Fortescue (ASX: FMG) on track 6 months into the year

Stock

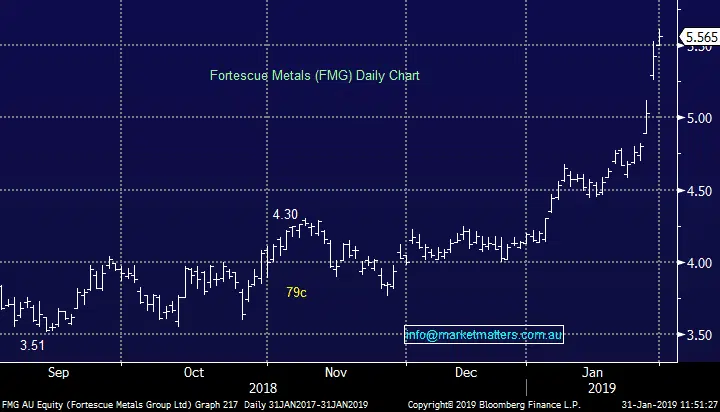

Fortescue Metals (ASX: FMG) $5.56 as at 31/01/2019

Event

As if there wasn’t enough news flow in the iron ore space to keep investors occupied, Fortescue has today released its quarterly production report for their 2nd quarter.

The report was solid, and the stock has jumped today – partial credit for the move does have to go to the iron ore price which tracked higher again overnight.

Total ore shipped rose 5% on the same period in FY18, climbing to 42.5mt, while at the half way point for the year they have shipped a total of 82.7mt, well on track to meet the full year guidance. Costs also moved lower in the quarter, which is unsurprising given the maintenance undertaken in the first quarter.

Fortescue also begun shipping a higher grade ore in the quarter, which the company plans to build to around 25% of product out by 2020.

The key for Fortescue through the quarter was a reduction in the discount received on their lower grade 58% product, vs the global standard 62% price index. The discount blew out to 40% early in the quarter, but has since tightened to around 20% helping FMG print cash.

Fortescue Metals (ASX: FMG) Chart