question 7

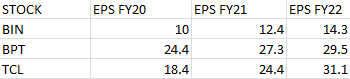

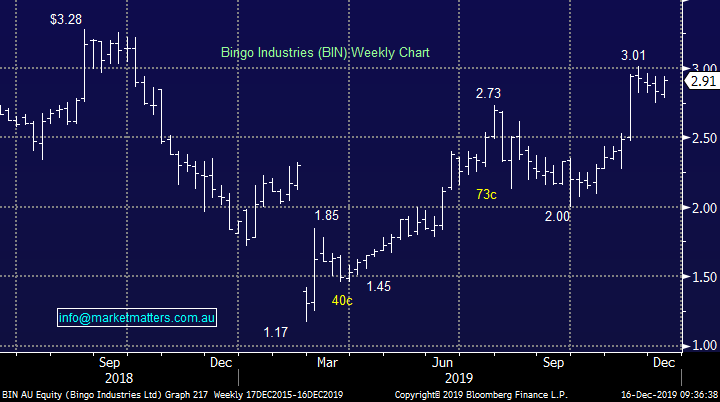

"MM, My information is that forecast EPS for both above companies is declining whereas TCL is increasing. Are you confident on your recommendation?" - Robert. (this question refers to the alert of selling TCL, and buying BIN and BPT last week. We also increased SGM in the process.)

Hi Robert, EPS forecasts for the three companies below. Bloomberg consensus generally the most comprehensive. Both BIN and BPT expected to grow strongly, although so is TCL. Importantly, the calls were for two separate portfolios, TCL was being sold from the MM Income Portfolio to make way for the purchase last week of BHP. This fits our view of reducing ‘bond proxies’ in favour of ‘cyclical growth’.

The alerts for BIN and BPT were outright buys in the Growth Portfolio, again to position more towards growth. While early days, the switch between TCL and BHP in the income portfolio has added 3.31% in relative value (TCL down –1.37% and BHP up 1.94%).

MM is bullish BIN, BPT & BHP, while being bearish TCL.

Bingo Industries (BIN) Chart

Question 8

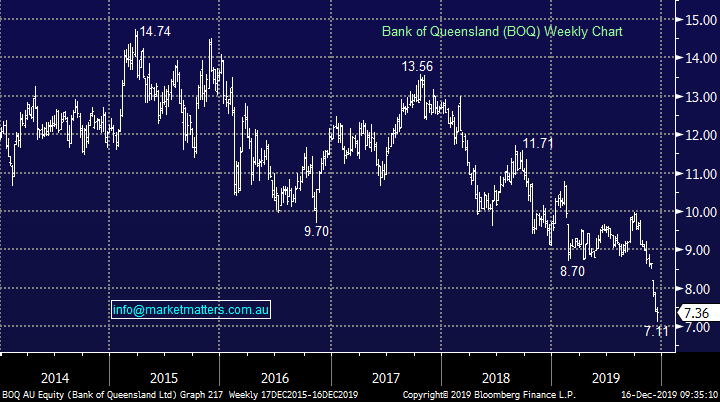

"Hi Team, can you PLEASE EXPLAIN what you meant by " the BOQ has a share purchase plan next week with a pricing window" This might seem trivial or lacking KNOWLEDGE but it's why I became a member to learn. Many many thanks" - Cheers Warren

Hi Warren – no such thing as a trivial question, if it doubt ask it, we’re here to help. In late November BOQ launched a capital raise that comprised an institutional placement at $7.78 per share raising $250m plus they included a Share Purchase Plan (SPP) for retail investors allowing retail holders to buy up to $30,000 worth of shares at the same price as institutions which at the time was a 10% discount to the share price i.e. a seemingly good deal.

Since then the share price has plummeted and closed Friday at $7.36. To protect retail buyers in the SPP there is a caveat in the pricing. If during the SPP pricing period, which is this week, BOQ shares are below the $7.78 institutional issue price, retail buyers will be able to buy stock at a 2% discount to the volume weighted average price (VWAP) during the pricing period i.e. this week. Assuming the SPP was priced off $7.36 close on Friday, the SPP shares would be offered at ~$7.21.

