The good, the bad and the ugly of a big reporting day (SGR, IAG, HSO, SRX)

The ASX200 continues to reward the traders / investors who follow exactly what feels wrong almost every day! Yesterday morning we woke up to see the Dow up almost 200-points, resource stocks strong and the SPI futures indicating the ASX200 would open up close to 40-points, but by lunchtime the local market had been smacked 75-points from its high and was trading down over 25-points – as we often say short-term market movements are just noise and this was a perfect example.

The local market remains firmly within its 14-week trading pattern between 5629 and 5836, with the required catalyst to break this slumber yet to raise its head. Amazingly the market has again closed within 10-points of the middle of its trading range after threatening to break out in both directions in the last 10-days.

We remain neutral with a slight negative bias, but importantly patient, the volatility on an individual stock level seems to continue to increase which is enough to keep us busy.

ASX200 Daily Chart

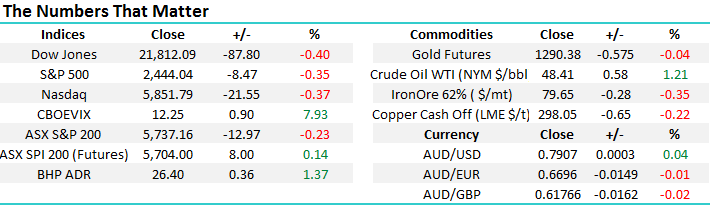

US Stocks

US equities slipped around 0.4% overnight as more antics from their “interesting” President causes renewed concerns for risk assets. While we still see a correction for the S&P500 back towards 2350 its path is clearly going to be as tricky – similar to trying to pick the ASX200 at present!

We remain bearish US stocks targeting a correction of ~5% over coming weeks as sell signals continue to slowly emerge.

US S&P500 Weekly Chart

Yesterday we saw some large companies step up to the reporting plate, but unfortunately the net result on the day was not encouraging for the overall Australian equity market:

The Good – A2Milk (A2M) +6.9%, QUBE Holdings (QUB) +3.3% and Star Entertainment (SGR) +5.1%.

The Bad – IAG Insurance (IAG) -8%, Sirtex (SRX) -10.5%.

The Ugly – Healthscope (HSO) -15.3%

Also, Woolworths (WOW) came in ok with the stock closing marginally lower -0.4%, but nothing raised its head within their result which led us to consider investing in the retailer – we covered this in the Income Report yesterday.

It’s worth pointing out that insiders i.e. directors / executives sold shares in HSO and SRX in 2016, which is why we keep a close eye on any activity by the people “in the know” – it’s simply not human emotion to sell something today that you are confident will be worth more moving forward. However, in both these cases the stocks have now fallen significantly reducing our concern as to what lies ahead following the sales.

Today we’ve selected 4 of the above companies who reported for closer inspection.

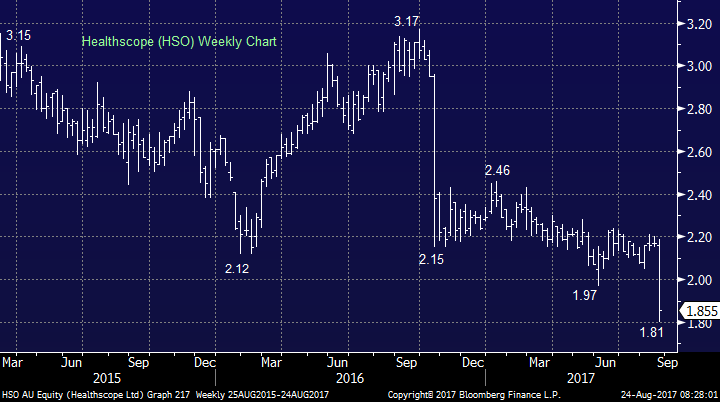

Healthscope (HSO) $1.85

HSO is a stock we’ve invested in twice since late 2015 with a net profit of well over 16%, not bad for a stock which has been smacked over 40% in the last year. This is a great advert for our slightly more active approach to investing than a few subscribers are familiar with.

HSO is the 2nd largest private hospital operator in Australia and they have been investing with gusto to be positioned for our ageing populations increased demand for healthcare. We believe the growth in demand for private healthcare has many, many years ahead of it and it’s this fundamental view that has seen MM purchase the stock twice in the last few years when an appropriate entry level presented itself.

