Volatility is increasing across many markets, time to prepare! (USD, BEAR, BBUS, IEM, WBC, JHG, CYB, MQG, ASX, OSH, CSL, COH, RIO)

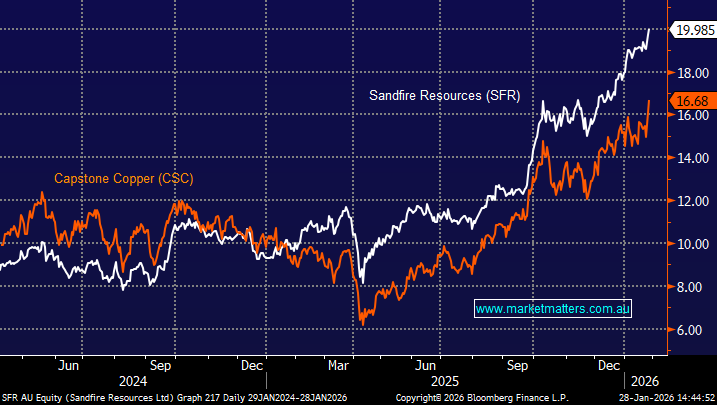

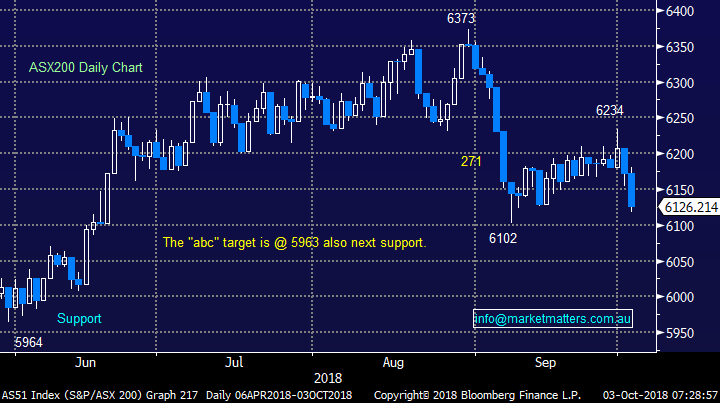

Yesterday the ASX200 was sold off hard for the second consecutive day falling -0.75% with ongoing weakness in the banks, diversified financials, insurance and real estate sectors to name a few. There’s no doubt that the negative fallout from the Hayne Royal Commission has returned with a vengeance, this ones clearly a domestic issue.

However, the weakness during our time zone was more of a global phenomenon as the Hang Seng plunged almost -2.4% plus European & US futures were also down fairly hard all day. In fact, so much was flashing away on the screens that it almost went unnoticed that the RBA left rates at 1.5% with pretty unchanged commentary but the $A took the announcement on the chin quickly retreating back under 72c.

· MM remains mildly negative the ASX200 short-term with an initial target ~5960 or around -2 ½ % lower.

Overnight stocks again recovered reasonably well in the US with the S&P500 finally closing down less than -0.1%, Europe still closed down -0.7% but it did regain half of its losses. Macro issues continue to create discomfort in specific areas but US stocks still appear to be receiving a safety haven bid:

· Italian bond yields hit a 4-year high as worries resurfaced around the countries Eurosceptic populist government – the scary word “contagion” is back in the financial press.

· Emerging markets are again back under pressure as the $US firms e.g. Indonesia’s Rupiah hit a 20-year low yesterday and stocks in the group again came under pressure.

