How do lower rates impact Hybrids?

The following report is an extract of the MarketMatters Income Report that was published on June 12. Click here to get access to the full report and more

Hybrid securities have roared back into focus thanks largely to a Coalition victory at the 18 May Federal election and that has prompted a decent rally across the universe of hybrids. During May, the median margin over the bank bill rate across financial hybrids came in by 0.12% from 3.19% to 3.07%. This has combined with an obvious lack of supply which drives prices up on market. The next major bank hybrid needing to be refinanced does not have a first call date until 23rd March 2020 being the NABPC - supply is therefore tight and expected to stay that way for some time.

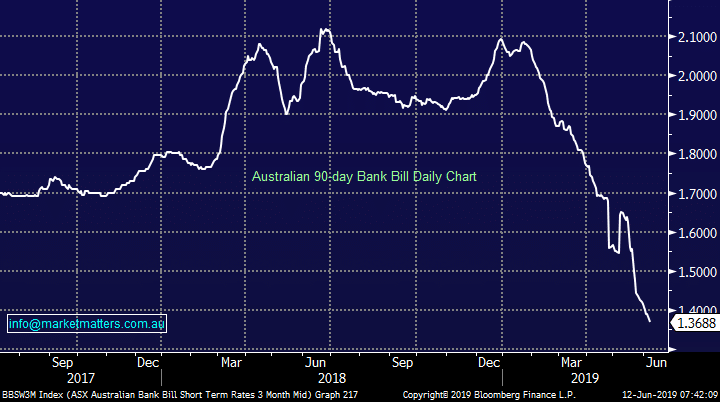

Hybrids however are floating rate notes, and lower interest rates mean lower returns from hybrids. Most hybrids are priced off the 90 day bank bill swap rate (BBSW) and pay a margin over it. As shown in the chart below, the BBSW has fallen sharply as interest rate expectations have changed. Given the median margin for financial hybrids is 3.07% and the BBSW is 1.37%, the median grossed yield to first call is 4.44%. That obviously includes shorter and longer dated issues however the number has come in fairly dramatically over the last few months.

Australian 90-day bank bill swap rate chart

You may have also heard about bank funding costs following the recent RBA interest rate cut and the decision by 2 of the majors not to pass through the full 25bp reduction. The argument being that over the course of the last few months, the cost of funds have declined substantially for the banks which would have helped them, and they should have passed on the full amount.

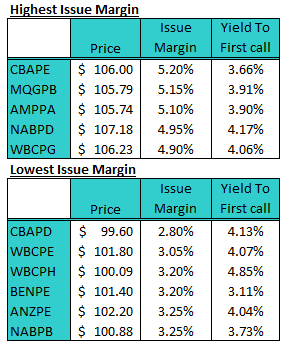

In terms of bank hybrids, there are two obvious ends of the spectrum as shown in the table below – both from CBA providing a good comparison of how the external credit environment can change. CBAPD was issued when demand was high, margins were slim and CBA could raise money at a margin of 2.80% over bank bill swap sits at one end of the spectrum, while CBAPE sits at the other. This was issued on a margin of 5.20% over bank bill swap when funding markets were tight, volatility was high, credit spreads were wide etc.

You may have also heard about bank funding costs following the recent RBA interest rate cut and the decision by 2 of the majors not to pass through the full 25bp reduction. The argument being that over the course of the last few months, the cost of funds have declined substantially for the banks which would have helped them, and they should have passed on the full amount.

In terms of bank hybrids, there are two obvious ends of the spectrum as shown in the table below – both from CBA providing a good comparison of how the external credit environment can change. CBAPD was issued when demand was high, margins were slim and CBA could raise money at a margin of 2.80% over bank bill swap sits at one end of the spectrum, while CBAPE sits at the other. This was issued on a margin of 5.20% over bank bill swap when funding markets were tight, volatility was high, credit spreads were wide etc.

As we stand now, the market is calm and demand is strong, meaning securities are generally trading above the $100 face value to varying degrees. Those paying higher margins have obviously done better over time.

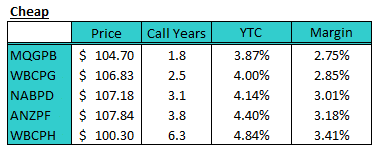

In terms of current value among listed hybrids, the below offers a view based of different durations to first call. The shorter dated notes are generally lower risk (less time for things to change / go wrong) while the longer term notes pay a higher return. The below notes screen relatively cheap v their peers and duration.

As we stand now, the market is calm and demand is strong, meaning securities are generally trading above the $100 face value to varying degrees. Those paying higher margins have obviously done better over time.

In terms of current value among listed hybrids, the below offers a view based of different durations to first call. The shorter dated notes are generally lower risk (less time for things to change / go wrong) while the longer term notes pay a higher return. The below notes screen relatively cheap v their peers and duration.

While hybrids relative to other asset classes remain attractive, they’re generally not a compelling buy at current levels. As a rule of thumb, we tend to view a universe with a median margin amongst the financial hybrids at 3% as expensive, versus a margin nearer 4% as cheap.

While hybrids relative to other asset classes remain attractive, they’re generally not a compelling buy at current levels. As a rule of thumb, we tend to view a universe with a median margin amongst the financial hybrids at 3% as expensive, versus a margin nearer 4% as cheap.