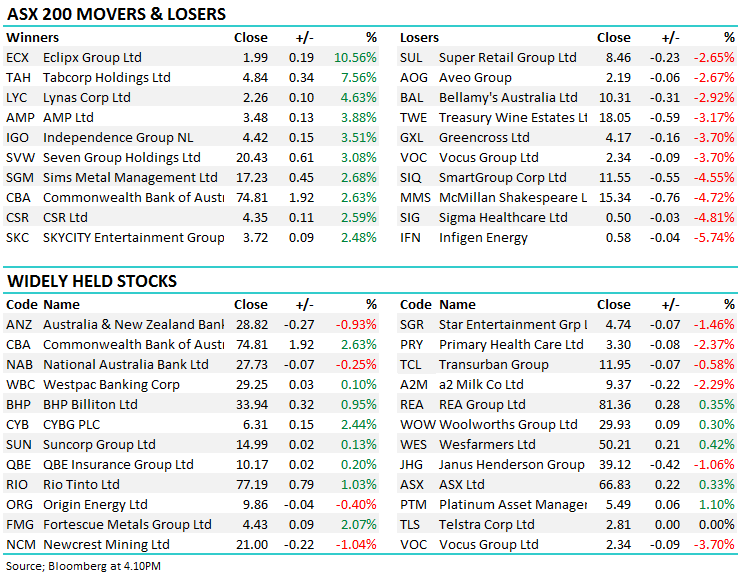

CBA doing the heavy lifting (CBA, TAH, AMP)

WHAT MATTERED TODAY

A few of the better known Aussie brands reported today with Tabcorp (TAH), Commonwealth Bank (CBA) and AMP all rallying post their results. We’ll touch on these in more detail below, however in the case of CBA and AMP, the results were not as weak as the market had feared while TAH’s numbers were weak, however their guidance was strong particularly around the likely synergy benefits to be achieved from the Tatts acquisition.

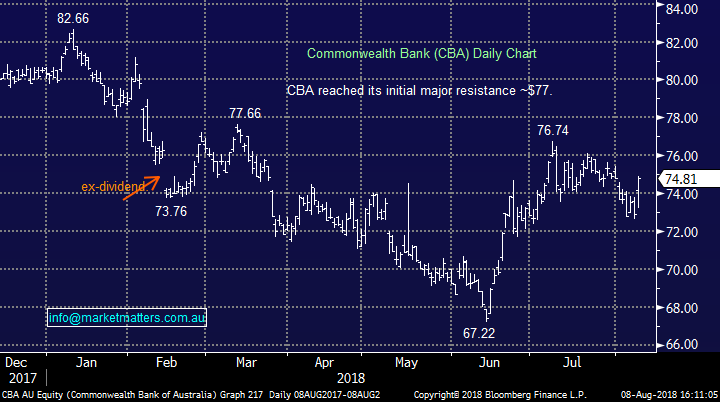

The results put a bid tone under the market for most of the session before a late sell off saw the index trade lower into the close – a soft outcome really given that CBA, the markets largest index constituent was up more than 2.5% on the session adding ~11 index points. We wrote about CBA’s result in today’s Income Report here.

Commonwealth Bank (CBA) Chart

Suncorp, the largest weighted stock in the MM Growth Portfolio reports full year numbers tomorrow…expectations are outlined below. The Insurance / Banking company has enjoyed a strong run in recent times up from the mid 12’s to above $15 before both JP Morgan and Bells downgraded the stock last week, both to a hold and $15 price target. Clearly there are now more risks for disappointment given the SP run of late.

In their full year numbers we’ll be looking closely at underlying insurance margins and how they are tracking towards SUNs through the cycle 12% target, while volume and pricing will also be key. SUN is reducing costs and has excess capital in the balance sheet so the chance for a special dividend remains.

Market Expectations – SUN

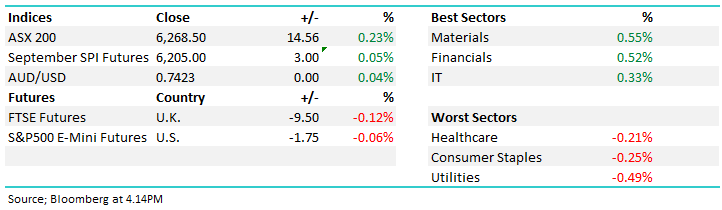

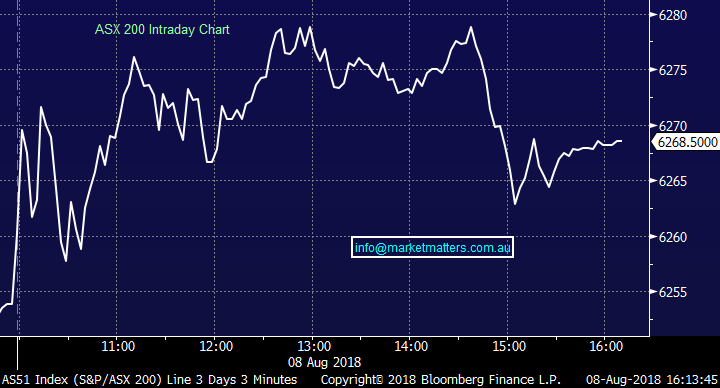

Overall, the ASX200 gained 14 points today or +0.23% to close at 6268 – Dow Futures are currently trading up 3pts.