In today’s report we are going to look at a large 11 stocks / positions that we are considering into the current market weakness – it feels like MM may well be active in the coming days / weeks. Remember our current market positioning allows significant flexibility on the buy side:

- In the Growth Portfolio we hold 13% in $A cash, 5% short the ASX200 via Bear ETF, 5% leveraged short the S&P500 plus 3% in a $US ETF

- In the Income Portfolio we hold 4% in cash plus a ~45% weighting to more conservative hybrids and fixed income funds – we clearly have the ability to up weight more aggressively back into equities

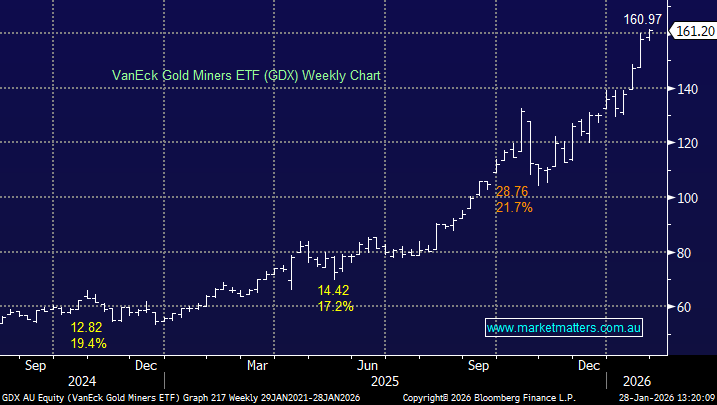

At MM we believe that equities are in the “late cycle” of the longest bull market in history hence this is the time for more traditional old fashioned “blue chip” stocks which have often not been the best performers over recent years.

Please excuse the volume of charts / brevity on each position in this report but we are just covering a lot of ground this morning to ensure subscribers are in tune with our thoughts / planning over the coming days.

ASX200 Chart

1 Australian Dollar ($A) 71.85c

The $A fell to 72c following the RBA’s statement but then proceeded to accelerate lower well under the psychological level as concerned investors / traders sought refuge in the greenback.

· We remain long-term bearish the $A targeting the 65c area.

This ongoing $A depreciation should continue to provide a major tailwind for the $US earners on the Australian market.

Australian Dollar $A Chart

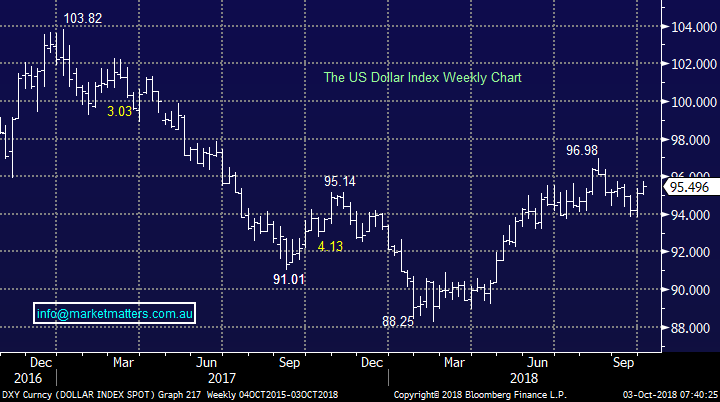

In the medium term the $US looks poised to pop / rally to fresh 2018 highs which would probably coincide with the move lower in many stock indices we are anticipating i.e. perhaps a blow off panic in the emerging markets indices.

· MM will consider taking our profit on our long $US ETF position if we see a sharp 2-3% rally in coming weeks.

$US Index Chart

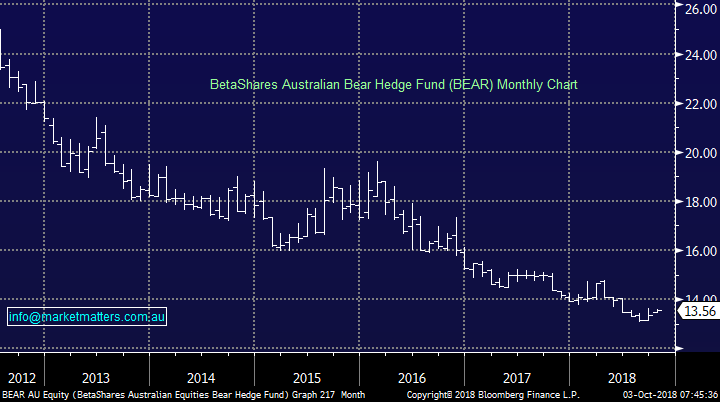

2 BetaShares Bear ETF (BEAR) $13.56

The ASX200 remains on track to break under 6000 as we’ve been looking for over recent weeks. If this move unfolds we will be looking to take a small profit from this ETF position and allocate into the market – a small way of adding value (alpha) as opposed to simply leaving the money in cash.