Assuming we are correct in this demand prognosis, the combination with a government rapidly running out of money to fund public healthcare should prove an excellent backdrop for HSO moving forward. Eventually, earnings should improve although political risks do always exist, just ask the banks and miners!

Yesterday’s result showed increased costs plus a lack of growth in short-term earnings i.e. the jaws of death for a stock. Healthscope announced a 3.4 per cent lift in revenue to $2.37 billion but profit was hit by a $54.7 million impairment from the medical centres sale, but more importantly the underlying result was also weak. The valuation is now looking attractive at 16.9x estimated 2018 earnings in a sector where we see growth.

We are bullish HSO close to the $1.80 area. **Watch for Alerts**

Healthscope (HSO) Weekly Chart

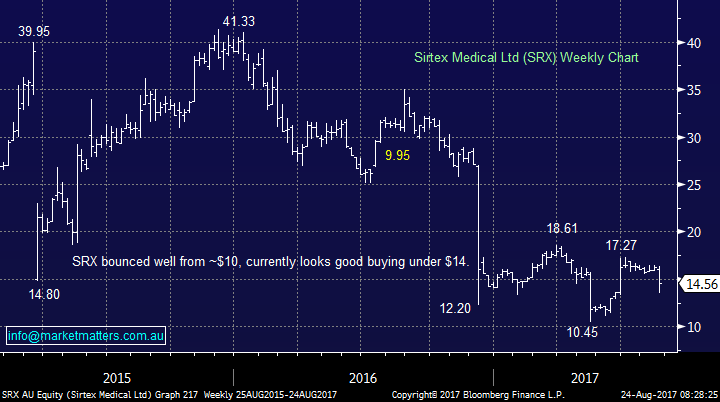

Sirtex (SRX) $14.56

Sirtex (SRX) is a medical company which focuses on the treatment of liver cancer. SRX shares fell over 10% yesterday following some substantial R&D write-downs leading to a net loss after tax of $26.3m. The company’s underlying NPAT was a far healthier $42.4m. Also, the company does have almost $120m in cash and no debt leading to it performing a buyback with another $27m to be spent by mid-September. The stock was not cheap before their report but it’s certainly looking more interesting following yesterday’s tumble.

We may consider buying SRX under $14 but this would be a high risk “trading position”.

Sirtex (SRX) Weekly Chart

Insurance Australia Group (IAG) $6.22

IAG joined both Suncorp and QBE in the sin bin following a result that showed contracting insurance margins, in this case from 14% to 11.9%. The company’s net profit rose 48% to $929m significantly assisted by a strong equity market, this clearly will not last forever. However, the company is now paying a 5.3% fully franked yield which should support the stock around $6 for a while.

Warren Buffett has invested into IAG and it will be interesting to see if he increases his stake into the current weakness. Technically the stock looks very average eventually targeting ~$5 but for this to unfold we are likely to need global equities to fall at least 10%.

We already own SUN and QBE and certainly do not want to increase our exposure to the currently unpopular sector.

Insurance Australia Group (IAG) Monthly Chart

Star Entertainment (SGR) $5.36

Star Entertainment (SGR) shares rallied over 5% to $5.36 on Wednesday after the casino / resort operator reported a solid net profit after tax of $264.4m, hitting consensus on the profit number although it missed slightly on revenue. SGR was saved by the pokies which now generates over 50% of its earnings compared to Crown at 22% - sounds like Sydney RSL’s might be struggling.

We don’t love the business but we do like Australian tourism leaving us overall neutral SGR.

We remain neutral SGR at current levels.

Star Entertainment (SGR) Weekly Chart

Conclusion (s)

Of the 4 stocks, we looked at today our thoughts in a nutshell are:

Buy HSO ~$1.80, buy SRX under $14 as a trade, leave both IAG and SGR alone.

Also, we do like both QUB and A2M but no clear risk / reward looks apparent.

Overnight Market Matters Wrap

· The US Indices closed in negative territory as investors see US President Trump still distracted from his pro-growth agenda and a potential government shut-down.

· Investors will be keeping an eye on the annual gathering of global central bankers in Jackson Hole tonight for any indication on potential rate hikes (or cuts).

· Gold rose to $US1290/oz, while oil rallied 1.21% as US crude stockpiles fell to its lowest level in 19 months.

· A flat open is expected this morning in the ASX 200, as indicated by the September SPI Futures.

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 24/08/2017. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here