Australian Reporting season is underway – for a full list of company reporting dates – click here

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; analysts have been busy updating numbers through the reporting season. One out of cycle move was Citi turning negative on A2 Milk today, lowering expectations around the daigou sale channels suggesting inventory levels are building.

Elsewhere…

· A2 Milk Co Downgraded to Sell at Citi; PT A$9.50

· Independence Group Cut to Underweight at Morgan Stanley

· Evolution Mining Raised to Equal-weight at Morgan Stanley

· IPH Upgraded to Buy at Canaccord; PT A$5.30

· Transurban Downgraded to Neutral at Credit Suisse; PT A$12.30

· Eclipx Downgraded to Neutral at Credit Suisse; PT A$1.90

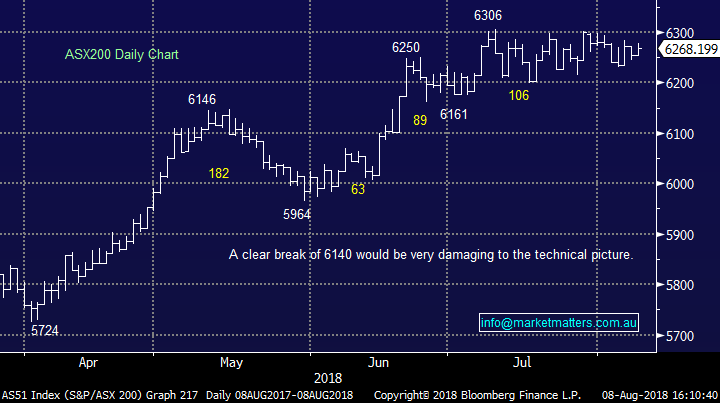

AMP Ltd (AMP) $3.48 / +3.88%; This morning AMP reported their first half results that proved to be better than the markets downbeat expectations, in terms of the underlying earnings, dividend and even at the profit line, albeit, it was down substantially on the pcp. Obviously AMP has some major structural headwinds playing out, and the reputational damage caused by the Royal Commission is hard to quantify, the results today gave some insight into the costs so far.

The underlying profit at $495m was ahead of forecasts of $485m however there were significant costs that impacted the net profit line which came in at $115m. These included $312m in advice remediation and related costs, $13m of costs associated with the Royal Commission and other bits and pieces.

AMP had previously guided to a profit of about $100m and todays result was better than that, however there remains many challenges on the horizon for the iconic Australian wealth business, including an ongoing reduction in adviser numbers with adviser headcount down by 7% over the year and net cash outflows – nearly $1B in cash outflows in the first half.

AMP (AMP) Chart

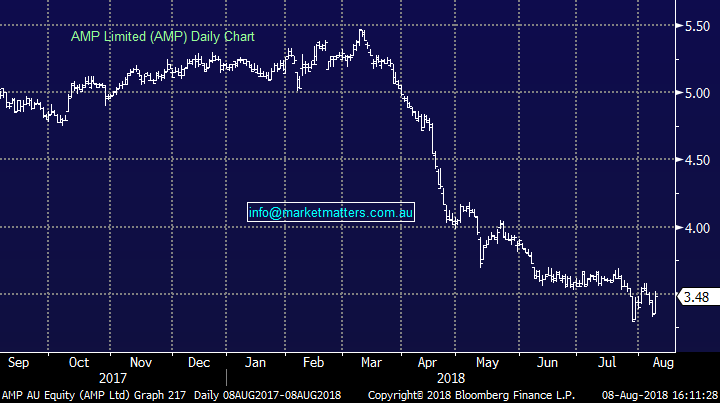

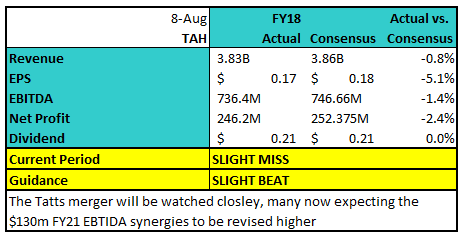

Tabcorp (TAH) $4.84 / +7.56%; Betting agency Tabcorp has rallied on what looks at first glance a poor result. The stock was sold off yesterday prior to the result but has bounced back strongly today despite missing consensus earnings by ~2% at $246.2m. The key to the market’s reaction has been the focus on the integration of Tatts post the merger completed earlier this year – it seems the market is starting to believe the purported $130m in EBITDA synergies expected in FY21, although only $8m has been delivered thus far.

The result is somewhat messy, it includes costs associated with the merger as well as a $91m loss to close the Sun Bets UK joint venture with News Corp. Some of these impacts were offset by a highly successful Soccer World Cup in which Tabcorp realized $26m revenue and also saw active users rise and remain elevated after the event.

Tabcorp has a large competitive advantage to other betting agencies and a digital foot print which is unrivalled – this will help them sustain market share as more betting moves online. It seems those with the inside tip focused on a near-term miss while the market is optimistic around future integration & growth

Tabcorp (TAH) Chart

OUR CALLS

No trades across the MM portfolios today

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 08/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here