· We are looking to liquidate our 5% position around the 5960 area basis the ASX200.

BetaShares Bear ETF (BEAR) Chart

3 BetaShares US Bear ETF (BBUS) $4.25

We are holding a leveraged 5% position in the bearish US ETF (BBUS) which is currently giving us some grief – the US Russell 2000 index has already corrected almost 5% but the S&P500 remains less than 1% below its all- ime high as investors are pouring money into the perceived safe haven of $US denominated large cap stocks.

· MM may liquidate this position into a 5% pullback and / or increase our emerging markets position looking to benefit from a contraction of the divergence of the performance between the respective markets – see yesterday’s report for details. Click here

BetaShares US Bear ETF (BBUS) Chart

4 iShares Emerging markets ETF (IEM) $58.80

MM has been patiently looking to add to our 3% position into weakness, ideally around the 56 area, this now feels a strong possibility as the emerging markets are again rapidly falling out of favour.

· MM is looking to allocate another 3% of our Growth Portfolio into the IEM around 56.

iShares Emerging markets ETF (IEM) Chart

5 Westpac (WBC) $27.24

WBC has been on our radar for a few weeks as it continues to fall out of favour compared to its peers, primarily because its holding the most interest only mortgages on its books.

Our short-term target for WBC is around $26.50 where the bank will be yielding over 7% fully franked.

· MM is looking to average our 5% with an additional 2/3% around $26.50, or ~3% lower.

Westpac (WBC) Chart

6 The UK - Janus Henderson (JHG) $36.25 & CYBG (CYB) $5.68

The UK and BREXIT is currently in the press for all the wrong reasons as their current political turmoil rivals our own in 2018.

This has created havoc to UK facing stocks on the local market but with panic comes opportunity.

· MM is considering adding ~2% to our JHG position below $35.

Janus Henderson (JHG) Chart

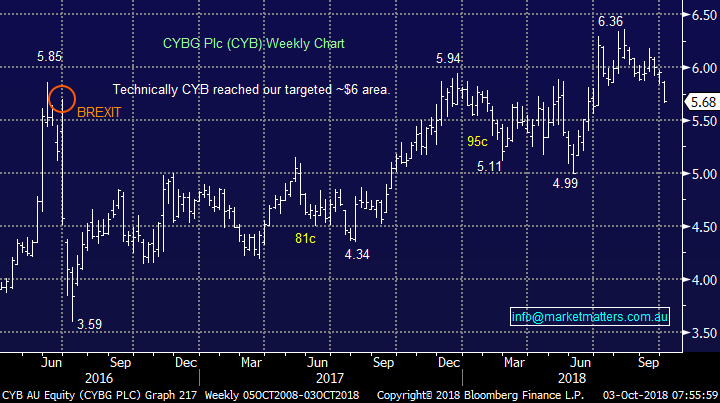

CYB bank remains one of our favourite financial stocks but it has not been insulated from the UK concerns tumbling over 10% from its 2018 highs.

Having taken a nice profit on our long position around $6 the current weakness appears to be just the opportunity we have been looking for.

· MM is considering buying CYB below the $5.25 area.

CYBG (CYB) Chart

CYBG (CYB) London Chart

7 Macquarie Bank (MQG) $122.63

We’ve had MQG on our radar for months after previously taking profit too early, unfortunately it happens to all of us at times. The current weakness is not exciting but MQG can often find “air pockets” on a day to day basis leading to large swings in its underlying share price i.e. creating opportunities. Hence it’s a stock which definitely needs a clearly defined plan:

· MM is considering allocating 5% into MQG below $116.

Macquarie Bank (MQG) Chart

8 ASX Ltd (ASX) $62.11

Another stock that’s been on our radar for a while and the current 10% correction is slowly but surely catching our eye.