BOQ is cheap at current levels and is starting to look interesting.

Bank of QLD (BOQ) Chart

Question 9

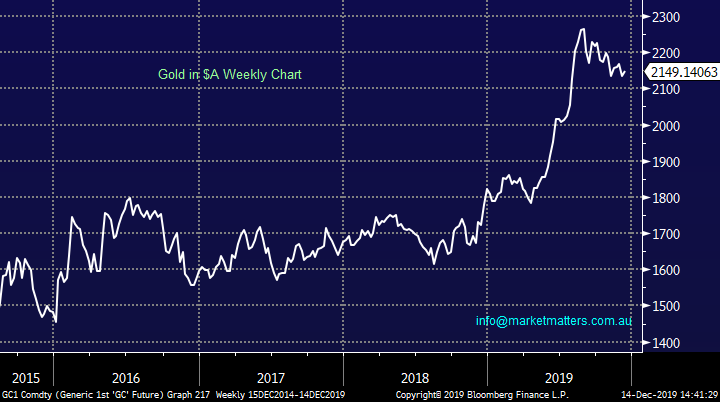

"HI MM TEAM, JUST YOUR THOUGHTS ON THE AUSSIE GOLD STOCKS IN PARTICULAR NORTHERN STAR??" - THANKS TIM

Hi Tim, as we noted on the weekend, our gold exposure has caused us some pain over recent weeks as we’ve seen heavyweight Newcrest (NCM) correct 28% and most smaller players fall even further but the gold price in $A has only fallen ~5% while major gold ETF’s are down ~15%, in other words the Australian Gold Sector has basically coped it worse than anybody!

We still believe that gold in $A will make fresh highs around 6-8% higher implying the local sector will regain some of the recent declines, clearly in hindsight Australian gold stocks had got way ahead of themselves when gold was rallying and bond yields falling.

MM believes there will be a better time to exit / reduce our gold exposure.

Gold in $A Chart

In terms of Northern Star Resources (NST), this would equate to a move above $10.00.

MM is a seller of strength in Gold, rather than a buyer of current weakness.

Northern Star Resources (NST) Chart

Question 10

"ALF Aust Leaders Fund I am trying to find out what happened with the Off-Market Share buyback announced by ALF This was a stock you included in your Portfolios but is no longer there. Please advise." - Richard

Hi Richard, Australian Leaders Fund (ALF) was a position we held previously in the MM Income Portfolio. We added ALF, which is a listed investment company (LIC) to the portfolio in December of 2017 on the expectation that poor performance would improve and that would in term allow them to re-start dividends and trade up closer to the net tangible asset (NTA) value of their underlying portfolio. That didn’t happen and we cut the position having bought at $1.06, we sold at $1.02 plus we also received 2cps dividend + franking – we booked a loss of 1.43%.

Subsequent to that, ALF launched a buy-back, however the structure was different and good (for holders). Essentially, the deal will allow holders of ALF to tender up to 20% of their existing holding and be paid the equivalent of NTA for them. The deal means that holders could at least realise appropriate value on a 5th of their shares. This was a positive move by Justin Braitling and Watermark Funds and more funds should do it, although they probably won’t. This was approved at their AGM 2 weeks ago and now looks likely to happen from what we can see.

NTA currently sits at $1.15 on a post-tax basis versus the current share price is 98c. They also have an on-market buy-back happening at the moment.

We covered the broader Listed Investment Sector in a recording a few months ago answering subscriber questions.

Listed Investment Companies (LICs) - Answering subscriber questions – VIDEO LINK

MM is neutral ALF at best

Australian Leaders Fund (ALF) Chart

Overnight Market Matters Wrap

• The US closed with little change last Friday, as investors wait for further information to digest with regards to the trade agreement made between US and China.

• Another wave of dramas with US President Trump is slowly growing as he is expected to be impeached this Thursday, however an acquittal is likely early 2020.

• On the commodities front, a healthy fall in Dr. Copper and aluminium was witnessed, while Nickel, Iron Ore and Crude Oil rose ahead of Christmas.

• The December SPI Futures is indicating the ASX 200 to open 42 points higher, towards the 6782 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.