We like oil but not iron ore at today’s levels

We discussed in the Weekend Report and again yesterday afternoon our concern that resource stocks had rallied too far, too fast, and that we were advocating taking at least 50% profits on resource stocks. So far this week resource stocks have struggled but last night's 6.5% plunge in the iron price is likely to accelerate this pullback. Remember, our bullish outlook for the $US is a clear headwind to commodity prices.

Since the US election, equity markets have focused on the positives, specifically to the banking and resources sectors. However, the increased risks of a trade war, especially with China, should not be ignored under a Donald Trump presidency. A trade war with China would potentially slow both economies, negatively impacting resource prices. Also as we have mentioned before, his plans for massive infrastructure spending will take time, assuming he can pass them through the senate. Simply, we feel resource stocks have priced in much of the good news while ignoring the risks.

In yesterday’s Afternoon Report, we highlighted that some major insiders had been selling / reducing their exposure to resource stocks e.g. Tony Haggarty, ex-CEO of Whitehaven Coal and the current CEO of Sandfire Resources (SFR) Karl Simich have both been sellers of late. It simply makes no sense to be buying into the ‘Trump resources hype’, when these seasoned / knowledgeable professionals are selling.Over the last 24 hours, the press has been abuzz with speculation of Wesfarmers (WES) looking to sell its ~$2bn coal mines, more credibility to the logic of giving the sector a wide berth for at least coming weeks.

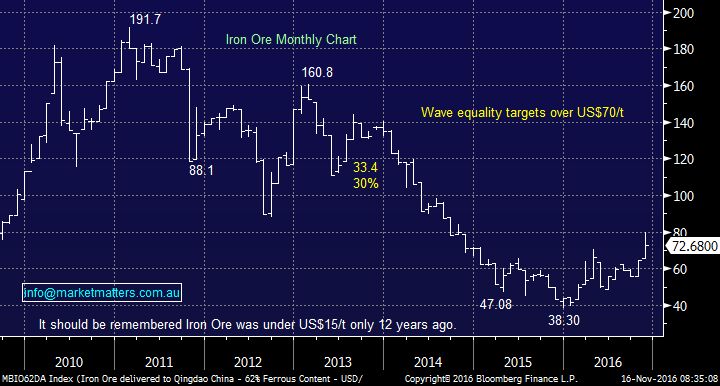

We are currently neutral - bearish Iron Ore, but a monthly close back under $US70/tonne would look awful technically.

Iron Ore Monthly Chart

When we look at the market heavyweights, we see some clear short-term risks.

- BHP Billiton (BHP) - BHP has now rallied $11 since its panic low of 2016, but has clearly reached overhead resistance. While technically the stock looks ok over $23.50, we see no reason to be a buyer and would definitely be reducing over $24.

- Fortescue Metals (FMG)- FMG has been an amazing performer in 2016, but we feel this $6 region should hold these gains at least for a few weeks. A pullback to the mid $5 region feels very likely.

- RIO Tinto (RIO)- RIO tested the $60 region after Donald Trump's victory. Technically, we at least envisage a pullback towards $57.

- South32 (S32) - we believe S32 topped out at $2.84 and a pullback towards the $2.40 area is unfolding i.e. a 15% correction.

We should all remember the panic selling in only January of this year, the current buying euphoria over the last week feels an almost exact mirror reflection of that time! Be cautious here.

BHP Billiton Weekly Chart

Conversely we remain optimistic on the price of crude oil which is running its own race, which short-term is dictated to by OPEC and Russia. We believe most OPEC members need higher oil prices to address struggling economies, hence they will make this happen - they need it.

Our bullish outlook of the last few months for crude oil remains intact, targeting ~$US60/barrel.

Crude Oil Monthly Chart

We are long Origin (ORG), with an initial price target of ~$6.20 and potentially over $7. Our 10% exposure to the oil price feels enough considering the obvious risks around OPEC.

Summary

- We are neutral / negative resource stocks in general but remain positive the oil sector.

- For investors long resource stocks and owning no oil exposure we would at least advocate switching 50% into the oils.

*Watch for alerts today.

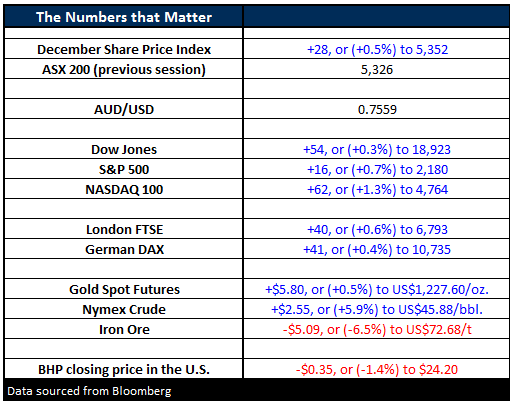

Overnight Market Matters Wrap

- The US share markets closed stronger overnight, with the DOW finishing up 54 points (+0.3%) to 18,923, while the broader S&P 500 rallied 16 points (+0.8) to 2,180. The ‘tech’ NASDAQ 100 index reversed yesterday’s losses and more to close 62 points (+1.3%) higher at 4,764.

- A mixed session in the commodities sector –

- Iron Ore followed the selloff in Asia yesterday and settled 6.5% lower to US$72.68/t. Could this be a short term top in the commodity space?

- Crude Oil bounced back with a vengeance, rallying 5.8% to US$45.85/bbl.

- The US$ index held above 100 and looks likely to go higher – Analyst expectations are now pricing a 96% chance of a rate hike in December - up from 92% yesterday!

- The ASX 200 is expected to open marginally higher this morning, testing the 5,345 level as indicated by the December SPI Futures.

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 16/11/2016. 8.00AM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here