· MM is considering buying ASX around the $60 area.

ASX Ltd (ASX) Chart

9 Oil Search (OSH) $9.04

OSH looks strong technically and the shorter term momentum is clearly behind the energy names.

· MM is considering buying OSH around $8.90 as a short term play only.

Oil Search (OSH) Chart

10 CSL Ltd (CSL) & Cochlear (COH) $199.93 and $200.11 respectively

These 2 market favourites we discussed in yesterday’s report and they keep slipping lower, CSL has now corrected over -15%.

· As we said yesterday we like both CSL and COH below $190.

CSL Ltd (CSL) Chart

Cochlear (COH) Chart

11 RIO Tinto (RIO) $78.07

We already own RIO have obviously enjoyed its recent rally but a 3% position is never enough when stocks fly out of the blocks. Again another stock we have discussed a few times recently:

· MM is currently considering increasing its RIO position below $77.

NB we will also consider Fortescue Metals (FMG) into fresh 2018 lows.

RIO Tinto (RIO) Chart

Conclusion

We are looking at the following 11 positions into further market weakness, note there are a high proportion of financials and resources in the group which fits our long term macro view of rising interest rates and inflation:

- The $A take profit on our ETF position if we see a sharp 2-3% appreciation in the $US.

- Look to take profit on our BEAR ETF basis the ASX200 around 5960.

- Close the BBUS ETF basis the S&P500 5% lower and / or hold against an increased position in the emerging markets on a spread basis.

- Add to our IEM ETF around the 56 area.

- Add to Westpac around $26.50.

- Add to JHG below $35 and buy CYB below $5.25.

- Buy Macquarie below $116.

- Buy the ASX around $60.

- Buy Oil Search around $8.90 as a short term trade.

- Buy Cochlear / CSL around $185.

- Add to our RIO below $77.

Obviously which buy / sell buttons we press will depend on prices at the time and respective correlations to new purchase and existing holdings i.e. we are prepared to be very committed to a view but not hold all our eggs in one basket.

Overseas Indices

The US Russell 2000 continues to follow our anticipated path, only another 2-3% downside expected, we are forced to wonder if the S&P500 will now participate in this move.

US Russell 2000 Chart

European indices certainly wobbled overnight but when we stand back they remain pretty range bound.

Our ideal retracement for the German DAX is another ~7% lower.

German DAX Chart

Overnight Market Matters Wrap

· A mixed session in the US overnight with the Dow hitting all-time highs and outperform the majors, while the broader S&P 500 ended with little change, along with the Nasdaq 100.

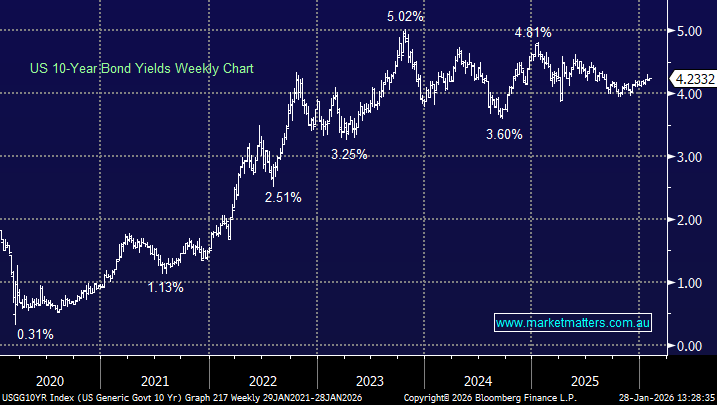

· US Fed Chairman Powell said that he doesn’t see unemployment leading to a jump in inflation that could in turn lead to faster rate hikes. US 10 year bonds are trading at 3.05%.

· Crude oil continued its path to the upside, trading above US$75.00/bbl. and still at multi-year highs.

· The December SPI Futures is indicating the ASX 200 to open 11 points higher, towards the 6140 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 03/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.